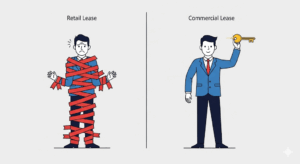

Commercial vs Retail Shop Lease: how to escape the Retail Shop lease straitjacket

A costly mistake is entering into a Retail Shop lease when you do not have to. Sadly, a Landlord may own a property that looks like a shop and rent it to a business that feels like a shop, leading them to sign a “Retail Shop lease” when it is not required.

The Retail Shop lease is a legislative straitjacket designed to protect the Tenant. A Retail Shop lease strips away the rights a Landlord gets in a Commercial Lease.

Example where a Retail Shop lease was not required

As a recent example, a Landlord leased their commercial property to a high-end graphic design studio. The Landlord saw that the studio had a reception area for the public and incorrectly assumed the tenancy fell under the state’s Retail Shop Leases Act.

When the landlord failed to recover normal outgoings, such as land tax, only then did he go to his accountant. His accountant unearthed the mistake. Because the ‘primary use’ of the premises was for business-to-business services and it was not located in a retail shopping centre, the draconian Retail Shop lease was never required.

Instead, the Landlord should have spoken with his accountant or lawyer, who would have built a Commercial Lease on the Legal Consolidated website. By not seeking advice, he needlessly cost himself thousands of dollars and surrendered his contractual freedom.

A Commercial Lease is the Landlord’s best tool for flexibility and control. Suffer a Retail Shop Lease only if the law in your state requires it.

Example of a medical practice incorrectly using a restrictive Retail Shop lease

Here is another example that we saw involving a medical practice.

A Landlord leased a street-front property to a physiotherapy clinic. Because the clinic accepted appointments from the general public, the Landlord assumed it was a retail business under the state law.

Believing he was required to, he signed the tenant to a rigid Retail Shop lease. This meant the landlord had to pay for expenses like council rates and land tax, which they would normally have passed on to the tenant.

However, in that state, allied health services like physiotherapy are not legally defined as “retail”. The landlord was never required to use the restrictive retail lease. They could have used a Commercial Lease, which would have provided them with fairer financial returns and more flexibility.

The Retail Shop Lease: Destroys the Landlord’s Rights

A Retail Shop Lease is a highly regulated agreement controlled by state legislation. This legislation was created to protect Tenants and, as a result, heavily restricts the Landlord’s rights. When a lease falls under the Retail Leases Acts, many of the protections and rights a Landlord negotiates with their Tenant become irrelevant—the legislation overrides them.

Problems with Retail Shop leases

These are examples of how the Landlord (often needlessly) suffers under a government Retail Lease:

- Limited Recovery of Outgoings: Landlords are forbidden from passing on costs, such as land tax, outgoings and capital expenditure, to the Tenant.

- Mandatory Disclosure Statements: The Landlord must incur the expense of having their accountant prepare an intrusive, often irrelevant, and detailed statement for the Tenant, even before the lease begins. A minor error gives the Tenant grounds to terminate the Retail lease.

- Restrictions on Rent Reviews: Clauses prevent the rent from increasing (“ratchet clauses”). Worse still, if the current market rent is lower than the rent they are currently paying, the rent is adjusted downwards. This unfair restriction does not apply to Legal Consolidated Commercial Leases.

- Tenant-Biased Dispute Resolution: Disputes are typically funnelled into specialised, low-cost tribunals (like the New South Wales Civil and Administrative Tribunal or the Victorian Civil and Administrative Tribunal), which are notoriously pro-tenant.

Every State has its own confusing Retail Shop Rules

Each jurisdiction has its own distinct set of rules, all of which reduce the Landlord’s power to protect their interests:

- New South Wales: Retail Leases Act 1994

- Victoria: Retail Leases Act 2003

- Queensland: Retail Shop Leases Act 1994

- Western Australia: Commercial Tenancy (Retail Shops) Agreements Act 1985

- South Australia: Retail and Commercial Leases Act 1995

- Tasmania: Retail Leases Act 2022

- Australian Capital Territory: Leases (Commercial and Retail) Act 2001

- Northern Territory: Business Tenancies (Fair Dealings) Act 2003

Advantages of a Commercial Lease over a Retail Lease

If your property is not captured by retail shop legislation, instead build a Commercial Lease. It is governed by the principles of contract law, which champion ‘freedom of contract’. This puts you, the Landlord, in the driver’s seat.

The advantages of a Commercial Lease for the Landlord:

- Full Control Over Outgoings: You can negotiate for the Tenant to pay all property outgoings, including land tax (except in Queensland).

- Flexible Negotiations: You and the Tenant are free to agree on any commercial terms you see fit, without legislative interference.

- More Secure Rent Reviews: You can negotiate rent review mechanisms that protect your investment returns.

- No Mandatory Disclosure: The administrative burden of complex, mandatory disclosure statements does not exist.

The fundamental difference is choice. A Commercial Lease is a negotiation between two parties. A Retail Shop Lease is a set of rules imposed upon the Landlord by the government.

When are you forced to use a Retail Shop Lease?

You are only compelled to use a Retail Shop lease if your property falls under the Retail Shop definition within your state or territory’s Act. While the tests vary, the triggers often involve:

- The Use of the Premises: The business is used wholly or predominantly for the sale of goods or services to the public.

- The Location of the Premises: The property is located in what the Act defines as a “retail shopping centre”. The original intention may have been to regulate large shopping centres, but some states define a ‘retail shopping centre’ as having as few as five retail shops with common ownership.

If your leased property does not meet these specific legal triggers, you are not obliged to use a Retail Shop lease. In that case, for the protection of your investment, a Commercial Lease is the prudent choice.

A Trap for Self-Managed Super Funds: The Unnecessary Retail Shop Lease

History is riddled with landlords entering into Retail Shop leases when they did not have to. But this mistake is particularly damaging for Self-Managed Superannuation Funds (SMSFs).

The auditor of an SMSF recently contacted us. The SMSF leased its business real property to a company run by the fund member. While leasing business real property to a related party is permissible, it must be conducted on a strict ‘arm’s length’ basis. This means the terms of the lease must be the same as those for any unrelated tenant in the open market.

In this case, the business real property was not subject to the Retail Shop Lease legislation. However, the SMSF had entered, unnecessarily, into a Retail Shop lease with the member’s company.

The SMSF Auditor correctly noted that Retail Shop leases are heavily tenant-friendly. By needlessly using a Retail Shop Lease, the SMSF was providing a distinct advantage to the member—an advantage that an unrelated tenant would not have received. This breaches the ‘arm’s length’ rule.

Thankfully, the accountant promptly built an SMSF-compliant Commercial Lease on Legal Consolidated’s website just in time to protect the SMSF from a qualified audit and ATO notification.

Legal Consolidated’s View on Retail and Commercial Leases

We build legal documents that protect our clients’ interests. For Landlords, a Commercial Lease provides the maximum protection and contractual freedom. We believe you should only accept the significant burdens of a Retail Shop Lease when compelled to by law. Our documents are designed for Landlords who are legally permitted to operate outside the restrictive, pro-tenant framework.

Legal Consolidated provides both a Commercial Lease and an SMSF Commercial Lease:

- Commercial Lease: To lease your commercial office, warehouse, or industrial property, build an Australia-wide Commercial Lease Agreement

- SMSF Commercial Lease: If your SMSF is leasing a commercial property, build an SMSF-compliant Commercial Lease