Couples Estate Planning Bundle

$1,487 includes GST

-

Includes: Mirror Three-Generation Testamentary Trust Wills and 4 POAs.

Free building process: read hints, educate yourself, answer the questions, and telephone for help.

Couples Testamentary Trust Bundle

The couple’s online bundle includes:

- two tax effective 3-Generation Testamentary Trust Mirror Wills;

- two Enduring Powers of Attorney; and

- two Medical/Lifestyle POAs.

Each document comes with a cover letter explaining how to sign each document. Select the blue-button above to start building the Estate Planning bundle online. The building process is free and highly educational.

1. Tax effective Wills with 3-Generation Testamentary Trust Wills

The two Tax Effective Mirror Wills contain 3-Generation Testamentary Trusts. In the first instance, you leave everything to each other. After you both die, you leave everything to the same beneficiaries.

And to the tax man, I leave…

Every year, Australian taxpayers voluntarily pay the government millions of dollars in ‘death taxes’. The four defacto death duties are:

- Capital Gains Tax

- Stamp Duty

- Income tax

- up to 32% tax on superannuation

Are you going to be one of them? Estate Planning ensures that your estate goes to those you care about. Not the Tax Man.

3-Generation Testamentary Trusts

Professor Brett Davies invented Testamentary Trusts in 1994. In 1997 he then invented the 3-Generation Testamentary Trust. The 3-Generation Testamentary Trusts’ additional advantages include:

- better tax advantages

- generally, pay no tax on the estate income for 80 years

- works for three generations: spouse, children and grandchildren

- discretionary in nature: a beneficiary can choose not to set up any trusts

- wound up when no longer required

- each beneficiary gets their own 3-Generation Testamentary Trust

- when acting unanimously, the children can divide up the class of assets differently. Say you have $1m in shares, $1m in property and $1m in cash. One of your children can take all of the shares. The other is the property. The remaining child takes the cash. There is no CGT and stamp duty.

32% death tax on your superannuation

After you die, your adult children pay 17% or 32% on your Superannuation. That is a non-dependency tax on your concessional superannuation. Our Super Testamentary Trust, which you get automatically in your Will, seeks to reduce this tax to zero.

What happens if my children divorce after I die?

The Divorce Protection Trust delays or stops capital and

income going to a beneficiary who is suffering divorce or separation proceedings. It reduces the Family Court

getting its hands on your money when you are dead.

The Divorce Protection Trust sits dormant in the Will until needed. The Divorce Protection Trust activates for the benefit of the married person and that person’s children and grandchildren. It removes that person’s power to control the trust while suffering the separation.

The Divorce Protection Trust benefits the current and succeeding generations. This helps protect the assets from the Family Court.

The trusts in your Will include:

- 3-Generation Testamentary Trusts – reduces CGT & stamp duty

- Superannuation Testamentary Trust – reduces the 17% or 32% tax on Super going to adult children

- Bankruptcy Trusts – if a beneficiary is bankrupt

- Divorce Protection Trust – if a child separates, it stops the Family Court from taking your money

- Maintenance Trust – if a beneficiary is under 18 or vulnerable

2. Enduring Power of Attorney

The second group of documents you are building are enduring POAs. An Enduring Power of Attorney (POA) is a legal document. It allows you to appoint a person to make financial decisions about your assets. The POA deals with your assets, e.g. real estate and bank accounts. A POA stops the government from meddling in your affairs.

We are a national Australian law firm. Your POA that you are building online is prepared for your State or Territory.

Your spouse automatically holds both your Enduring and Medical POA in the first instance.

3. Medical/Lifestyle Power of Attorney

While your Enduring POA looks after money, property and wealth, your Medical POA deals with your body. Who looks after you, when you cannot?

The government, retirement home or doctors? Should they control your body?

Do you trust your family more? If so, make a Medical POA (Power of Guardianship and Medical Treatment Decision Maker).

Wife trapped in a retirement facility?

Our client had a wife. She is trapped in a high-end aged care facility. She had Alzheimer’s Disease. Our client wanted to get her out. The home said he had no right to touch or move a person. Not even a wife. He rang me in tears. I told him to go home and get the Medical Power of Attorney. He got it. The retirement facility saw it. He got his wife out.

Escape a bad hospital

Our client’s wife was in hospital. The doctors were ‘behaving like Gods, not doctors’. Our client presented the Medical POA. And he moved her to another hospital. There was nothing the doctors could do.

The Medical POA allows you to appoint loved ones. If you lose mental capacity, then they decide your:

- personal lifestyle

- where you live

- medical treatment

But only if you cannot make decisions yourself.

You can build lifestyle/medical POA’s for any Australian state:

- Enduring Power of Guardianship – New South Wales, Tasmania and Western Australia

- Appointing Medical Treatment Decision Maker – Victoria

- Enduring Power of Attorney – ACT and Queensland

- Advanced Care Directive – South Australia

- Advance Personal Plan – Northern Territory

An enduring guardian makes decisions about:

- where you live, whether permanently or temporarily

- who you will live with

- whether you work

- consent to medical & dental treatment

- protecting life or ‘flicking the switch’ when in a vegetable-like state

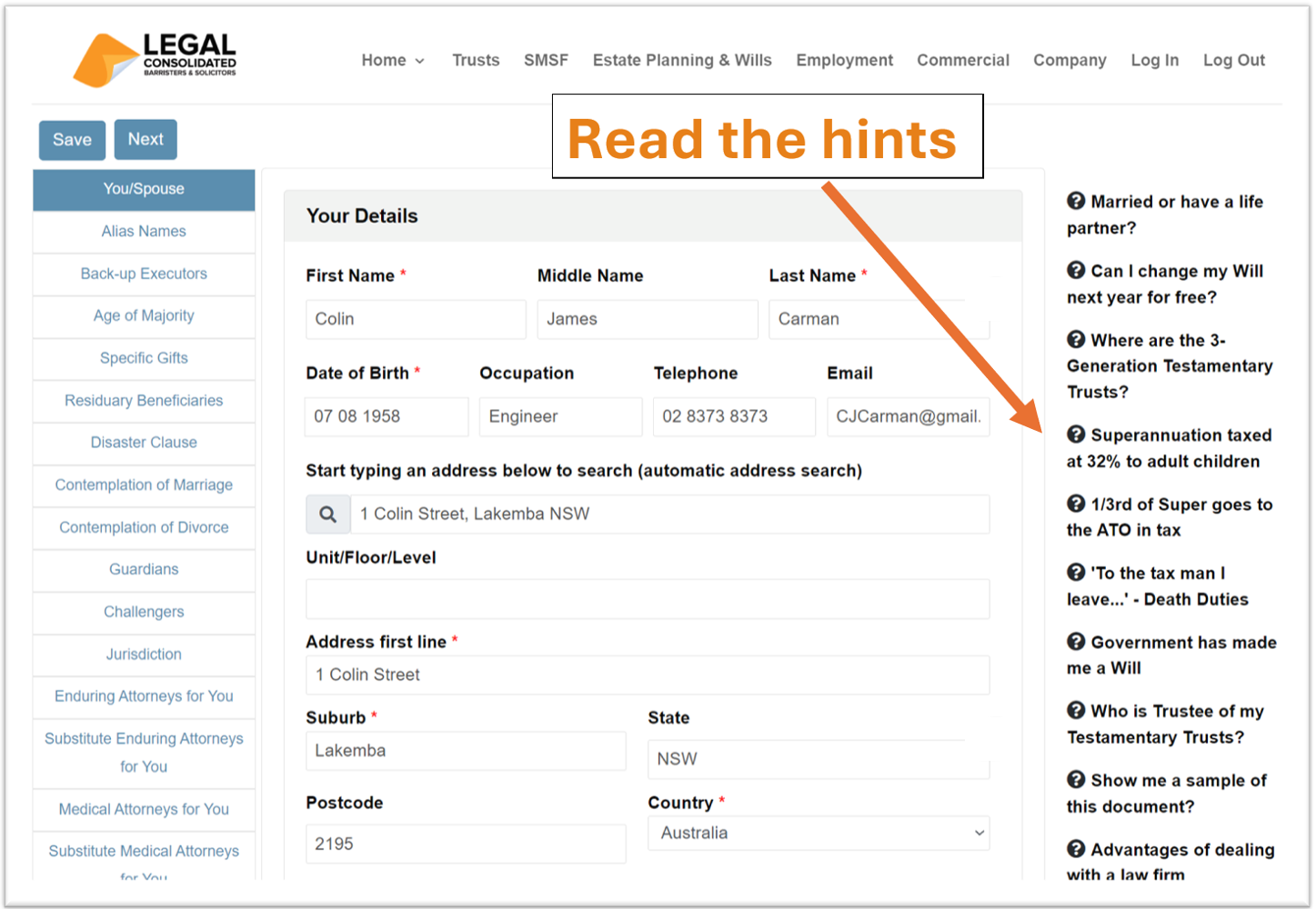

Read the free hints as you build the Estate Planning bundle

The free building process educates you.

Read the free hints. The free-building process answers most questions. Read the hints before you telephone the law firm for more help.

Free storage and monitoring of your signed Wills

Your original signed Will is valuable. Keep it safe, and let your Executors know where it is stored. (You may wish to email them a copy of your Will.)

You can store a signed Will at home, at the bank or with the Executors.

Alternatively, you can store your signed Wills at no cost with a law firm specialising in Will storage.

The law firm stores your signed Wills for free and monitors death notices. They provide the original Will to your executor when you die. They also guide and support your executor in managing the estate and setting up trusts in your Will.

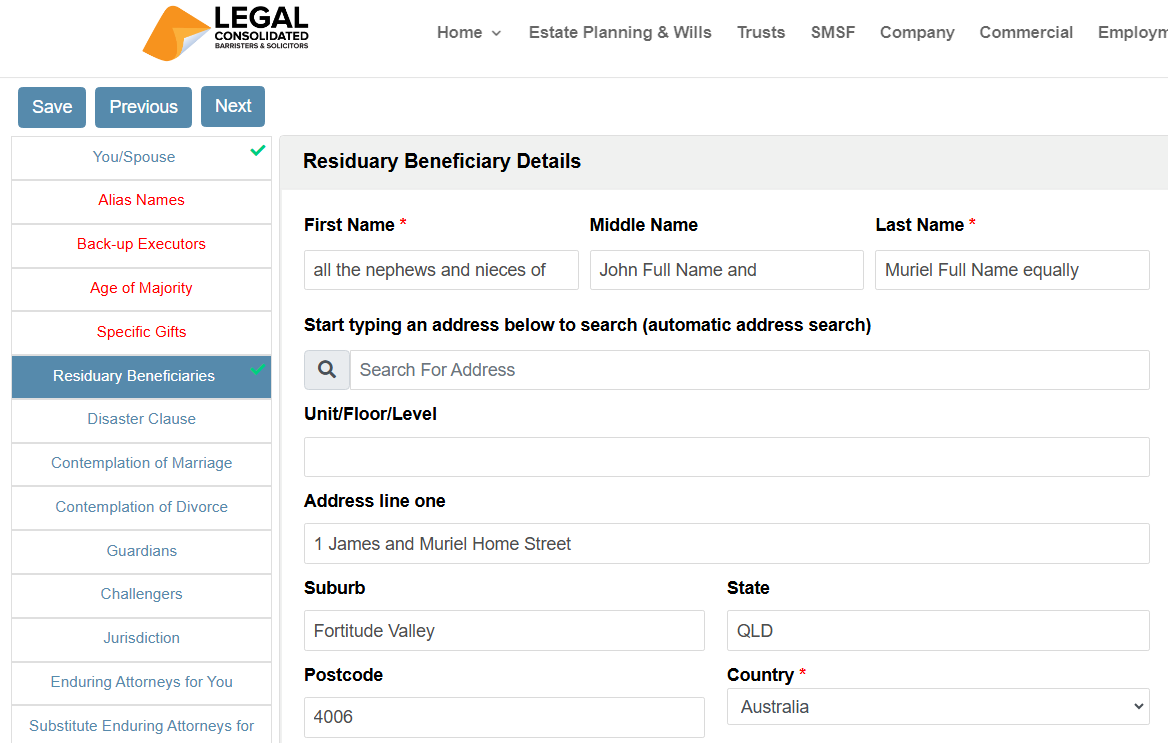

We have no children. We are leaving everything to our nephews and nieces. How do we put those Residuary Beneficiaries into the 3-Generation Testamentary Trust Will?

With Legal Consolidated Wills, you can name the beneficiaries by class. In your case, you are leaving everything equally to your and your spouse’s nephews and nieces. This is how you answer the Residuary Beneficiary question:

all the nephews and nieces of John Full Name and Muriel Full Name equally

Type in your home address. That is, put in the Will Maker’s address.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

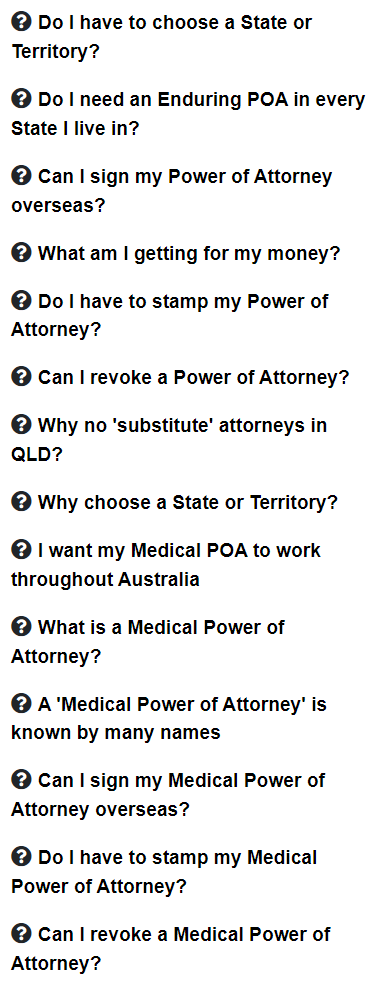

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will