Enduring Power of Attorney

$128 includes GST

-

An Enduring Power of Attorney (POA) is a legal document. It allows you to appoint a person to make decisions about your assets. The POA deals with your assets e.g. real estate and bank accounts.

What is a QLD Enduring Power of Attorney?

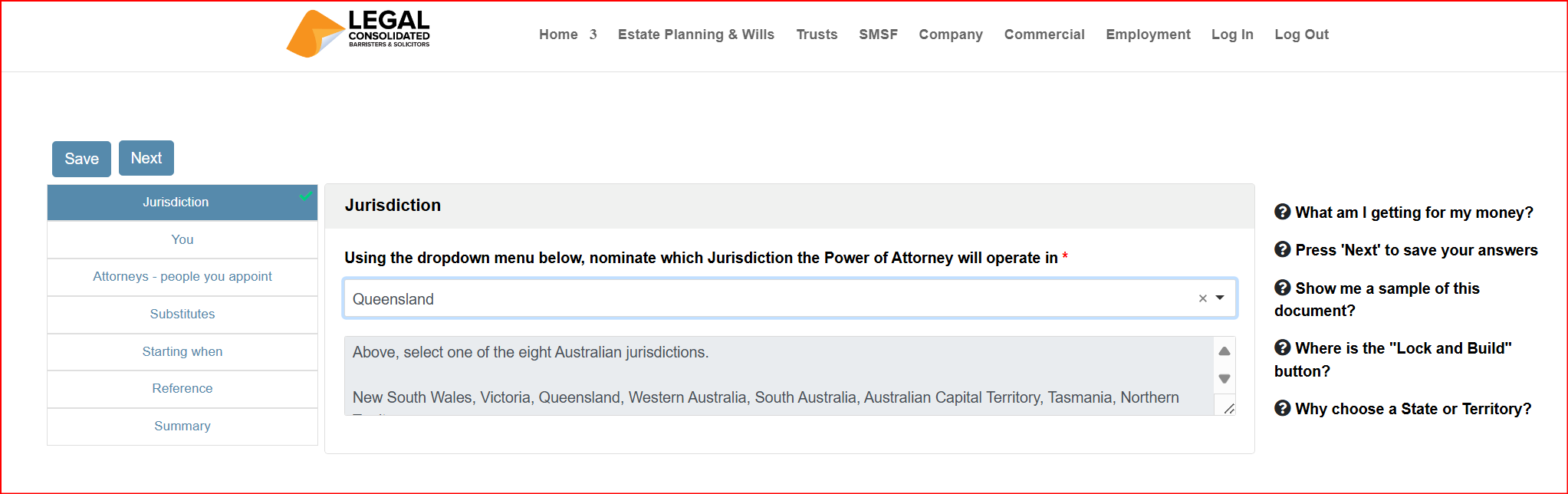

A QLD Enduring POA is a legal document. The Enduring Power of Attorney appoints a person to make decisions about your assets. The Queensland POA deals with your assets e.g. Queensland real estate. A QLD POA cannot operate outside of Queensland.

A QLD Enduring Power of Attorney (EPOA) is a legal document that authorises you to appoint one or more individuals to make decisions on your behalf. The person(s) you appoint is referred to as your ‘attorney,’ and you are designated as the ‘principal.’ This document remains effective even if you lose the capacity to make decisions yourself, ensuring that your affairs can be managed according to your wishes.

Free and ongoing advice for QLD POA attorneys

The advantages of having our law firm prepare your QLD Financial POA:

- Included in the cost of your POA is free advice for your attorney. They are not alone. Our law firm, forever and as often as needed, helps your attorneys and shows them how to use the POA. We give you and your family ongoing support.

- If you lose mental capacity, your Attorneys are welcome to telephone us for help and assurance. There is no additional cost.

- Over 30% of POAs prepared on the so-called ‘free’ government website are incorrect. Sadly, it is only after they are needed that this becomes apparent.

- There is extensive information on how to use the QLD Enuding POA that comes with the EPA.

- Finally, there are unlimited updates on the Queensland POA. The POA can be updated as often as you wish for free. This is while you have mental capacity.

Medical POAs and Financial Matters POAs – look identical

In Queensland, you can put both the ‘personal/health’ and ‘financial’ POA in the same document. Only one tick is all that is required. However, do not do this.

It is legally better to have a separate Medical POA and a separate Financial POA. This is because:

- There is ambiguity in the legislation as to whether you can have two QLD POAs. However, there is no ambiguity as to having one for medical purposes and another for financial purposes.

- When a doctor or nursing home reads your QLD Medical POA, there is no reason for them to know who holds your financial POA. Privacy and information are protected.

- Similarly, when you hand over a QLD POA dealing with only ‘financial matters’ to a government department, they do not find out who holds your QLD Medical POA.

- Finally, there have been occasions where a nursing home has seen fit to keep the original QLD Medical POA. Sometimes, as well as refusing to hand it back, it has been lost. Because you have two POAs, you have kept the financial POA out of

the clutches of the nursing home and medical facility.

If the person witnessing your POA has a different view, they can telephone the law firm: 07 2111 0869.

What legislation does Legal Consolidated use to prepare your QLD Enduring POAs?

Legal Consolidated prepares your Queensland EPA based on:

On our website, you can build all 16 POAs Australia-wide.

We draft the POAs based on continual feedback from the witnesses being Justices of the Peace and Commissioners. Our POAs and Medical POAs are cutting-edge and designed so that lawyers, accountants and financial planners can build the QLD POAs confident that they comply with the (often unwritten) requirements of banks, nursing homes and the QLD titles office.

Do I have the mental capacity to sign my Queensland POA?

In Queensland, it is assumed that you have the mental capacity to sign a QLD Enduring POA or QLD Medical POA until it is proved that you do not. If your capacity seems to have changed or is unclear, evidence must be gathered to show that your capacity is lacking.

Talk with your doctor or other specialists. If there is disagreement about your capacity, the Queensland Civil and Administrative Tribunal (QCAT) will evaluate the evidence and make a decision. See:

- Office of the Public Guardian webpage, ‘What is impaired decision-making capacity?’

- the Queensland ‘Capacity assessment guidelines’

Can I have more than one attorney in Queensland?

While all law firms take a different approach, Legal Consolidated recommends and only allows a maximum of three attorneys. We have found that more than that causes problems with banks, title offices, and government departments. Some of their computer systems and software automatically reject QLD POAs with more than three attorneys.

Do QLD attorneys have to act separately or together?

You can appoint multiple attorneys in a Queensland enduring power of attorney in Queensland. If you do, Legal Consolidated allows two ways you can authorise them to make decisions:

- individually (known as ‘severally’) – this means that one can act by themselves

- together (known as ‘jointly’) – this forces them to come together each time they need to make a decision, it can be more work but reduces the chance of fraud

Successive attorneys – appoint spouse and then children

A substitute attorney takes over when the original attorney no longer can.

When you build your QLD POA, Legal Consolidated allows you to nominate ‘successive’ or ‘alternative’ attorneys – this is up to a total of three including the original attorney.

For instance, your spouse is initially appointed as your attorney. If your spouse is either unwilling or unable to fulfil this role, then up to two of your children can be appointed to take over as your attorneys. This is to replace your spouse.

A successive attorney is someone who acts on your behalf when the original attorney is no longer able to act. For example, the original attorney may no longer have legal capacity, is dead or resigns from the role.

Example of QLD POA for a married couple with successive attorneys

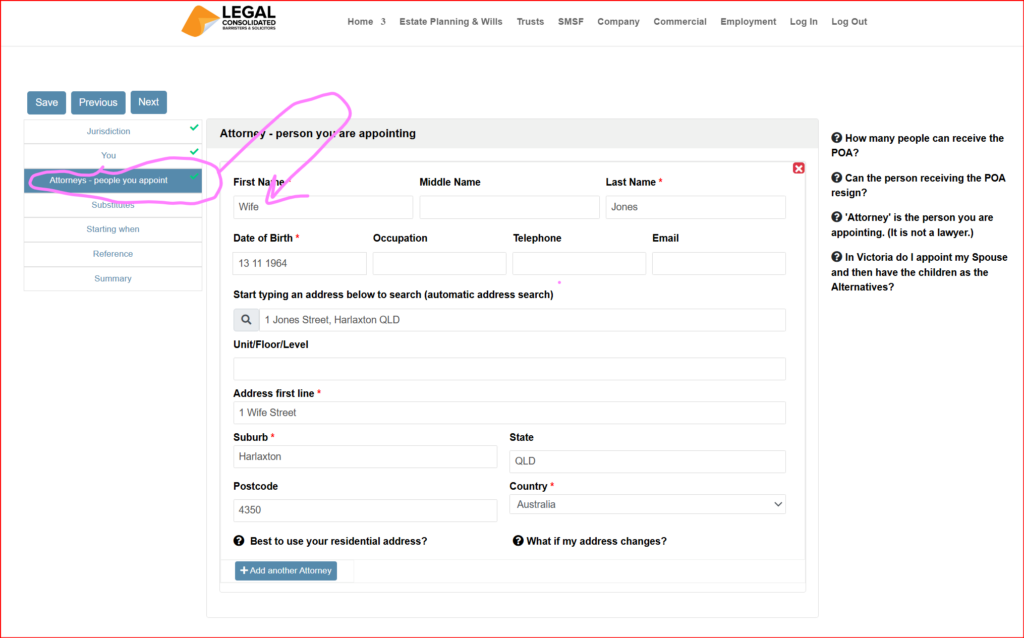

Mr Jones is married. He and his wife have four beautiful children. Mr Jones wants to appoint his wife to hold his POA. If and when his wife can no longer do that job he then wants his two oldest children to carry on the job of being his attorneys. This is how Mr Jones builds his QLD POA on Legal Consolidated’s website:

Mr Jones makes his wife the Attorney. Like most married couples with children, he does not want his children to carry out that job while his wife can perform that duty.

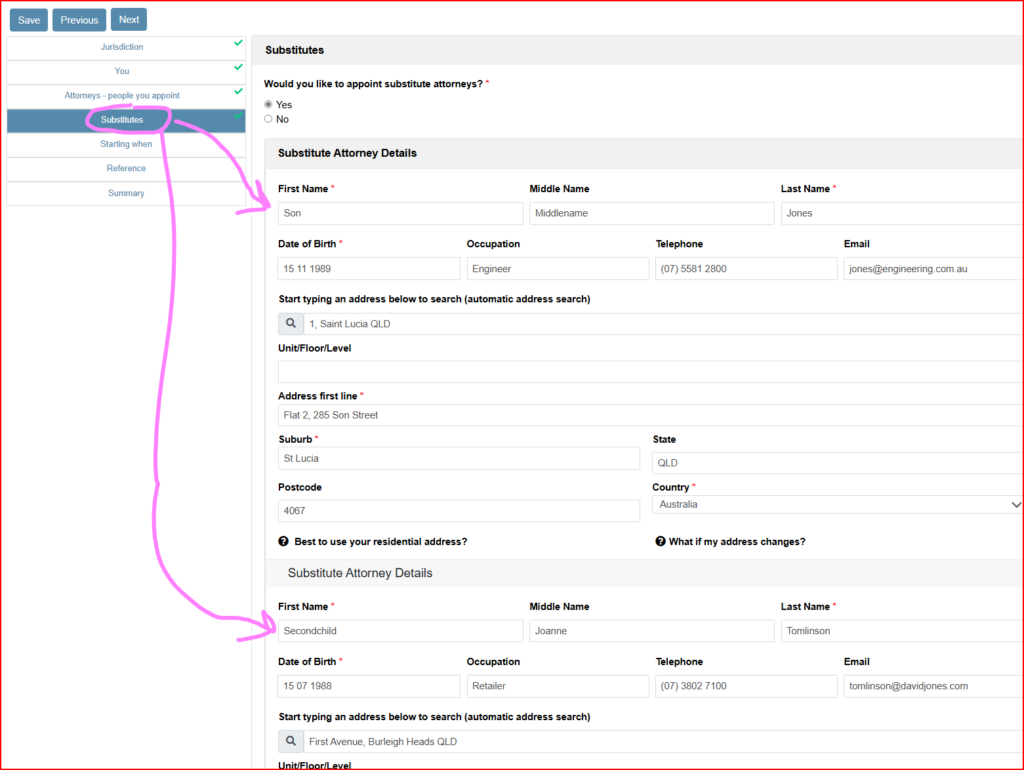

Mr Jones then presses Next. The next question asks if Mr Jones would like some backup Attorneys. Mr Jones presses YES. And puts in the details of two of his children:

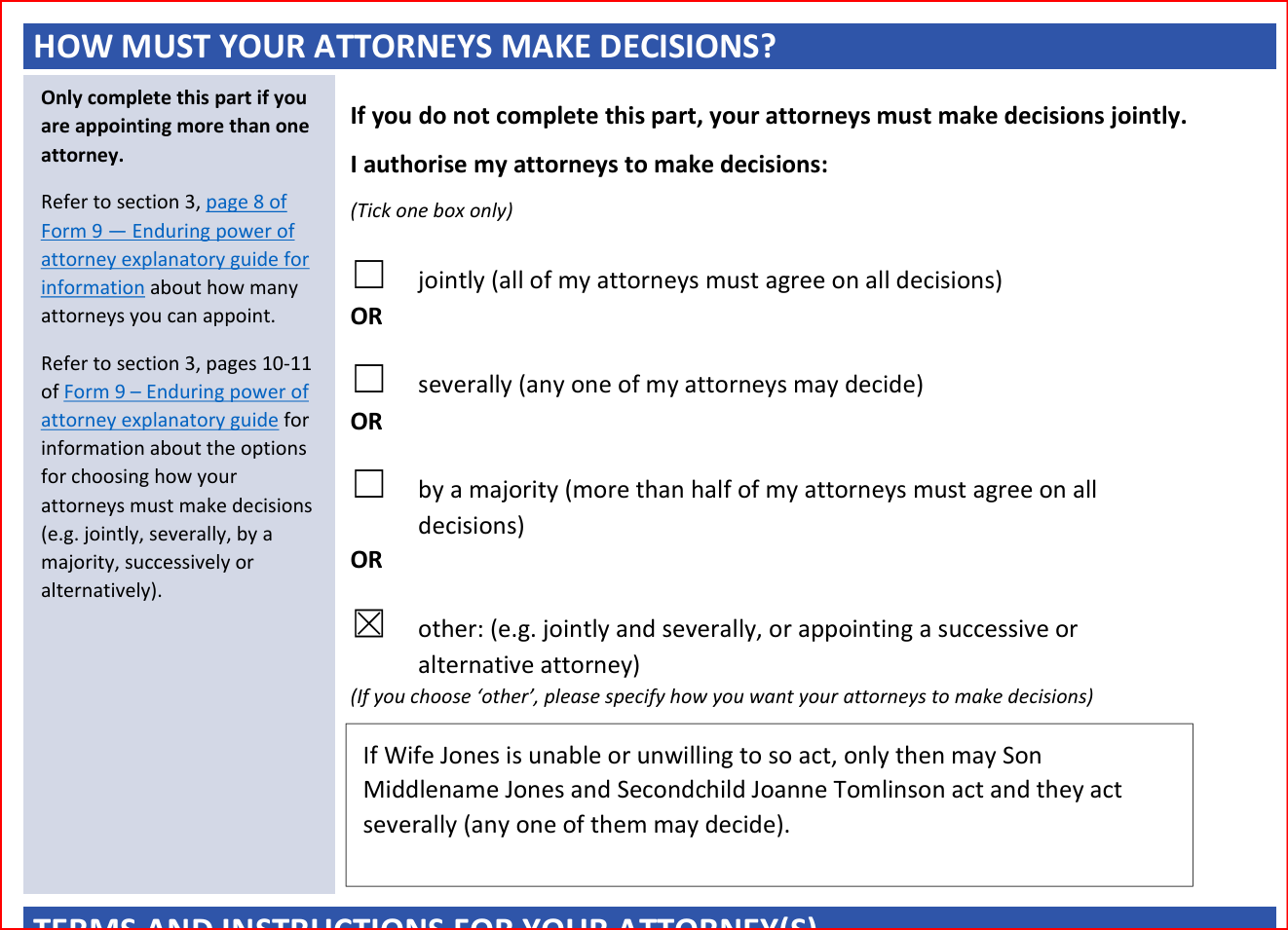

This is how the Successive Attorneys look like in Mr Jones’s QLD POA

* Mr Jones appointed his wife as the Attorney.

* He chose to include Substitute Attorneys, naming his two children.

* He ticked the box for the children to act independently of each other.

Do I need to update my QLD POA when an address changes?

Legal Consolidated Queensland EPA are prepared so that they remain valid even if an address changes. However, you are welcome to update your Legal Consolidated EPA at any time for free. This is for any reason.

What can’t the QLD POA do?

The QLD POA is an “economic” document. Your Queensland POA does not deal with your health treatments or lifestyle. To do this, instead, build a Medical Queensland POA on our website. Also, the person receiving your QLD EPA cannot:

* vote in any elections Queensland elections

* make a Will

* sign another POA in any Australian State

* act as a Trustee

* control your body (you need to build a Medical QLD POA on our website for that)

However, the person receiving your Enduring Queensland POA, can open and close bank accounts, pay debts, and buy and sell land. This is provided it is in your ‘best interests’ to do so.

How does the person receiving my QLD POA actually use the Queensland Power of Attorney?

Here are some examples:

Example 1 – Using your bank account using your Queensland POA

The persons you appoint walk into the bank and present to the bank clerk with your Savings Account book and your QLD POA. Your bank clerk stares blankly at them. He sees his bank manager. The manager explains to the bank clerk that those persons “now stand in your shoes”. They can do whatever you could do with the bank account. The manager asks to take a copy of the Enduring QLD POA for future reference. The bank manager tries to keep the original QLD POA but the persons you nominate decline and gets back the QLD POA. The transaction on the bank account takes place.

Example 2 – Signing your QLD Enduring POA

You tell the persons that you nominated, to sign a lease agreement. You are on holidays overseas and email is unavailable. Your attorney contacts the landlord with your Queensland POA. They:

1. tell the landlord that there is a QLD POA

2. tell the landlord that they are signing the lease on your behalf

3. they sign in their usual signature area and write under the signatures “signed as attorney for *your name* under a QLD Enduring POA dated ## Month, year”.

You are now bound to the lease. The landlord may photocopy the QLD POA to attach to the lease.

Does my Queensland Enduring POA work outside Queensland?

A Queensland Power of Attorney only works in the State of Queensland. If you have assets in another State, then build and sign an Enduring Power of Attorney for that other State as well.

The Queensland Power of Attorney only operates because the Queensland government passed an act of parliament. To state the obvious, the Queensland government has no jurisdiction or control over other states of Australia.

Often you hear Queensland government authorities claiming that other States ‘honour’ a Queensland Power of Attorney. Legal Consolidated has found this not to be the case.

Every State of Australia has its own unique enduring/financial and medical/lifestyle POAs.They are totally different in every state and territory. And they operate differently.

In my QLD POA, is the ‘attorney’ my lawyer?

The expression ‘attorney’ refers to the people you appoint in your QLD POA like your spouse, children and friends. It does not refer to a lawyer.

What happens if I lose mental capacity in Queensland without an Enduring Power of Attorney?

If you lose mental capacity in Queensland without an Enduring Power of Attorney (EPOA) in place, the Queensland Civil and Administrative Tribunal (QCAT) may intervene to appoint a guardian or administrator to manage your affairs. A guardian is designated to make specific non-financial decisions, such as your living arrangements, some legal matters, and the types of services you receive. They are not authorised to make decisions regarding financial matters, significant healthcare issues, wills, marriage, or child relinquishment.

Conversely, an administrator is appointed to handle decisions related to financial affairs, such as managing your pension, superannuation, property leases, and other property-related and financial legal matters.

If a suitable family member, friend, or relative is available, QCAT may appoint them to these roles. In cases where no appropriate individual is available, the Public Guardian may be appointed as your guardian, or the Public Trustee of Queensland may serve as your administrator.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will