Company Registration

$1,075 includes GST

-

Bucket Company for Family Trust includes:

• ASIC fee, ASIC Certificate and ACN

• Constitution: Div7A, 30 share classes, electronic secretary file and Share certificates

• Company Officer registers, minutes and consents

• We oversee & meet with ASIC, as required

How do I build a ‘bucket company’ for my Family Trust?

This bucket company becomes a beneficiary of your Family Trust This is automatic under most Family Trust deeds.

As soon as you build the bucket company you can start distributing income from the family trust to this new corporate beneficiary.

Can I get a bucket company many years after I started the Family Trust?

You can build the bucket company many years after you got the Family Trust deed. It does not matter. The bucket company automatically becomes a beneficiary under your family trust.

Why is my company automatically a beneficiary of my family trust?

Family Trusts have beneficiaries. Family trusts have ‘classes’ of beneficiaries. And these classes are often ‘open’.

Example of how ‘open’ classes of family trust beneficiaries work:

You are welcome to add your logo to our law firm’s documents for free.

- I get married. My spouse automatically becomes a beneficiary of my Family Trust.

- When I have children my children automatically become beneficiaries of the Family Trust.

- My children have children. My grandchildren automatically become beneficiaries of my Family Trust.

- When I get an interest, shareholding or directorship in a company then that company becomes a beneficiary of my Family Trust:

-

- Any company I have an interest in becomes a beneficiary of my Family Trust.

- Any company I own shares in becomes a beneficiary of my Family Trust.

- Any company I am a director of becomes a beneficiary of my Family Trust.

-

This is because the Family Trust has ‘classes’ of ‘beneficiaries’. And these classes are ‘open’.

However, before your accountant prepares the Trust Distribution Minutes or makes any distributions check that the classes of beneficiaries include the bucket company. Or, if the bucket company is going to act as trustee of another family trust (second family trust) then check that the second family trust is also a beneficiary under the family trust.

Why do Family Trusts allow beneficiaries to be added?

The more beneficiaries you have in a Family Trust the better.

If you could make every person on the planet a beneficiary then you would do that. But the Australian Tax Office claims you are not able to do this. This is because the beneficiaries are not ‘certain’ or ‘ascertainable’.

In the 1990s a client instructed us to prepare a Family Trust Deed and staple the Melbourne White Pages to the family trust deed. We applied for a Private Ruling. But the ATO stated that the ‘classes’ of beneficiaries were uncertain and unascertainable. (The “White Pages” was very thick book. It was delivered free to your home. It had a list of people and their telephone numbers.)

I think you get the point. The more beneficiaries in your Family Trust the better.

Q: But if you have evil people and strangers in the Family Trust cannot they ask for money?

A: No. Most Family Trusts have over 400,000 beneficiaries. Beneficiaries have no right to income. The Trustee is instructed by the Appointor on who gets income. This is mostly to yourself, spouse, children, grandchildren, parents and a company you control. (We call this a “Bucket Company” or “Corporate Beneficiary”.)

What is the definition of a ‘beneficiary’ in a Family Trust?

The definition of beneficiaries generally includes ‘my spouse, children, grandchildren, great-grandchildren and any company I have an interest in, from time to time‘.

So generally any company you have an interest in is also a beneficiary under your Family Trust.

Interestingly, if you have a share in say, Rio Tinto, and if Rio Tinto has 300,000 beneficiaries, then all 300,000 beneficiaries are also beneficiaries of your family trust!

So pretty much any company you have an interest in is a beneficiary of your family trust.

(Obviously, a “Special Purpose Company“, while also a beneficiary of your family trust, can not be used as a bucket company. This is because a Special Purpose Company can only do one job. This is to be a trustee of your Self-Managed Superannuation Fund.)

Example of a definition of “Beneficiaries” in a Family Trust deed

This is the Legal Consolidated definition of a Beneficiary in our Family Trust Deed:

Beneficiary (but never the Settlor):

-

-

- as of the Commencement Date the Default Beneficiaries, Trustee, Appointor and Back up Appointors;

- any entity, subsidiary, parent company, company and association (whether incorporated or not) that has an interest in, related to, Associate, or Associated Entity in any of the Default Beneficiaries, Trustee, Appointor and Back up Appointors and each of their directors, members, employers, employees, contractors, independent contractors (and in all cases including whether equitable and legal, whether vested, expectant or contingent);

- charities and charities listed by the Australian Charities and Not-for-profits Commission from time to time; and

- schools, universities, colleges and other educational bodies of any kind, private and otherwise, either within or outside Australia from time to time.

-

(Each referred to as Persons)

Plus, for each of the Persons the following classes:

-

-

- any Spouse, Children, Grandchildren, Great-grandchildren, parent, grandparent, sibling, uncle, aunt, niece, nephew;

- any entity of which the Person is a director, trustee or partner;

- any entity in which the Person has a legal or equitable interest (whether vested, expectant or contingent);

- any entity for which the Person is a Beneficiary or potential Beneficiary (whether vested, expectant or contingent);

- any entity who is the personal representative of the Person;

- any entity employed by or employs the Persons;

- any charitable, religious or community organisation, group or association of which the person is a member, participant or benefactor;

- any entity who would be or could possibly be an Associate or Associated Entity of that Persons; and

- any entity or classes nominated by the Trustee from time to time (at the Appointor’s direction).

-

The classes are open to include an entity that has not yet come into existence or a class not yet identified.

The term ‘entity’ in this definition, also includes natural persons, companies, trusts, associations, groups and entities.

Child, Children, Grandchildren and Great-grandchildren include stepchildren, illegitimate children, de facto children and legally adopted children and children that are adopted out, from time to time.

To see the complete definition of “Beneficiaries” open the “Sample” of a Family Trust deed.

You can see that the definition of beneficiaries is as inclusive as possible. And the definition seeks to have as many classes of beneficiaries as ‘open’ as possible.

Family Trusts go on for 80 years, or forever in South Australia. Therefore, over time, you and your spouse will die. And your children and their spouses and their children continue as beneficiaries of your Family Trust.

The young man builds his family trust. He has no wife or children. He then marries. He has children and grandchildren. He dies of old age. Conveniently and automatically these ‘new’ family members are beneficiaries of his Family Trust.

Why is a corporate beneficiary called a ‘bucket company’ in a family trust?

A company that you distribute family trust income has many names. For example:

- corporate beneficiary

- company beneficiary

- bucket company – before Division 7A, once you used up your human beneficiaries’ low marginal tax rates ‘you then tip the rest of the income into the bucket company’

Tax Advantages of a corporate beneficiary in a Family Trust

Your Family Trust distributes to human beneficiaries first.

This is mum, dad and the children.

This is to use up their low marginal tax rates.

What happens after the Family Trust runs out of beneficiaries on low marginal tax rates?

When there is no one left on low marginal tax rates then the family trust pours the rest of the income into the ‘bucket’ company. The company gets whatever income is left to be distributed.

Unlike humans, companies pay a fixed percentage rate of tax. Whether the company gets $10,000 or $100,000 in trust income it pays the same percentage tax rate.

However, with a bucket company make sure you also have a Division 7A Deed.

But a Bucket company has 5 challenges

As with everything you do there are challenges. These are the 5 issues with a bucket company:

1. Pay the income physically into the bucket company’s bank account

So you decide to distribute Family Trust income to the bucket company.

You must now do two things:

- you complete a Family Trust distribution statement; and

- then physically transfer the money into the bucket company’s bank account. This is before lodging the tax return.

You, therefore, need to have the actual cash in the Family Trust bank account. But rarely does a Family Trust have such ‘lazy money’ sitting in cash.

So if there is not enough cash you need a Division 7A Loan.

2. Division 7A Loan Deed for a Bucket company

When a trust or a human owes money to a company then you need a Division 7A Loan Deed.

When a Family Trust fails to pay all the income to the bucket company then you need a Div 7A Loan Deed. The Div 7A loan agreement is a loan between:

- the family trust that is distributing the income; – but actually does not physically pay the income; and

- the bucket company that has not actually been paid the Family Trust distribution income

If the family trust doesn’t pay all the distributions in cash before the tax return is lodged, then a Div 7A loan is required.

A Div 7A loan:

- Has a maximum term of 7 years

- Has a minimum annual repayment plan

- Has interest that is payable at a rate set by the government each financial year

- The minimum repayments can be met by the Family Trust physically making payments to the bucket company each year. However, it is possible for the bucket company to declare dividends that are offset against the minimum repayment obligation. Obviously, speak with your accountant first.

3. Hard to get money out of a bucket company

Money is ‘trapped’ in a company. This includes a bucket company.

As can be seen above with Div 7A you cannot just take money out of a company.

One way to get money out of the company is to pay a dividend to the shareholder of the bucket company. The dividend is already taxed at the company tax rate. Therefore, the shareholder gets a (franking) credit on the tax already paid.

Example of a bucket company distribution:

The bucket company paid tax on the income many years ago at 30%. The imputation or franking credit is, therefore, 30%. The company declares a dividend to Mum. Mum’s tax rate is 47%. But the bucket company has already paid 30%. So Mum just pays the difference. This is 17%. So Mum just pays 17% of the dividend from the bucket company.

Mum is now retired. If Mum has a low income because she is now retired then she can, over time, drip-feed dividends into her name. This is with a potential tax rate of zero. And the government often may give you back the franking credit.

4. Who owns the shares in the bucket company?

As we saw above, the wealth of a company is trapped.

A common way to get money out of the bucket company is to declare a dividend. But only shareholders can get a dividend.

There are also asset protection issues.

Commonly, you follow the ‘man of straw and woman of substance’ asset protection strategy.

Dad runs the business and is at risk. Mum does not take on the risk of the business. Mum, therefore, holds all the good assets. This includes shares in a company. Therefore, Mum holds the shares in the bucket company.

Alternatively set up yet another separate Family Trust. This is to hold the shares of the bucket company. But you need to think long and hard. Every company and trust you set up has to be looked after. There are more accounting fees each year. And a Family Trust deed needs to be updated every 5 – 7 years.

Another trust is another mouth to feed.

Your accountant needs to conduct a benefit analysis.

You should also talk to your accountant about other ways to get money out of the company. These may include winding up the company, employing family members and service trust agreements. Legal Consolidated does provide advice in this area.

5. What do you do with the money in the bucket company?

You saved tax by distributing money to a bucket company. Congratulations. But now you have a pile of cash sitting in the bucket company.

Cash from the Family Trust that is now in the bucket company needs to be invested.

The bucket company is now an investment company. It seeks to generate an income source for the shareholder.

But, often, a company may not be the best vehicle to hold ‘appreciating’ assets.

When a human or a trust sells an asset they often reduce their capital gain, automatically, by 50%. This is when they hold that asset for over 12 months. This may be one of the reasons why your accountant wanted you to set up a Family Trust in the first place.

But, sadly, companies do not get that capital gains tax relief.

What you get in the Legal Consolidated bucket company

Included in the above price you get:

- start building your bucket company for free. The hints and training videos guide you. Telephone us for legal advice on how to answer the questions

- the law firm oversees the incorporation process with ASIC – every step of the way

- the law firm meets and speaks with ASIC regarding your company name, as required

- includes:

- all ASIC incorporation fees

- Certificate of Incorporation

- Australian Company Number (ACN)

- comes with the law firm letter:

- confirms a law firm prepared for your beneficiary company

- show you how to get a free ABN, TFN and GST

- cutting-edge Company Constitution contains:

- Division 7A Loan Agreement – required by all company beneficiaries of a family trust

- tag along, share buybacks and pre-emptive rights – helps with succession planning after you die

- accountant-friendly, GAAP-compliant valuation powers

- profit distributions, even when there is no ‘profit’ for ATO purposes – important for companies taking income from a family trust

- over 30 different classes of shares, including preference shares

- permits electronic:

- meetings and signatures

- storage of secretarial file

- no need for annual meetings

- allows single directors – directors can be treated as employees as a way to get money out of the bucket company

- no company seal required

- can be used to take income from the Family Trust and then invest or operate a business or lend money to a related person

- personalised Share certificates

- minutes, registers and consents, including:

- Company Officer registers

- Company Officer consent forms

- Application of shares

Can I stop the company incorporation once I have instructed Legal Consolidated to incorporate the company?

Most incorporations take only a few minutes.

Others may take up to 3 working days. This is if ASIC does a ‘manual review’.

Once ASIC incorporates the company it is too late to cancel. But before the incorporation, if we can get to ASIC within time, we can often cancel the incorporation process.

Let us know immediately if you wish to cancel the incorporation process. And during working hours we will let you know if that is possible.

What is an ASIC ‘Manual Review’ of a company to be incorporated?

A common reasons for an ASIC ‘manual review’ is if the company name does not appear in the dictionary that ASIC uses. This would include ‘made up’ words or acronyms. Or one of the addresses is not in the ASIC list of Australian addresses.

Can my corporate beneficiary do other jobs?

A bucket company by definition is a holder of wealth. Therefore, for asset protection, it is best that your bucket company does not carry risk. It should just hold ‘safe’ passive assets like cash and shares. This is in contrast to being a trustee or holding risky assets such as running a business.

To quarantine (reduce) the risk, talk with your accountant about lending money to yet another company or another vehicle, such as a ‘trading’ Family Trust.

Speak to your accountant about whether you want your bucket company to carry out more jobs. But, yes, your bucket company can also perform other duties, such as:

- corporate trustee of a family trust – but this is not recommended because a corporate trustee carries risk

- corporate trustee of a unit trust – but not recommended because of asset protection issues

- corporate trustee of Self-Managed Superannuation Fund – (but not recommended. It is better to build a separate Special Purpose Company for your SMSF instead)

- corporate trustee of a Custodian Bare trust when an SMSF borrows money

- bare trustee: Declaration of Trust BEFORE you buy – ‘secretly buy’

- bare trustee: Acknowledgement of Trust – ‘AFTER the Trustee buys’

- crowd-sourced funding vehicle

- vehicle to operate a business in its own right (rather than through a trust) – but see best practice for asset protection

What does the corporate beneficiary do with all the money it gets from the Family Trust?

Q: My client has a family trust.

He now finds it hard to distribute excess trust income to his children. This is because the children are now working and have their own other income.

He is thinking of building a Legal Consolidated corporate beneficiary.

Legal Consolidated does do not recommend that an asset-rich vehicle (‘safe house‘) like a company beneficiary be exposed to business risk. This is because if it can not pay its debts as they fall due it can be wound up. And all assets are lost to the liquidator. But can the corporate beneficiary carry on investment activities like trading stock and shares? And other passive investments?

A: A Legal Consolidated corporate beneficiary of a family trust can do anything it wants. It can own and operate a business. It can hold property. And it can hold passive investments like shares.

Except for a Special Purpose Company being the trustee of an SMSF, all Legal Consolidated companies are prepared that way.

But best practice for asset protection is not to let asset-rich vehicles (e.g. non-working spouse, SMSF, bucket company) be exposed to risk.

But the bucket company gets richer each time the family trust distributes money to it. And you may not be happy to just keep the company’s money sitting in a bank account. You may want your company to put its money to work.

A bucket company should try and limit its risk by investing in passive investments. We are not financial planners but there are other ‘passive’ investments, not just listed shares. Alternatively, let the asset-rich bucket company lend money. And let the lender take the risk.

If the bucket company is lending to:

- another company (even if related) use this Loan Agreement

- a related human, Family Trust, Unit Trust, Partnership or Bare Trust then use a Division 7A Loan Agreement

- an unrelated third party use this Loan Agreement

I am about to update my Family Trust deed. Should I build the bucket company first?

Q: My client needs to update his Family Trust Deed. It is over 7 years old.

Should I incorporate the bucket company first? And then add it specifically in the updated Family Trust deed?

A: I would not recommend that fiddle around with the current list of beneficiaries already named in your Family Trust. If add to the beneficiaries then you normally trigger a CGT and stamp duty events. Once the Family Trust is created you generally cannot add beneficiaries.

However, read the above information. Most Family Trusts have ‘open classes’. This usually includes ‘any interest I have in a company from time to time’.

Part IVA and the bucket company in Commissioner of Taxation v Guardian

In Comm of Tax v Guardian AIT Pty Ltd ATF Australian Investment Trust [2023] FCAFC 3 the Full Federal Court held that the general anti-avoidance rules of ‘Part IVA’, could be used to stop the practice of sending income to a ‘bucket company’ to reduce taxes.

The court said that the family trust distributions do not automatically escape the Part IVA rules. The case is unique, perhaps bizarre. But it means that accountants have to be vigilant. The ATO has shared its views on the case.

Facts of Comm of Tax v Guardian AIT

In the Guardian case, the court dealt with a situation where a non-resident taxpayer named Mr Springer controlled various entities. There was a discretionary family trust (AIT) that earned significant income, and a private company (AITCS) owned by AIT. Here’s a summary:

2012 Events in Guardian AIT:

-

- AIT earned income in the 2012 tax year.

- AITCS became entitled to this income and paid tax at the corporate tax rate.

- In the same year, AITCS declared a fully franked dividend to AIT.

- AIT then distributed this dividend to Mr Springer.

2013 Events in Guardian AIT:

-

- AIT earned income in the 2013 tax year.

- AITCS became entitled to this income and paid tax at the corporate tax rate.

- In the following year, AITCS declared another fully franked dividend to AIT.

- AIT then distributed this dividend to Mr Springer.

The Tax Commissioner issued assessments based on section 100A for the trust distributions from AIT to AITCS and subsequently to Mr Springer. Section 100A could potentially lead to different tax treatment. But, both the Full Federal Court and the Primary Judge ruled that section 100A didn’t apply. This is because there was no ‘reimbursement agreement’ when AITCS became entitled to trust income. Rather the case focuses on the use of Part IVA as an alternative to section 100A. This is where the Tax Commissioner aimed to cancel the tax benefit that Mr Springer received.

What does Guardian AIT teach us:

- Part IVA and Trustee’s Discretion: Guardian shows Part IVA can apply to a trustee’s income allocation decision.

- 2012 vs 2013 Schemes: Different outcomes for 2012 and 2013 schemes are due to evolving circumstances vs. repeated actions, raising Part IVA risk.

- Objective Intention and Tax Benefit: Part IVA considers objective intention, not subjective. The court ruled intent matters less than objective circumstances.

- ‘Counterfactual’ Analysis: The court determined AIT would’ve paid Springer directly, ignoring the advisor’s advice due to Part IVA changes.

- Was the purpose Asset Protection?: Appointing income to AITCS for asset protection is rejected as AITCS lacked wealth accumulation or protection use.

- Division 7A Impact: AITCS’s dividend declaration arose from Division 7A concerns, this is distinct from the ATO’s view on unpaid present entitlements

How to choose a name for your new Family Trust bucket company

As you build your corporate beneficiary company on our website, check if your preferred company name is available.

Restricted words and expressions in an Australian company:

- ‘bank’

- ‘trust’

- ‘royal’

- ‘incorporated’

You cannot use words that could mislead people about a company’s activities. This includes links to the Government, the Royal Family, or ex-service groups.

ASIC also refuses offensive and illegal names.

Australian Company Name Abbreviations for a bucket company:

- and: &

- Australian Business Number: ABN

- Company: Co, <span”>Coy

- Proprietary: Pty

- Limited: Ltd

- Australian: Aust

- Proprietary Limited: Pty Ltd

Your Bucket company Constitution contains:

- Adj Professor, Dr Brett Davies’ Doctorate is on business succession planning, our preemptive rights are cutting edge

- ‘tag along’ requirement forcing minority shareholders to also sell their shares together with majority shareholders

- accountant-friendly, GAAP-compliant valuation powers

- profit distributions, even when there is no ‘profit’ for ATO purposes

- over 30 different classes of shares – see the sample. And you can add to the classes of shares at any time

- allowing Directors and shareholders to use Zoom and other online facilities

- built-in Division 7A Loan Deeds

Does a Family Trust bucket company need special classes of shares?

A company can issue not just the standard ‘voting shares with dividends’. (Often called ‘ordinary’ shares.) Ordinary shares carry one vote per share and they entitle the shareholder to participate equally in the company’s dividends.

Under a Legal Consolidated Constitution, there is power for the company to issue different classes of shares. You are only limited by the imagination of you and your accountant. For example, the company could issue shares that have no voting rights but have the rights to a dividend.

Or the company may issue one of the many types of ‘preference shares’. Preference shares entitle the shareholder to get only a fixed dividend each year. But the dividends are received in ‘preference’ to the ordinary shareholders. Also, on a winding-up of the company, the owners of the ‘preference shares’ get the capital payout before the ordinary shareholders.

Normally, your accountant will not recommend any special classes of shares. Normally it is enough to just issue ordinary shares. But you need to talk with your accountant before the bucket company starts to accumulate wealth. Issuing more shares, any shares, once the company holds assets may trigger Capital Gains Tax and stamp duty. Legal Consolidated does give advice on these matters. The above is general advice only. Your accountant will help you with this.

“Pty Ltd” is an abbreviation for “Proprietary Limited”

- ‘Proprietary’ means the company is privately held.

- ‘Limited’ means the liability of the shareholders to pay the debts of the company is limited. This is called ‘limited liability‘. See here for asset protection.

Minimum requirements for a bucket company:

- at least one director/secretary living in Australia (for asset protection best to have only one director)

- a physical Australian address for the registered office

- at least one shareholder (this should be a ‘safe harbour’ person – the ‘person of substance‘ rather than the ‘person of straw’)

Six advantages of using a law firm to incorporate a bucket company

The 6 advantages of using Legal Consolidated to incorporate a company to be used as a beneficiary of a Family Trust:

- 94% of bucket company incorporations happen within a few minutes of you building the company online

- when required, we contact ASIC to confirm your company name, at no charge

- what if your company name is unavailable or challenged by ASIC? We contact you and help you find one that is available

- you receive a secure, personalised email containing:

- Certificate of Incorporation

- Company Constitution

- All minutes

- Letter on our law firm’s letterhead confirming we prepared and are responsible for the company’s incorporation

- our hints and training videos guide you. The law firm is available for legal advice on how to build your bucket company

- the bucket company constitution is a deed. Only a law firm can legally prepare deeds.

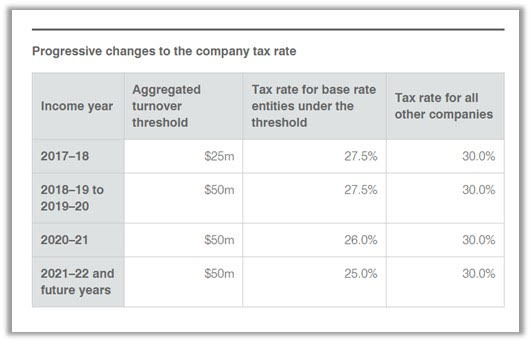

Australian company tax rates for a bucket company v’s human tax rate

- A company pays tax at a fixed rate. (Unlike humans that pay tax at a marginal rate.

- In contrast, a human being pays tax at different marginal tax rates. The more the human earns the higher the tax rate on that additional income.

Your bucket company (flat) tax rate depends on whether the company is a ‘base rate’ entity.

From 2021 there is a 5% difference.

The maximum rate that a corporate beneficiary can use to frank dividends is its corporate tax rate. This is for imputation purposes. It is worked out based on the bucket company’s position in the previous year. It is either:

The maximum rate that a corporate beneficiary can use to frank dividends is its corporate tax rate. This is for imputation purposes. It is worked out based on the bucket company’s position in the previous year. It is either:

- the current year’s Low Rate; or

- the High Rate is based on the prior year’s levels of aggregated turnover, base rate passive income and assessable income.

If the bucket company is set up in the current year then the maximum franking rate is the Low Rate for the current year.

Who should be the shareholder of the Beneficiary Company?

-

Bad asset protection to put assets in a business owner’s names

You are a business owner. And, therefore, like all business owners are a risk of bankruptcy. It is poor asset protection for you to own valuable assets. This includes shares in an asset-rich company. For example, let us say your Family Trust distributes $100,000 to the corporate beneficiary each year. For 10 years.

Your bucket company now has $1m in it. If you own 50% of the company and you go bankrupt then the trustee in bankruptcy takes your shares which is 50% interest in the company. It takes $500,000. The man of straw should hold no assets. Instead, the woman of substance holds wonderful valuable assets like shares.

-

Dividends can only be paid to the shareholders. And this can be limiting

You correctly point out that the company can only pay dividends to the shareholders. And your shareholders are two individuals. (Well, one person, as you would be silly as a business operator to own assets, so it is just your wife as the shareholder.)

So you suggest, instead, that a second family trust owns the shares. This is in the bucket company. If the shareholder is yet another Family Trust (second trust) then you can distribute the dividends to the second Family Trust. This free training video explains how Family Trusts work.

I like this. It is a good idea. But check with your accountant to see if you have enough beneficiaries that are useful. How many children and grandchildren do you have over 18? Do a cost-benefit analysis. It is not just the cost of building the second Family Trust on the Legal Consolidated website:

1. You pay accounting fees, every year, to look after this ‘safe house‘ family trust; and

2. Every 5 – 7 years a Family Trust deed needs to be updated.

So this, otherwise, clever strategy is not without cost.

On a side note: it is, indeed, hard to get assets out of companies. Assets in a company are generally ‘trapped’. But paying dividends is only one way of getting assets out of the company. Your accountant may recommend, say, winding up the company or setting up a Service Trust Agreement. (Yes, for a Service Trust you need to set up yet another Family Trust!)

-

CGT and stamp duty when transferring valuable shares

Once the shares in the bucket company have value then you pay Capital Gains Tax to transfer the shares in the bucket company from your wife to your new/second Family Trust. And if the bucket company has invested in assets such as property then there is also (stamp) duty. This is because the bucket company is ‘land rich’.

If you are going to go with the second/new Family Trust strategy better to put that in place now. Or, at least, before the shares in the bucket company become valuable.

Q: In the company building process, why is there no specific question on what we want the company for?

Q: Why are there no questions about the company being used as a “Bucket Company”?

As a lawyer, I incorporated my first company in 1988. At that time we put in the purpose of the company. For example, to operate a butcher shop. Or, be the trustee of a Family Trust or trustee of a Unit Trust. Or, to be a beneficiary of a Family Discretionary Trust (i.e. a ‘bucket company’).

That all changed when the states gave control of companies to the federal government. The Corporations Act 2001 (Cth) took over. There is no longer a need to restrict what you can use the company for. Even today we review brand new companies incorporated on non-law firm websites. Only to find, even after all this time, they still limit the use or purpose of the company. That is no longer the correct approach.

Instead, Legal Consolidated, allows you to use the company for any purpose. And not just as a bucket company. (The only exception is a “Special Purpose Company” that can only be used for one purpose. And that is as trustee of a Self-Managed Superannuation Fund.)

Enjoy the flexibility of a Legal Consolidated company.

What else do I need to do when I set up a ‘bucket company’?

Q: Does Legal Consolidated contact me about what we need in the company constitution? I see that the Division 7A loan deeds are built-in — so I do not need to worry about that separately?

Are all relevant legal-like documents for the company provided? Or, might there be others I need to purchase separately?

A: The Legal Consolidated Constitution is drafted to give the directors maximum flexibility. If we could put more powers and flexibility into the Constitution we would. We, therefore, do not contact you regarding the Constitution, Minutes, and Company Secretary paperwork. It is all in the pack you receive via email. This is as soon as the law firm has finished working with ASIC to have your company incorporated.

However, over the life of your new company, you need to do many other things. Here are some of them:

- Before the end of each financial year, your Family Trust needs to prepare and sign Trust Distribution Minutes.

- Update the company constitution perhaps every 20 years or so (your company constitution is on Legal Consolidated’s free monitoring service. So, we will email you when you need to update your company constitution.)

- Think about asset protection, estate planning and being good to your spouse so that you have a strong marriage. As tax lawyers, we do not like separations as it reduces your financial assets.

- You need to talk with your accountant about whether you need an ABN, GST, TFNs and lots of other acronyms. We are lawyers. We are not accountants. So we cannot help you with what you need from that perspective. But the cover letter that comes with your company shows how you or your accountant can get those registrations for free from the government.

- Talk with your accountant about the company making a Corporate POA.

- Division 7A includes situations where your family trust distributes income to the bucket company. But does not actually pay the money across. The Division 7A Loan Agreement is included in the Legal Consolidated Company constitution. As you correctly state. But remember:

- as well as having the Division 7A Loan Deed there is, in addition to this, a lot of accounting work and strategies for these loans and Unpaid Present Entitlements (UPEs).

- the Div 7A in the Constitution only works between the company and the shareholder(s). If the company lends money to another person then that other person needs to build their own, separate standalone Div 7A Loan Agreement. So to labour the point, the Family Trust may still need its own separately prepared Div 7A Loan Deed. Talk with your accountant to check whether that is the case in your individual circumstances.

- We are only doing the legal work of setting up a bucket company. We are not giving you any specific advice or legal advice. We are not doing any due diligence. We also do not know your individual specific circumstances. You should speak with your accountant about other issues you need to address. This is relating to not only the bucket company but all other financial matters.

For more information on Australian companies:

The constitution allows for digital signatures

Can an Australian company, itself, give a Power of Attorney?

Maintaining a company register

Do Australian company Minutes require a wet signature?

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case