What is a company power of attorney?

In a company power of attorney, the company appoints a person to act on its behalf. The person the company appoints is called an ‘attorney’.

What is the effect of a POA for a company?

The company empowers the attorney. This is done with a company’s power of attorney. The company power of attorney allows the attorney to:

- sign on the company’s behalf

- carry out the company’s tasks

- have the legal authority to act on the company’s behalf

- look after the company’s affairs

A Company POA is needed when directors are sick, lose mental capacity, go missing or die. However, a Company POA does not operate while the company has no directors.

How to appoint a company power of attorney

Prepare a Deed of Company Appointment where the company is appointing a person to act for the company. The company signs the deed.

Example of how a company power of attorney works

The company must urgently sign a document. A director is missing. The director is sick, dead, suffering from dementia or overseas. However, a Company POA does not operate while the company has no directors.

Thankfully, by signing a Company POA the company has appointed an ‘attorney’. The attorney signs legal documents on behalf of the company. The document is called a Company Power of Attorney.

Is a Company POA a legal document?

A company power of attorney is a legal document where the company appoints another ‘person’. This person, a human, is an ‘attorney’ and acts on the company’s behalf. The attorney carries out tasks for the company. Being an attorney is different to the job of being a director.

Formalities of a Company Power of Attorney

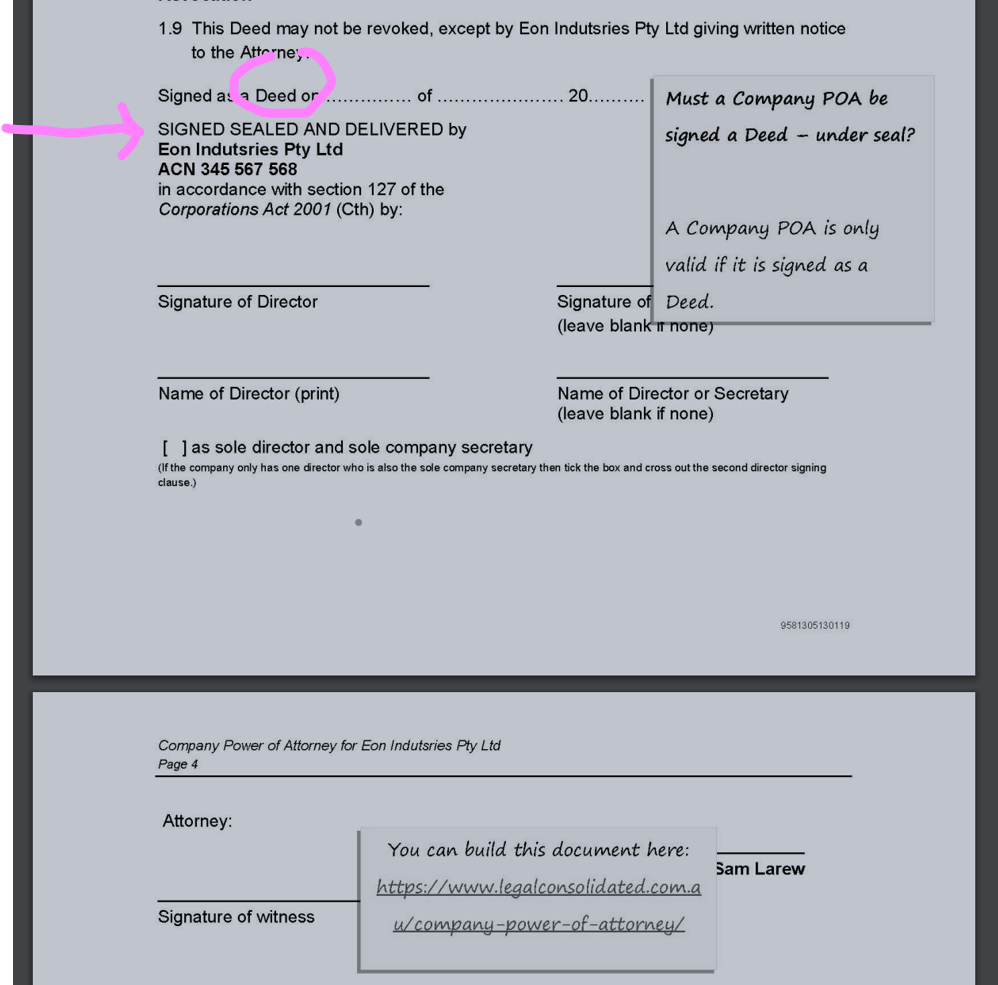

To be valid, a Company Power of Attorney requires strict formalities. One key requirement is that a Company POA must be signed as a deed. Legal Consolidated POAs are always prepared by way of a Deed.

Must a Company POA be signed as a Deed – under Seal?

Yes, a Company Power of Attorney must be signed as a deed to be valid. Signing as a deed ensures that the legal document has the necessary legal weight and enforceability. To sign a POA, as a deed, requires:

- Written Document: The POA for a corporation must be in writing.

- Execution as a Deed: The document must explicitly state that it is signed as a deed. This is typically done by including wording such as “Signed as a deed” just before the signing clauses.

- Signature Requirements: The deed must be signed by the authorised company representatives.

- Company Seal (if applicable): If the company’s constitution requires a company seal, the seal must be affixed to the deed. However, many modern companies have dispensed with the need for a company seal, relying solely on the signatures of authorised representatives. Legal Consolidated’s POA works for both.

Why is Signing as a Deed of Company POA important?

Signing the POA for a company as a deed provides three legal benefits:

- Legal Validity: It confirms the document’s authenticity and the company’s intention to grant the attorney the specified powers.

- Enforceability: Deeds are legally binding documents that are generally more difficult to challenge or revoke than non-deeds.

- Formality and Certainty: The formal process of signing as a deed adds a layer of solemnity and certainty, ensuring that all parties are aware of the seriousness of the document and its implications.

What is the difference between a Company attorney and a Director?

A Company Attorney does a different job to the director:

- Director: A company acts through its directors. The company directors sign documents and make decisions for the company. A director is elected by its shareholders under the Corporations Act. A director has onerous responsibilities under the Corporations Act. If something goes wrong, the director often goes bankrupt together with the insolvent company.

- Attorney: An attorney under a Company Power of Attorney is appointed by a legal document called a Deed. This is where the company appoints a person to act and sign documents on the company’s behalf. Shareholders do NOT appoint the attorney. It is the company, itself, that appoints the attorney.

Who appoints the company attorney – directors or the members?

Members (also called shareholders) own the company as they own the shares in the company. The workhorse, the person who manages the company is the director. The members hire and fire the directors.

However, it is the company itself that appoints the attorney under the Company POA.

What is the difference between an Enduring POA and a Company POA?

A company POA is different from a human POA.

- Companies make Company POAs. The Attorney does things only for the company. (The Attorney does not help any humans. It only performs services for the Company.)

- Humans make Enduring and Medical POAs. The Attorney only helps the human. (The Attorney has no power to help the company.)

Can a Company make an Enduring POA?

A company can not make an Enduring POA or a Lifestyle POA. Likewise, a human can not make a Company POA:

- Only a human can make an Enduring POA.

- Only a company can make a Company POA.

How is a Company POA different from an Enduring POA?

- Company Power of Attorney – a company appoints an attorney. The Attorney’s ‘master’ is the company and no one else. The Attorney does not act in the interests of the directors or the shareholders. Rather the Attorney acts in the company’s best interest.

- Enduring and Medical/lifestyle POAs – a human appoints an attorney. The Attorney’s ‘master’ is the human. The Attorney serves no one else.

Business Structures that can be used with a Company POA

Family trusts do not need a Company POA, unless the trustee of the Family Trust is a company

- Family Trust Deed – watch the free training course – do you need company?

- Family Trust Updates – everything – replace the trustee of the family trust with a company and update the deed

- The company as Trustee of Family Trust – build a company designed to be a trustee of a family Trust

- Bucket Company for Family Trust – build a company designed to be a beneficiary of the family trust

Unit trusts need a Company POA if there is a company as trustee of the Unit Trust

- Unit Trust – which allows for a corporate trustee

- Change Unit Trust Trustee – replace the trustee of your Unit Trust with a company

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures that need a Company POA

- Partnership Agreement – where one of the partners is a company

- Incorporate an Australian Company – and build a company POA

- Upgrade the old Company Constitution – to clean up old rules

- Replace lost Company Constitution – before you build a company POA

Can my Enduring POA also look after my company?

Q: I am a human (donor) and I appoint someone under an Enduring POA (attorney). I am also a director of my company. Surely, if I am sick, my attorney can step in and look after all the jobs that I have to do – including being a director? Cannot my donor ‘stand in my shoes’ and help manage the company, just like a director?

A: The answer is no. Many things that you have to do cannot be outsourced under an Enduring POA. For example, if you have a job and cannot work, then the attorney cannot step in and turn up to your place of work. Similarly, the donor cannot give the job of being a director to another person – not even his attorney.

Under an Enduring POA, you grant a power of attorney to someone to manage your financial affairs. But this does not extend to your job of being a director. Your attorney cannot sign documents on your behalf in your capacity as director of your company. Your role as a company director is not something you can ‘delegate’.

You do not ‘own’ the right to be a director. Only the company has the right to hire and fire a director. A director does not have that right of appointment.

I am a director. If I get sick, can my Enduring Power of Attorney step in and act for me?

I have an Enduring Power of Attorney (POA). It lets someone else—my Attorney—stand in my shoes. But there are limits.

Some jobs are personal. Only I can do them. Being a director of a company is one of those jobs that cannot be delegated. No document, rule, or even an act of God can let someone else take over your personal duty as a director.

If I get sick and cannot act as a director:

-

My Attorney cannot turn up to my work and do my job. You cannot send a stranger to your place of employment.

-

My Attorney cannot take over my duties as a director. That role is personal. It cannot be delegated. If I cannot act, the directorship fails.

A human POA is of no use. It is impotent.

This is why my company must have its own Power of Attorney—a Company Power of Attorney.

-

A human POA protects me.

-

A Company POA protects the company.

Both are needed. One does not replace the other.

But, a ‘human’ enduring POA can look after the shares in my company?

Correct. But you asked the wrong question. In all Legal Consolidated Enduring POAs (most law firms also do this) the human attorney exercises the rights of the donor as a shareholder. But your attorney under your Enduring POA is acting on your behalf as a shareholder – NOT as a director.

For example, if you hold a Legal Consolidated Enduring POA for your Dad then you ‘stand in his shoes’. Therefore, you can call a general meeting of the company. Provided your dad has the votes, then you can replace directors etc…

But we are not talking about that. We are talking about the company (not your Dad) appointing an attorney. This is to act ‘like’ a director.

An enduring POA does not give you the right to stand in your Dad’s shoes as a director. Being a director is a personal obligation. A director cannot hand his responsibilities and job of being a director to someone else. (For example, only the company can appoint a director.)

Further, a human POA does not allow you to make decisions for the company. Only a company can:

- appoint directors.

- make a Company POA.

This is the case even if your Dad is the sole director or shareholder.

Benefits of a Company POA

My husband died. His $2 million life insurance was trapped in our SMSF. The SMSF’s corporate trustee requires signatures from both directors—my husband and I. I pointed out that dead people cannot sign. The insurance company was unmoved. Fortunately, when my accountant built the corporate trustee on LegalConsolidated.com.au, he also built a Company Power of Attorney. This allowed my son to sign the insurance release forms.

Companies sign Company POAs. The company is appointing a human to act as its attorney. The attorney now:

- acts on the company’s behalf

- sign most documents on the company’s behalf

Director gone Walkabout? Company POA saves the day

When a director goes walkabout, the company’s operations can face significant disruptions. However, a Corporate Power of Attorney (Corp POA) helps provide stability and oversight to ensure the business continues to run smoothly. The Corporate POA offers:

- Continuity of company affairs: Ensures business activities and operations proceed without interruption, maintaining productivity and meeting obligations.

- Good stewardship: Guarantees that the company’s assets and resources are managed responsibly and effectively in the director’s absence.

This is especially crucial if the director is missing, as the Corporate POA steps in to maintain order and uphold the company’s best interests during uncertain times.

Ensuring Business Continuity: The Role of a Corporate Power of Attorney

The problem of the missing director:

A company operates through its directors, who sign documents and make crucial decisions on its behalf. But what happens if a director is missing, sick, or otherwise unable to act? The company can lose its ability to function effectively, akin to a ship without a rudder.

Solution when a director is missing:

To safeguard against such disruptions, the company can appoint an attorney through a Corporate Power of Attorney (POA). This designated attorney has the authority to perform necessary actions and make decisions for the company. This includes signing documents and making important business decisions, ensuring the company remains operational even in the absence of a director.

By building a Corporate POA, the company maintains continuity and stability, preventing any potential operational setbacks.

Corporate POA protects the company

What happens if the director suffers death? Illness? Travel? Mental incapacity? Bankruptcy? Who looks after the company when the director is missing?

A Company Power of Attorney ensures your company continues to operate.

Two directors? But one is missing?

Does your company have two or more directors? If so, under the Corporations Act, at least two people must sign all deeds. This is either two directors or a director and a secretary.

Problem: Two directors: but one is missing. For example, you suffer a car accident on the day of signing.

Solution: Before the car accident, the company appointed a person – an attorney. This is via a Company POA. Under the Company POA, that person signs the urgent document.

The company has two directors, but only one human holds the Corporate Power of Attorney

Q: My company has two directors, but Legal Consolidated only allows me to appoint one person as the Company POA. Is that correct?

A: Your company may have one director or ten directors. It makes no difference, and it is not relevant to how a company’s POA works.

Legal Consolidated only allows you to appoint one person to hold the Corporate POA. That is correct. We do that so that insurance companies and land title offices around Australia are more likely to accept the corporate POA.

Why does Legal Consolidated only allow one attorney per Company Power of Attorney?

Q: I want to appoint both of my children to act under a Company Power of Attorney (Company POA). However, I was only allowed to insert one attorney during the building process. Do I need to build and pay for a second Company POA to appoint the second child?

A: Yes. You must build a second Company POA to appoint a second attorney. One Company POA allows one company to appoint one human, no more.

This is not a limitation. It is best practice under common law. A single attorney increases clarity, enforceability, and legal validity.

One Company, One Attorney – Why Company POAs Must Be Singular

Why it is best practice to have only one attorney per company? Ever wondered why a registrar might toss a Company POA in the bin with a smirk, saying, “Too many attorneys, too little clarity”? This is why Company POAs with more than one attorney are being rejected by banks and regulators.

The Company Power of Attorney is not governed by statute, but developed through centuries of English and Australian case law.

In contrast, Enduring POAs and medical/lifestyle POGs are governed by strict legislation in each Australian state and territory.

In Bryant, Powis and Bryant Ltd v La Banque du Peuple [1893] AC 170, the Privy Council held:

“A power of attorney must be construed strictly. It confers only such authority as is given expressly or by necessary implication. It cannot be extended by construction.”

This principle is echoed in Australian courts. In R v Toohey; Ex parte Northern Land Council (1981) 151 CLR 170, the High Court of Australia reaffirmed the strict interpretation of delegated corporate powers, noting that:

“Where power is delegated by instrument, especially to act on behalf of a company or a trust, the authority must be found within the four corners of the document.”

Allowing two people to act simultaneously under one POA creates uncertainty. The law does not tolerate ambiguity. If both attorneys disagree, whose decision prevails? If both try to act simultaneously, which one binds the company? Why should the bank or the titles office have to deal with that? They will not; instead, they merely reject a Company POA with two attorneys.

Our Company POA is the gold standard. Law firms across Australia build and white-label it.

Company POAs are not creatures of Australian legislation – they derive from ancient English law

Each Australian jurisdiction has statutory rules for Enduring POAs—see e.g. Powers of Attorney Act 2014 (Vic) or Powers of Attorney Act 2006 (ACT) and medical/lifestyle Power of Guardians. These Acts provide prescribed forms, witnessing rules, and fallback provisions. If a statutory POA is unclear, legislation may still give it effect. And even then, over one-third of POAs prepared from a government website do not work!

In contrast, a Company POA is a common law document with no statutory safety net, relying solely on Legal Consolidated’s precise drafting.

In Ex parte Kingston Cotton Mill Co (No 2) [1896] 2 Ch 279, 288, Lopes LJ emphasised the precision needed in company delegations:

“A company is an artificial person, and must act through agents. But those agents must be clearly authorised. The law does not infer corporate consent from vague instruments.”

We have been preparing Company POAs since 1988; dual appointment POAs are more likely to be rejected by banks, ASIC, government land titles offices, and other authorities.

Why Appointing more than One Attorney in a Company POA fails

We have seen identical Company POAs lodged with the same land titles office. One was accepted, and the other was rejected. The only difference was which officer reviewed it. No court or government agency is obligated to accept any POA. They scrutinise form, structure, and clarity.

In De Bussche v Alt (1878) 8 Ch D 286, the Court of Appeal reiterated the fragility of delegated authority:

“The moment a delegate steps outside the limits of the written delegation, the act becomes void as against the principal. The courts have no power to correct or repair ambiguous grants of authority.”

This means that even if both attorneys act in unison, the dual authority under a Company POA is unclear ab initio (from the beginning). The act of both attorneys working together may still be invalid. This puts a risk on the banks and government regulators. Banks and government regulators do not like ambiguity (except when they create it!)

More Detail, Not Less – Company POAs Require Clarity

For human Enduring POAs less is more. The shorter the document, the broader the authority. This is because state parliaments give Enduring POAs fallback rules. However, a Company POA only grants what is explicitly written in the Legal Consolidated Corp POA.

In Black v Smallwood (1966) 117 CLR 52, the Australian High Court held:

“When a company acts through an agent, the court will not imply authority merely because the transaction was corporate in nature. There must be actual or ostensible authority.”

That is why the Legal Consolidated Company POA is long and detailed. It must list each power clearly—execution of contracts, banking, litigation, property transfers, and more. If a power is not listed, the attorney does not have it. But even then, the document cannot cover every eventuality. If we attempt to do so, it risks clashing with workplace legislation, ASIC regulations, and taxation law. There is a balance.

The Legal Consolidated Standard – Company POA Built for legal certainty

Since 1988, Legal Consolidated’s Company POA has been refined to meet evolving case law, regulatory expectations, and institutional requirements. Despite Legal Consolidated providing the gold standard of Company POAs, used by lawyers across Australia, no law firm can guarantee universal acceptance, as banks, ASIC, or land titles offices may impose varying standards. By limiting each POA to one company and one attorney, we ensure maximum clarity and enforceability.

Does ASIC require that a Company POA be registered?

Q: For a company POA, are there any other documents or registrations with ASIC required to validate the Attorney’s authority?

A: The Australian Securities and Investments Commission (ASIC) is the regulator of Australian companies. ASIC does not have a registration service or system for Company POAs. The Legal Consolidated Company Power of Attorney itself is a sufficient legal instrument that grants the designated human the authority to act on behalf of the company. However, ensure that the Corp POA is properly signed according to the legal requirements that we set out in our cover letter. Further, keep the original Company POA as part of the company’s records.

Different groups and government regulators may not accept a company POA. Check with the relevant organisation before you let the Director go on a safari tour or die.

Life Insurance companies and SMSF require a Corporate Trustee POA

For asset protection, most companies only have one director. If you have one director, then you only need that one director to sign Deeds. However, if you have two or more directors then you need two directors to sign all deeds.

When the SMSF has a company as a trustee then all members must be directors of that corporate trustee.

Therefore, many SMSFs have two directors – Mum and Dad. Such SMSFs must have both directors sign. What happens if your spouse dies? You can not get the life insurance out of the insurance company.

Two directors? Then the Corporations Law requires:

- two directors; or

- a director and a secretary

to sign Deeds.

If one director loses capacity or is unavailable, the company is unable to sign documents and enter into agreements. The Corporate POA fixes this.

Corporate Trustee of your SMSF must have a Company POA

Example: Your Self-Managed Superannuation Fund has two members: Mum and Dad. The trustee of the SMSF is a company. The directors of the company are Mum and Dad. Mum dies. Mum has given a human POA to her son, Johnny.

Some fund managers, especially for Self-Managed Super Funds, require both directors to sign to release monies.

- Fund Managers do not accept a human POA if the director is unable to sign. Johnny cannot sign on behalf of Mum. This is because Mum is acting as a director.

- Anyway, as Mum is dead her human POA to Johnny no longer operates. A human POA ceases to operate when the person giving the POA dies. (Interestingly, your Will only operates at your death. So your POA and Will are mutually exclusive.)

In contrast to a human POA, the Company POA outlives the directors. A Company POA only stops working when the company, itself, dies. (Or to put it formerly when the company is wound up.)

Central Management and Control of a Self-Managed Superannuation Fund

The ATO generally requires that Self-Managed Superannuation Funds be governed and controlled by its members. There can be between one to six members of an SMSF. Most SMSFs have a company as the trustee. This is called a ‘corporate trustee’ of an SMSF. (Most SMSF corporate trustee companies are also “Special Purpose Companies“.)

Where you have a company as trustee of your SMSF then, generally:

- all the members must also be the directors; and

- only the members are allowed to be the directors.

If you are unable to ‘look after’ your SMSF then your SMSF may become ‘non-complying‘. This is not good as you can lose up to half of the value of your SMSF in penalties for this breach of the SIS Rules.

To help with this ‘central management and control‘ your lawyer, financial planner and accountant, as standard practice, build on Legal Consolidated’s website both:

- an Enduring POA for each member; and

- a Company POA for the SMSF corporate trustee

Which helps with Central Management and Control of your SMSF – an Enduring POA or a Company POA?

The Australian corporate Power of Attorney is only for the SMSF company – it is not for individual directors or SMSF Members. A Company Power of Attorney is distinct from an Enduring POA. Unlike an Enduring POA, a corporate Power of Attorney establishes a principal/agent relationship.

This is important for the Central Management & Control requirement. The predicament is that an Enduring POA does not help with the company’s needs. Instead, a corporate Power of Attorney is employed to manage the company’s affairs when the director or directors are physically or mentally unavailable.

Legal Consolidated does not advise on the interesting topic of SMSF’s Central Management and Control. Rather, our Enduring POAs and Corporate Trustees are designed to be two of the tools used by your advisers to achieve Central Management and Control of an SMSF.

Why should all SMSFs have both an Enduring POA for each member and a Corporate Trustee?

Central Management and Control for a Self-Managed Superannuation Fund (SMSF) is important for the fund’s residency for tax purposes. Both the Enduring Power of Attorney (Enduring POA) and Corporate Power of Attorney (Corporate POA) are prerequisite instruments to help with central management and control issues of an SMSF.

Enduring Power of Attorney (Enduring POA):

An Enduring Power of Attorney is a legal document where a human l grants another human the authority to make decisions on his or her behalf. This is especially true for their incapacity. In the case of an SMSF, if a trustee becomes physically or mentally incapacitated and has appointed an Enduring POA, the appointed human may be able to step in to manage the trustee’s duties, including decisions related to the SMSF. This can be important for ensuring that the central management and control of the SMSF is maintained even if one or more trustees are unable to actively participate.

Corporate Power of Attorney (Corporate POA):

A Corporate Power of Attorney involves granting a person (natural or unnatural) the authority to act on behalf of a company. In the context of an SMSF, if the SMSF has a corporate trustee structure (where a company is the trustee of the fund), a Corporate POA may allow the company to continue to make decisions and manage the SMSF’s affairs. This is if the directors of the corporate trustee are unavailable due to physical or mental reasons. This may help maintain the SMSF’s central management and control.

Does the company’s Attorney also look after the Family Trust’s Appointor?

Q: My company is the trustee of my Family Trust. As the Legal Consolidated asset protection strategy suggests my corporate trustee does no other job. The company only does that one thing.

The Legal Consolidated cover letter that comes with the Company POA states that:

“an Attorney under a Company Power of Attorney cannot exercise any trusts, powers or discretions bestowed on the Appointor.”

Q: Does that mean a company POA serves no purpose if it is just a trustee of a Family Trust?

A: Do not confuse the Trustee of the Family Trust with the Appointor. They are two very different people:

- The Trustee of a Family Trust (whether human or a company) is a squashed cabbage leaf. While it does a lot of work and carries huge bankruptcy risks the Trustee of a Family Trust has little power. To add insult to injury the Appointor of the Family Trust can sack the Family Trust’s trustee. This is at any time. And for no reason. Or, rather, the Appointor does not need to explain why it is sacking the Trustee of the Family Trust.

- In contrast, the Appointor is the luckiest person in the world. The Appointor:

- does no work

- carries no risk

- is all-powerful. (For example, the Appointor tells the Trustee how to distribute Family Trust income.)

Most Australian Family Trusts are structured this way:

- The Trustee is a company (especially if it runs a business or owns real estate)

- The Appointor is a human (usually Mum or Dad, rarely both)

So, at this point, you are beginning to realise that your question is wrong.

- The corporate trustee can never usurp the position of the Appointor.

- Similarly, the person appointed as the company’s Attorney has no sway over the godlike Appointor.

As it states in the Christian bible:

‘A servant is not greater than his master.’ John 15:20 (excuse the sexist language)

The Appointor is god. The corporate trustee and the person holding the corporate POA are mere servants.

The Appointor does not care if the corporate trustee has dead directors or company POAs. Such topics of conversation are beneath the all-powerful Appointor.

A company appoints an attorney through a POA. This allows the attorney to act in the company’s stead. Every company has a job to do. This is whatever business that company is engaged in. The attorney is there to help the company perform its business. However, the corporate POA has limits. The person holding the corporate POA has no greater power than the company or its directors.

In other words, the attorney becomes the company. It is no greater power than the company itself.

If the business of a company is to be a Trustee of a Family Trust, then the attorney looks after the company and helps it perform that job (Obviously, the attorney does not become the trustee of the Family Trust). As a trustee of a Family Trust, the attorney’s power is limited to the job of a Trustee. That is, the attorney’s job is only to act in the service of the Family Trust’s Appointor.

Being the Appointor is a different job altogether. The Appointor controls the Family Trust and gives orders to the trustee. The Appointor also gives orders to any attorney of the corporate trustee. A corporate trustee is not an Appointor. Therefore, the company’s attorney cannot be an Appointor.

Limitations of a Company Power of Attorney – when acting as a trustee of a Family Trust

The company cannot give power greater than it already has. For example, let us say the trustee company’s director is sick. The company cannot act without a director. However, because a company appointed an attorney, the attorney can continue to operate as a corporate trustee of a Family Trust.

However, the Appointor of a Family Trust bosses the corporate trustee around. The Appointor of a Family Trust can sack the corporate trustee.

The company is a servant to the Appointor. Therefore, the person holding the company POA acts accordingly.

This is the purpose of a company POA when the company is a trustee of a Family Trust.

Succession planning of a Family Trust is carried out by a Deed of Variation of the Appointor. The company POA for the corporate trustee has no bearing on this.

Watch a free training course on Family Trusts here.

In summary, for a Company POA – corporate attorney:

- The corporate trustee of the Family Trust appoints the Attorney.

- The Attorney only acts for the company.

- The Attorney has no control over the Family Trust.

- The Attorney has no involvement with the Appointor’s affairs.

- To labour the point, just as the corporate trustee does not get involved in the high and mighty affairs of the Appointor, so too, the company’s Attorney does not get involved in the Appointor’s business.

- The Attorney merely looks after the corporate trustee of the Family Trust. The Attorney has no other job.

Does the person holding the Company POA act for the directors or the company? How does the corporate attorney work?

The Attorney is appointed by the company. The Attorney is not appointed by the directors. The Attorney is not appointed to help out the directors of the company.

The Attorney only acts for the company. The Attorney’s job is to get involved with the affairs of the company. It is not appointed to look after or act for the directors.

Company constitution silent on company power of attorney?

An Australian company has legal capacity. A company is a person. (Sure, an unnatural person, but a person nonetheless.) As such, under the Corporations Act, a company is allowed to appoint an attorney. It is not usually necessary to have a specific power in the Company Constitution.

However, if you are unsure, have your accountant, financial planner or lawyer check to make sure that the Company Constitution does not prohibit the appointment of an attorney. This would be most unusual.

Why not just use a ‘human’ Enduring POA from one of the directors?

Corporate attorney vs Enduring POA:

- There are company POAs; and

- There are human POAs: enduring and medical/lifestyle.

A ‘human‘ power of attorney gives your attorney legal authority to manage another human’s assets and financial affairs. This is when the human is unable to do so. This is for illness, accident and absence.

In contrast, a company power of attorney authorises a person to:

- act on behalf of the company; and

- sign documents on behalf of that company.

A ‘human‘ POA does not work for a company.

This is a key reason why company powers of attorneys are so important. A human power of attorney is not a substitute for a company power of attorney.

Even if you grant a human power of attorney to someone to manage your financial affairs, this does not extend to your company. Your human POA attorney cannot sign documents on your behalf in your capacity as director of a company.

Companies need a company POA.

In contrast, a human needs a human POA.

No. A human power of attorney is not a substitute for a Company Power of Attorney. A Company POA is completely different.

- A human POA in Australia is called an “Enduring Power of Attorney”.

- Human medical/lifestyle POAs in Australia are called:

-

- Enduring Power of Guardianship – Western Australia, Tasmania and New South Wales

- Enduring Power of Attorney – Australian Capital Territory and Queensland

- Advance Personal Plan – Northern Territory

- Appointing Medical Treatment Decision Maker – Victoria

- Advanced Care Directive – South Australia

Neither an Enduring nor a Medical POA can be used to act for a company. Instead, you need a Company Power of Attorney.

Even if you, as a human being, have granted a power of attorney to someone to manage your financial affairs, this does not extend to your company. An attorney under an Enduring POA cannot sign documents on your behalf, in your capacity as director of a company.

Can a person holding a (human) Enduring POA act on your behalf as a director?

A ‘human’ Enduring POA does not allow your attorney to stand in your shoes in your capacity as a director.

A ‘director’ is a personal obligation. You can not delegate that position. You must perform the duty yourself.

A directorship is a personal role and cannot be delegated.

Mancini v Mancini [1999] NSWSC 799 states:

‘The office of a director is a personal responsibility, and can only be discharged by the person who holds the office…

The office of a director is not a property right capable of being exercised by an attorney or other substitute or delegate of the person holding the office; many rights as shareholder can be distinguished in this respect because they are rights of property.’

Therefore, an enduring power of attorney can only be used for ‘personal’ use.

Further, humans holding positions within a Company (E.g. Director or Secretary) cannot use a personal (human) enduring power of attorney to sign documents on behalf of the company.

To give you an example, a business employs Ralf. Ralf has given an Enduring POA to his son Luke. Ralf is sick. Can Luke turn up at Ralf’s place of employment and take Ralf’s position? No, of course not.

What is the difference between an enduring POA and a company POA?

An Enduring POA protects a human. A company POA protects a company.

How does a Company POA interact with my Will?

A Company POA protects the company, not humans. Humans have their own Enduring and Medical POAs.

Like Schwarzenegger’s Terminator, a Company POA does not end when a human dies—it only ends when the company itself is wound up, or the company terminates the Company POA itself.

The company giveth, and the company taketh away.

A Company POA and a Will serve different masters. They fulfil entirely separate purposes and operate independently of each other.

The company itself grants the Company POA. It is not given by humans such as shareholders or directors. The Company POA exists solely to protect the company’s interests, not humans.

The Company POA ensures the company continues operating effectively, even if directors become incapacitated, absent, or dead. (However, a Company POA does not operate where the company has no directors.)

The effectiveness of the Company POA is unaffected by the death of a director or shareholder (unless the company has no directors left).

In contrast, a Will is a personal legal document made by a human. It distributes the dead person’s personal assets and property.

Even if the director who signed the Company POA on behalf of the company dies or becomes incapacitated, the Company POA does not terminate. It remains in force until the company explicitly revokes it or until the company itself ceases to exist.

This is similar to a human Enduring and Medical Powers of Attorney upon the human’s death.

Who can your company appoint as its corporate attorney?

Your company can appoint a human:

- over 18 years of age

- of sound mind

- an Australian resident

Choose people you trust. If they make a mistake, you as a director of the company remain liable.

Is the director liable for the acts of the Company’s Power of Attorney?

Q: The corporate attorney made a mistake. Am I liable for their actions?

A: A director remains liable for a company attorney’s actions. To reduce liability and promote accountability, the company may want to consider appointing two persons to act jointly, acting as a check and balance to each other. Consider who is suitable for the role of Attorney to reduce such issues.

Company Power of Attorney’s obligations?

A Company Power of Attorney must:

- Avoid conflicts of interest. This is between the attorney and the company.

- Act honestly.

- Act in the company’s best interest.

- Retain proper accounts and records.

- Keep the attorney’s finances and assets separate from the company’s finances and assets.

- Not pay themselves or others with the company’s money. This is unless directed to do so. This is different from claiming out-of-pocket expenses in carrying out the attorney’s duties under the company POA.

Do I have to register the company power of attorney at the title’s office?

This Company POA you are building has NOT been prepared to be lodged at a Titles Office. If you need to deal with land then speak with your conveyancer, lawyer or settlement agent.

Does the company POA work overseas?

Legal Consolidated is an Australian law firm. We do not give advice on jurisdictions outside of Australia.

While we do not limit the scope of the company POA we are not able to tell you how it operates outside of Australia. You need to brief a lawyer in that other country.

Q: Does the POA give the attorney the same powers as a director (i.e. appoint and remove directors if required) or is Probate still needed if a sole director dies?

You are confusing the operation of the company with the ownership of the shares of the company. These are two separate matters.

People holding a company POAs and directors both protect and look after the company. But neither has any interest or control over who owns the shares in the company.

- Shareholders own the company. They hire and fire the directors and people holding company POAs

- Directors and Company POAs look after the company. They must act in the company and shareholders’ best interests.

For example, I hate the directors and I hate the people holding the POA over the company. But there is nothing I can do. This is because my dad owns all the shares in the company.

But Dad dies.

In his Will, Dad leaves me the shares in the company. I immediately call a general meeting of the company. As the shareholder, with much relish and enjoyment, I replace all the directors with my own people. And I revoke the company POA.

How to revoke a Company POA

Each law firm has its own rules for revoking a Corporate POA. However, Legal Consolidated Corporate POAs are revoked by a Directors’ resolution. You do not need the person the company appointed to consent. But let the attorney know that the Company has terminated the company POA.

Is a company POA revoked when the company is dissolved?

Yes. A company’s Power of Attorney is automatically revoked when the company is dissolved or ceases to exist. It makes no difference if the company is dissolved by a liquidator (e.g. insolvency) or by the members by consent.

I only want the Company POA active when I am incapacitated or dead

Q: My accountant is building a company on the Legal Consolidated website. He is also building a Company POA immediately. Why is that? I only want the Company POA to start when the company cannot find me or I am dead or worse!

A: Most accountants building a company also build a Company POA straight away. It makes sense. You do not know when you as the director (often the only director) will be lost, dead or worse. (However, a Company POA does not operate while the company has no directors.)

The other problem is that, for example, the word ‘incapacitated’ in Victoria only has 3 separate meanings. (My doctoral thesis touches on the ambiguity of words.) The last thing your company wants in a crisis (e.g. you going into a coma) is for it to have to go to Court to try and interpret confusing and ambiguous words like ‘incapacitated’, ‘lost’, ‘dead’ or ‘worse’.

Q: Make the corporate POA conditional on some event? Eg. death or incapacity?

A: The corporate POA is operational all the time, from the moment the company approves it. However, you can keep the company POA in a safe in a sealed envelope and only instruct it to be released when a certain event occurs.

E.g. “If China invades Australia, immediately provide this envelope to Derryn.”

E.g. “In the event of my death, take any pets I have and this sealed envelope to my brother Brian Neal Buss.”

Q: Is this a ‘limited’ Enduring POA deliberately limited in scope to business issues?

Can my financial adviser, accountant or lawyer hold my Corporate Power of Attorney?

Who is the ultimate controller of a company: shareholders, directors or corporate attorneys?

- The shareholders ‘own’ the company.

- Directors and company POAs merely ‘look after’ the company. And they only carry out that job at the ‘pleasure’ of the shareholders.

If I liked the directors and people holding the company POA then after Dad dies, I would do nothing. I let the directors and people holding the company POA continue doing the work of looking after ‘my’ company. But they better be polite to me, or I will sack them! As the shareholder, I can sack them anytime. This is by calling a company general meeting.

Without my involvement as the ‘owner’ (via my shareholding), the directors continue to be in control of making company POAs. The directors can hire and fire the company POAs. Sure, I can override that if I wish. The ‘owner’ (shareholder) always holds the final control. But the whole reason you appoint a director is to allow the director to run the company.

Do I need Probate to transfer Pty Ltd shares?

Consider Probate. Probate is ‘proving the Will’. For some assets (e.g. real estate and large bank accounts) the Executor will have to get Probate. This is because someone is refusing to hand over the dead person’s asset until they see the Grant of Probate. However, probate is not generally required for the transfer of shares in a Pty Ltd company.

In contrast, if you own $2m shares in BHP then the BHP share registry requires Probate.

But with a Pty Ltd you usually just go to the accountant’s office or your dad’s home. You pull out the company secretary file. And, with a blue pen, complete the share transfer form and fill out the new share certificate. Well, that is the case if you have a Legal Consolidated company. If you got your company from a non-law firm, then good luck!

To labour the point neither the director nor a person holding a company POA has any knowledge, power or interest in:

- who owns the shares in the company

- your Dad

- you

- Probate

- transfer of the shares

Their job is only to look after and operate the company.

A Company POA does not operate while the company has no directors, so the above is more important if the person that died was a sole director of the company.

Any stamp duty on a Company POA?

We draft your Company POA so that it is not necessary to pay stamp duty on the Company POA. A Legal Consolidated Barristers & Solicitors’ Company POA is not generally dutiable.

What does the word ‘attorney’ mean? Is it a lawyer or a person holding the company POA?

The expression ‘attorney’ is often used in the USA as a ‘lawyer’. In Australia, we are generally called ‘lawyers’, ‘solicitors’ and ‘barristers’ and ‘legal practitioners’. The national law firm “Legal Consolidated Barristers & Solicitors” as the name suggests are both barristers and solicitors.

For an Enduring POA, Lifestyle Guardianship POA and Company POA the expression ‘attorney’ refers to the person you appoint to ‘step in your shoes’ and act for you. (It is not your lawyer.)

Company POA does not usually operate while the company has no director

Q: I am the sole director and shareholder of a Pty Ltd company. The company has signed a company power of attorney, intending for the appointed attorney to manage the business after my death until an executor can handle the affairs. However, the bank informed me that they would freeze the company’s accounts upon my death as there would be no directors. This is if they found out I was dead. I am not sure how they would find that out. Anyway, they mentioned that after my death, the shareholders of the company (or executors if the shareholder is deceased) would need to appoint another director. Why is a company power of attorney not sufficient to continue business operations after the death of the sole director?

A: The issue following the death of the sole director and shareholder does not lie in the effectiveness of the company power of attorney but in the absence of any directors to act for the company. Although the POA remains operational, it cannot override the statutory requirement stipulated by the Corporations Act 2001 that a company must have at least one director to legally operate. According to Section 201A of the Act, without a director, a company cannot meet its governance obligations, leading to what is effectively an operational paralysis — such as the freezing of company bank accounts.

When the sole director dies, the company legally persists but becomes functionally inert as there is no appointed director to make decisions or take action. The company POA, while still valid, cannot facilitate company actions independently of this requirement. The bank’s decision to freeze the accounts serves as a protective measure to secure the company’s assets until a new director is appointed by the shareholders, or, if the sole shareholder (who is also the director) is dead, by the estate’s executors. Probate is generally not required, and this can generally be done on the day of your death, if your executors are so inclined. Once a new director is in place, the attorney designated under the company POA can resume acting for the company,

Need a company POA for a Partnership or Limited Partnership

Q: How do I prepare a company POA for a partnership composed of individuals?

- Partnership Agreement deed

- Unit Trust and Unit Holders Agreement

- Upgrade the Company Constitution and Shareholders Agreement

Start building the company POA for free. Read the free hints. And only then telephone us for legal advice

For help building your Company POA telephone us. But start the free building process for the company POA first. Read the free hints.

The building process is designed to educate and empower you.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

- give my power to make a Will to somebody else?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will