Most Div 7A loans fail to comply with the ATO’s latest ruling

The government left the Div 7A loopholes open in its latest budget. The ATO is not happy.

The government left the Div 7A loopholes open in its latest budget. The ATO is not happy.

The ATO seeks an excuse to render the Div 7A loan ‘agreement’ faulty. These are the six drafting errors the ATO is targeting:

Drafting a Div7A Loan – ATO’s six concerns:

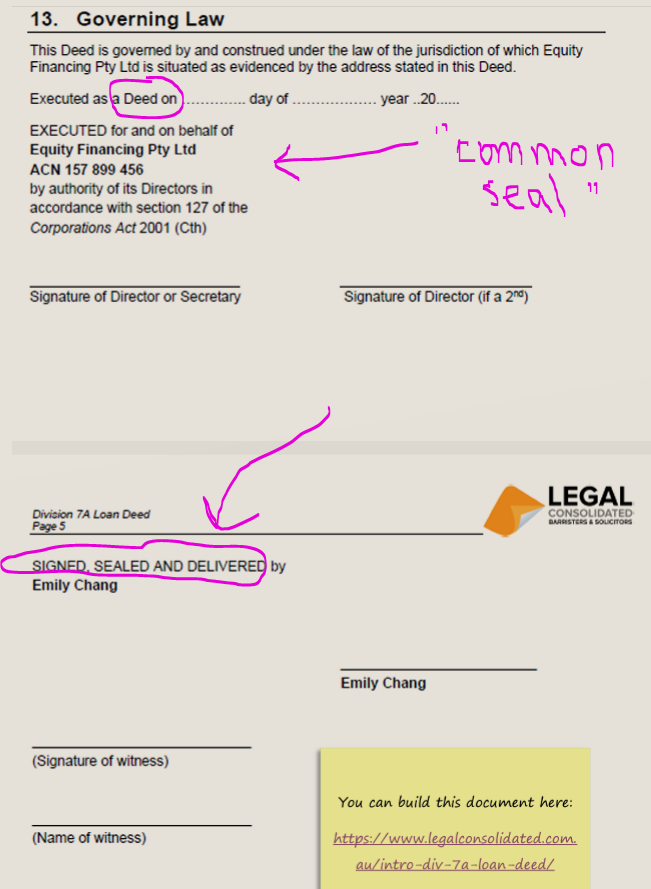

1. Prepare loans as ‘deeds’ – ‘agreements’ do not work

‘Deeds’ do not require ‘consideration’. However, a loan drafted as an ‘agreement’ requires ‘consideration’.

‘Agreements’ require money changing hands. But, often, no money changes hands in a Division 7A. This is because of the close relationship between the company and you.

Rather than money changing hands, you often record the movement of money in a ‘journal entry’. That is fine. However, ‘journal entries’ are not ‘consideration’. The Loan Agreement does not operate. It is not valid. (This is the case for any loan. Including a Loan to a Company or a Loan to a Child. The Family Court, Bankruptcy Court, and the ATO exploit this ‘weakness’ in the Courts.)

Instead, deeds do not require consideration:

-

- All loans should be drafted as ‘deeds’.

- All Div 7A Loans must be drafted as deeds. This includes a Division 7A Loan from a company to its shareholder or a ‘related party.’

Is my Div 7A Deed valid? How to check if your Division 7A Loan Deed is correct?

These are the 3 requirements of a Div 7A Loan ‘Deed’:

1. Firstly, a Deed with this wording: ‘Executed as a Deed‘. This is on the last page of the Loan deed. This is just before the signing clause.

2. Secondly, the wording of a company signing clause is enshrined in legislation. This is called a ‘common seal’ signing clause; its rules are set out in the 127 Corporations Act 2001 (Cth).

3. Finally, the wording of a human signing clause is very exact for a deed. Most lawyers, including Legal Consolidated, use the expression “SIGNED, SEALED, AND DELIVERED”.

The Deed can use the expression ‘agreement’ in the Loan agreement. From what we see of the ATO’s current practice, using the word ‘agreement’ in the deed is acceptable. But you need the three things above.

If you are worried about the validity of your old Div 7A loan, build a new one on our law firm’s website.

A lawyer did not prepare my Division 7A loan agreement

Only accountants can prepare tax returns, and only financial planners can provide financial planning advice. In the same way, only lawyers can prepare deeds and legal documents.

A law firm must prepare a Division 7A Loan Agreement. If a non-law firm provided you with a Division 7A Loan Agreement, even as an MS Word document, they have broken the law. See Legal Practice Board v Computer Accounting and Tax Pty Ltd [2007] WASC 184.

Worse still, a law firm’s Professional Indemnity insurance does not cover the document, so there is a high risk that it will not work.

Is your Div 7A prepared and protected by a law firm?

If your Loan Agreement does come under the cover of a law firm’s letterhead, we recommend that you build a Div 7A on our website out of an abundance of caution.

Is the Division 7A Loan agreement for single use?

Q: Is the Legal Consolidated Div7A Loan Deed a single-use template, or is there an accountant’s version that can be reused for clients in my practice?

A: Legal Consolidated does not sell templates. When you build a document on our website, Legal Consolidated is responsible for the document. They are finished with legal documents. Each comes with a cover letter confirming that Legal Consolidated prepared the document. That protects the accountant. If you reuse a Div7A template, you are engaging in legal work. And that is illegal.

2. A Division 7A loan requires eight things to be enforceable:

1. Offer and Acceptance: an offer from one party and acceptance from the other

2. Intention: intention to be legally bound; social or domestic agreements don’t count

3. Consideration: payment is given for the promise (i.e. signed as a deed) – see above

4. Capacity: parties are competent to contract (i.e. old enough and of sound mind)

5. Free Consent: no coercion, undue influence, fraud, misrepresentation, or mistake

6. Lawful Object: the purpose cannot be illegal, immoral, or against public policy

7. Certainty: clear as to what the words mean

8. Possibility of Performance: Is it possible to perform, physically or legally

3. Out-of-date legislation in a Div 7A

There are Div 7A loans sold on websites (operated by non-lawyers) that incorrectly refer to:

-

-

- ‘ATO Practice Statement PS LA 2007/20’; and

- the ATO Ruling TD 2018/14

-

The Practice Statement has been withdrawn, and the ATO Ruling is no longer applicable. Including such outdated legislation in the Div 7A Loan contaminates the agreement.

4. Div7A loans must contain an ‘acceleration clause’

An ‘acceleration clause’ requires the borrower to pay the entire debt immediately if there is a breach. It is standard in all ‘commercial’ loans. Here, I agree with the ATO. Without an acceleration clause, your Division 7A loan is non-commercial and unusual. The loan falls foul of the ATO.

Why the ATO attacks ‘non-commercial’ Div7A loans

The ATO’s position is that a Div 7A loan must be on a genuine, arm’s-length commercial basis. Otherwise, it is a disguised distribution of profits rather than a loan. A loan agreement without a strong penalty for default is not a commercial agreement. A real lender, like a bank, never tolerates non-payment without severe consequences.

Section 109N and the auditor’s checklist

A complying loan agreement must meet the minimum standards in section 109N of the Income Tax Assessment Act 1936 (Cth). This includes a written agreement, a maximum term, and a minimum interest rate. However, experienced ATO auditors operate with a checklist that goes beyond these bare minimums. They actively test the commerciality of the agreement.

Build a commercially robust Div7A Deed

Many cheap templates, especially from non-law firm websites, fail this test. They are missing essential commercial clauses.

When you build a Division 7A Loan Deed on our law firm’s website, you get a commercially robust deed. Our lawyers draft the document to include these essential clauses. This hardens your loan agreement against this specific ATO attack point.

See an acceleration clause in our Sample Div 7A Deed.

5. Sections of Acts that change in a Div 7A agreement

Division 7A Income Tax Assessment Act 1936 (Cth) stops private companies from distributing tax-free to shareholders and their associates. Many Div7A loans incorrectly reference section 109E(5) Income Tax Assessment Act 1936. If the section is changed, the integrity of the Div 7A loan is at risk. The correct way of drafting a Div 7A loan is to reference the laws only “from time to time”.

6. Freshen up a Div7A, for free, by printing it out and signing it again

As set out below, a Div7A is an ‘at call’ loan. As with all unsecured loans, they potentially go stale after 6 years. However, the Legal Consolidated Div 7A Loan Agreement allows ‘dovetailing’. Furthermore, once purchased, you can print it off as often as you wish and reuse it for free between the company and the borrower. It restarts the 6-year Statute of limitations for another 6 years. See Taxpayer Alert TA 2024/2

7. ATO Targets Contrived Company Loan and Guarantee Arrangements in TD 2024/D3

TD 2024/D3 and Taxpayer Alert TA 2024/2 expose, often unavoidable, schemes where private company guarantees and loans are structured to sidestep compliance with Division 7A payment and loan rules under sections 109C and 109D.

Q: What is the Issue with Private Company Guarantees and Loans under TD 2024/D3?

A: The ATO is focusing on arrangements where:

-

- Guarantee of Third-Party Loans:

A private company (Trading Co) guarantees a loan taken by a related private company (Lending Co) from a third-party financier, such as a bank.

-

- Funds Transferred to Shareholders:

Lending Co uses the borrowed funds to pay or lend money to the shareholders of Trading Co (or their associates), often exceeding Lending Co’s distributable surplus.

-

- Failure to Meet Section 109N Requirements:

Any loan made by Lending Co fails to comply with Division 7A’s formal loan requirements under section 109N.

The ATO highlights these contrived steps:

-

- Default on Loans: Lending Co defaults, triggering Trading Co’s guarantee, forcing it to repay the financier directly.

- Indirect Payments: Trading Co may instead pay Lending Co to enable repayment of the third-party loan, avoiding direct Division 7A consequences.

On objective assessment, these arrangements are set up to bypass Division 7A rules that would have applied if Trading Co directly lent or paid the funds to its shareholders or their associates.

ATO’s View on Reasonable Person Test in Section 109U

Section 109U includes a ‘reasonable person’ test to assess the purpose of the arrangement. The ATO warns that even if a court or tribunal views the arrangement differently, it will still pursue compliance action where it believes Division 7A has been avoided.

The ATO makes clear that businesses engaging in these artificial guarantees and loan structures risk significant scrutiny and penalties. These arrangements are seen as an attempt to defeat the intent of Division 7A and undermine compliance with the payment and loan rules.

Our Division 7A Deed complies with:

- TD2011/15 – Division 7A – unpaid present entitlements – factors the Commissioner will take into account in determining the amount of any deemed entitlement arising under s 109XI ITAA 1936

- TD2015/20 – Division 7A: is a release by a private company of its unpaid present entitlement a “payment” within the meaning of Div 7A?

- TR2015/4 -CGT small business concessions: unpaid present entitlements and the maximum net asset value test

TD 2022/11 sets out the ATO’s approach to Div 7A, where a private company beneficiary is presently entitled to trust income from 1 July 2022: see 2022 WTB 29 [576].

The withdrawn documents (TR 2010/3 and PS LA 2010/4) continue to apply to pre-1 July 2022 entitlements.

Why did the government introduce Div7A? What is the mischief behind Division 7A?

Division 7A prevents private companies from distributing untaxed profits to shareholders or their associates under the guise of loans, payments, or forgiven debts.

What is the benchmark interest rate?

The government requires that you pay a minimum interest rate on the money your company lends you and your family.

That rate is published by the ATO each year.

The benchmark interest rate, which changes each financial year, adopts the Indicator Lending Rates—Standard Bank Variable Housing Loans Interest Rate published by the Reserve Bank of Australia. The ATO publishes the interest rate before the start of the new financial year.

Your Legal Consolidated Div 7A Loan Deed automatically adopts the benchmark interest rate. Your interest rate remains up to date.

This reference to an external source of information is similar to the Amount Lent being referenced to the company’s financials. This is also for each financial year.

Division 7A interest rate changes each year in line with inflation

The benchmark interest rate changes each financial year.

The ATO’s current and past benchmark interest rates are here.

Does the ATO issue annual rulings on the Div7A interest benchmark?

The ATO no longer issues annual rulings on the interest rate for Division 7A. Its TD 2018/14, which set the 2018-19 benchmark interest rate, has been withdrawn.

Does the Legal Consolidated Div7A Loan Agreement automatically adjust for the different interest rates every financial year?

The Legal Consolidated Division 7A Loan automatically updates for the current benchmark interest rate. So, you only have to build the Division 7A Loan deed once. This is for each shareholder.

How does the ATO view taking money from your company for personal use?

You ‘own’ your company. Therefore, you take whatever money you want from the company.

You see a wonderful piece of jewellery for your wife. Out comes the company credit card. You buy her the gift.

This is a personal item. It is not part of the business. You have gained a financial advantage from your company.

The ATO says you are wrong. You are not your company. Your company is a separate legal entity that pays tax at a lower rate than you and your wife.

You suffer a ‘ deemed dividend ‘ without a valid Div 7A Loan Deed. The tax penalties for taking money from your company are almost 100%.

Instead, you should have ‘borrowed’ the money from your company. The Div 7A Loan Deed treats the company money as a Div 7A complying ‘loan’.

Tax consequences when you benefit from your company

Speak to your accountant if you are a director, shareholder, associate of a shareholder, trustee, beneficiary, child, wife, or mistress, and you use the company money or assets for private purposes. Also:

- keep complete and accurate records to explain these transactions,

- report them correctly in your company or trust tax return and in your tax return.

There are tax consequences if you do not. You trigger Division 7A of Part III of the ITAA 1936; this means that transactions are treated as an unfranked deemed dividend in your assessable income. You pay an additional penalty tax.

Money or assets used for private purposes can include:

- salary and wages

- fringe benefits

- director fees

- dividends

- trust distributions

- the company ‘lending’ money to the Family Trust (including – unpaid present entitlements – UPEs) – this is opposite to the Family Trust or Mum and Dad lending money to the company

- allowances or reimbursements of expenses

What is the mischief in ‘borrowing’ money from my company?

Companies pay a constant ‘low’ flat rate of tax. In contrast, mum and dad can pay a high marginal tax rate.

- Therefore, Mum and Dad’s company earned the income in the good old days (before Div7A).

- The company pays tax at a lower tax rate. (It saves Mum and Dad paying a higher rate of tax.)

- The company ‘lends’ money to Mum and Dad. Mum and Dad buy a boat, have a holiday or whatever.

- Mum and Dad never bother to pay back the debt, so they never bother to pay the difference between the low company tax rate and their higher marginal tax rate.

- Mum and Dad merely renew the ‘loan’ every five years with a Deed of Acknowledgment of a Loan.

The government got sick and tired of this and introduced Division 7A Income Tax Assessment Act 1936.

According to the ATO, Div 7A ‘ensures that private companies can no longer make tax-free distributions of profits to shareholders’. The ATO also states:

‘It ensures that all advances, loans and other credits by private companies to shareholders, are treated as assessable dividends. In addition, debts owed by shareholders which are forgiven by private companies are treated as dividends.’ Explanatory Memorandum to Act No 47 of 1998.

Now, Mum and Dad:

- need a proper commercial loan deed that the company with the Division 7A rules and

- repay the money that the company ‘lent’ them.

Our Div7A protects you in 5 ways:

- you get money from your company

- you get a financial benefit from your company (use of the company boat)

- you get a loan from your company

- your company forgives a debt you owe

- your Trust has ‘unpaid present entitlements’ owing to the company

You need a separate Div7A Loan Deed for each person

For example, if you have:

- Husband

- Wife

- Son

- Daughter

- Trustee of a Family Trust

- Bucket company (the company is a beneficiary)

Then, you need six separate Division 7A Loan Deeds. Sign them, date them and put them in your company secretary file.

Is a Division 7A Loan Agreement a revolving line of credit?

Yes. The Legal Consolidated Division 7A Deed is a revolving line of credit. Therefore, you do not need to create a new Deed each year. This is a unique feature of Legal Consolidated 7A Loan Deeds. We listen to the ATO. We get a lot of information from accountants and lawyers attending ATO desktop audits. We ensure that our Div7A Loan Deeds are carefully prepared under the law and with what the ATO believes is best practice.

Why do Division 7A loan agreements not state the loan amount?

The Division 7A Loan Deed is like a credit card. It is a revolving line of credit. This means the same Legal Consolidated Division 7A Loan Deed can be reused each financial year. You do not need a new Division 7A loan agreement for each loan.

The Division 7A Loan Deed does not specify a fixed amount. This allows it to cover multiple advances and repayments over the financial year and from financial year to financial year without you needing to build a new loan agreement for each transaction.

To determine the amount subject to the loan for any particular financial year, the Division 7A loan agreement merely refers to the company’s financials. This is similar to the Loan Agreement referring to the Benchmark interest rate set by the ATO each financial year.

Our Division 7A Loan Deed simplifies administration by functioning as a compliant and reusable framework, much like a revolving line of credit.

ATO’s seven deadly sins of Div 7A Agreements

Recently, I was privy to the ATO’s checklist for Division 7A Loan Deeds. These are the seven deadly sins of Div 7A – and how to avoid them:

- Sign the Div 7A Deed BEFORE you lodge the company returns – the earlier you sign a Div 7A Deed, the better

- Sign the Deed as a ‘Deed’, not as an ‘agreement’. Agreements are not usual or commercial for loan agreements. Commercial loan documents are signed as ‘deeds’. All Legal Consolidated Div 7A Deeds are deeds. As lawyers, we would never let you build ‘agreements’. If you are unsure, look to the area where the Deed is signed. It should say ‘Signed as a Deed’. If not, go back to the lawyer who drafted the Div 7A and ask them to redo the loan agreement.)

- Payback 1/7 of each separate debt each financial year. Therefore, at the end of year 7, that particular loan is fully paid off. (Telephone us if you want a secured Div 7A loan.)

- Ensure the Deed automatically adjusts each year to the new ATO set ‘benchmark interest rate’

- Pay the ‘benchmark interest rate’ set by the government each financial year

- Build a Div 7A Loan Deed for the shareholders, children and loved ones. Anyone who may get some money from the company

- Ensure that your Div 7A Loan deed is ‘revolving’. This means you do not have to do a new one every year. The same Div 7A Loan Deed deals with each new ‘7-year loan’ you create yearly.

Repaying Division 7A loans by Journal Entry

I am scared of journal entries. A journal does not create a transaction. It does not do anything. It merely records transactions that happen. Journal entries are fraught with danger.

However, the practice of using a journal entry to pay a dividend to make a Div 7A loan repayment is widespread. But be careful when it comes to complying with rules governing the payment of a dividend by journal entry. This is to make a “minimum yearly repayment” on a complying Division 7A loan.

The Division 7A Loan agreement must be signed as a ‘deed’. Or the journal entry is doomed to failure. (See above.)

Division 7A Rules and the Dividend Strategy

Section 109E ITAA 1936 states that an unfranked deemed dividend arises. This is to a shareholder (or associate of a shareholder) of a Pty Ltd (private company). This is if the shareholder fails to make a “minimum yearly repayment” by 30 June each year. This is under a complying Div 7A loan deed.

Now, I would feel safer if the shareholder (or associated) made a cash payment to the company. However, often, the company’s profits are used to pay a dividend through a journal entry. This is in satisfaction of the “minimum yearly repayment” obligation owed by the shareholder.

Principle of mutual set-off for a Div 7A

A journal is a payment only if the principle of mutual set-off is satisfied. This involves two parties. They mutually owe each other a debt of obligation. And they agree to set off their liabilities against each other. The mutual debts are discharged. The moving of money in and out of bank accounts is not required.

The journal making the MYR is effective only if the shareholder’s obligation to the company to make the MYR is set off against an obligation owed by the company to the shareholder to pay the dividend. This dividend strategy is not available where the “minimum yearly repayment” is owed by an associate of a shareholder.

Journal entry ineffective in dealing with Division 7A

What if the company owes no obligation to the shareholder? This is because no dividend is validly declared by 30 June to create the company’s indebtedness to the shareholder. Then, the payment of the “minimum yearly repayment” by the journal entry fails.

Watch out for the Corporations and tax laws as well:

1. Do not forget the Company rules when it comes to Division 7A

Section 254T Corporations Act 2001 sets out the rules for dividend-making. There may also be additional rules in the company constitution. Declaring a dividend appears in the director’s minutes. This has been put in the company secretary file. This is within one month of the minutes. See section 251A.

For example, you declare the dividend on 30 June. Therefore, the directors’ minutes are filed in the company register by 31 July.

2. Tax rules for Div 7A

A private company making a frankable distribution gives the shareholder a distribution statement. This is no later than 31 October. (Four months of year-end.) See 202-75 ITAA 1997.

Are the accounts of a debtor company enough to create an acknowledgment by a debtor? VL Finance Pty Ltd v Legudi

Q: The ATO has concerns regarding Deeds and ‘journal entries’. But are the accounts of a debtor company enough to create an acknowledgment by a debtor? Surely, the annual company return of the creditor company is sufficient to create the relevant acknowledgment?

A: You are playing with fire here. I am not sure why you are looking for trouble.

Your argument fails under VL Finance Pty Ltd v Legud [2003] VSC 57. Your question about the annual company returns of the creditor company being enough to create the acknowledgment is rejected by the Court. This is the case, even though:

- The returns are signed by the directors, who are the actual debtors!

- And the accounts identified the debts.

The annual returns are not:

A statement ‘made’ by the directors in their capacity as debtors to the company in its capacity as the creditor. As your accountant will tell you, the annual return is merely a statement ‘by’ the company.

One of my students, who helped with the research for this article, dug up the case of Lonsdale Sand & Metal v FCT 38 ATR 384. In this case, the statement in the accounts of a debtor company is accepted as evidence of an acknowledgment by a debtor. However, this case relates to the old Section 108 loans, which predate Div7A. I would not rely on this case.

My family trust has no ‘spare’ cash. How can it pay back the money it owes the bucket company?

Q: I distribute money to my bucket company. This is so that we pay the lower corporate tax rate.

However, how will the discretionary trust ever be able to repay the loan if all income (including capital gain) must be distributed every year?

How can I repay the money if I only distribute it to a bucket company? If I were distributing also to human beneficiaries, I would get them to sign Deeds of Debt Forgiveness. This would free up cash.

A: The terror of Division 7A was introduced in 1997. Since then, my own Family Trust has never been distributed to our bucket company. It is too complex. I would rather pay the tax.

Your question reflects the complexity. First, you need to distribute the trust income and realised capital gains. Otherwise, the trustee of the Family Trust pays tax at the highest human marginal tax rate. Div 7A is designed to prevent you from permanently taking advantage of the lower constant company tax rate.

(You only pay capital gains if you dispose of an asset. If your family trust has shares in BHP and they triple in price, but you do not sell them, then you do not pay capital gains. You trigger the CGT liability only when you sell or dispose of the BHP shares.)

With a Div 7A Loan, you pay back one-seventh of the debt plus the statutory interest rate each financial year.

You claim that your Family Trust has no ready cash lying around to pay that 1/7th of the debt. Well, like all of us, you have to pay your debts. Sell Family Trust assets. The Family Trust can borrow. Or the Family Trust can declare insolvency, allowing the bucket company to sell the Family Trust assets to try to claw back the debt.

You mention that if you distribute to human beneficiaries, they can just forgive the debt. I agree. But I do not see how that frees up any ready cash. You were not going to hand over any cash to them anyway!

Sub-trust vs Division 7A Loan Agreement

Q: Why not put the money the Family Trust owes the bucket company in a sub-trust? The money is, therefore, earmarked for the sole use and enjoyment of the corporate beneficiary. And you have complied with Division 7A ITAA 1936.

A: Sub-trust arrangements stopped in 2022.

This is because of the ATO’s Draft Determination TD 2022/D1. The full name of the Determination is:

“Income tax: Division 7A: when will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?”

The TD 2022/D1 sets out the ATO’s view. This is when a private company beneficiary (bucket company) provides “financial accommodation”. This is to the Family Trust, Family Trust trustee, or a shareholder of the bucket company. This is for Division 7A purposes:

- for an Unpaid President Entitlement (UPE): The bucket company knows an amount that it can demand immediate payment. But it does not demand payment. It, therefore, consents to the Family Trust trustee keeping that amount for the Family Trust’s use or

- for a sub-trust held for the bucket company’s benefit: The bucket company knows that a shareholder (or associate) is using all or part of the sub-trust funds.

I have always believed that such arrangements fall foul of the provision for financial accommodation. In our view, this is for the very purpose of s 109D(3) ITAA 1936 Act. This is where a bucket company of the family trust knows a UPE. But does not demand payment. The ATO accepts that position.

The ATO states that when a UPE is placed on a sub-trust, there is no provision for financial accommodation. This is unless and until the associated funds are used by the bucket company’s shareholder or associate.

The sub-trust arrangement is dead.

Legal Consolidated has never been involved in sub-trust arrangements. As a conservative taxation law firm, we have always considered them too risky and complicated.

Why did the ATO kill off sub-trusts in Family Trusts for Division 7A

The ATO once gave out supportive views on the use of sub-trusts. See the old Ruling TR 2010/3 and Practice Statement PS LA 2010/4.

However, the ATO’s old views were never convincing. Legal Consolidated has never been involved or advocated sub-trusts for Division 7A and bucket company issues.

The ATO’s revised view is that a Family Trust corporate beneficiary with a UPE provides financial accommodation

“to anyone, the company allows to have access to the amounts to which they are entitled (whether or not they pay interest or other compensation)”.

Legal Consolidated first officially heard of the ATO’s anti-sub-trust approach in the 2014 Board of Taxation minutes. But even before then, it was clear that sub-trusts were a risky approach.

See also the ATO’s Practical Compliance Guideline PCG 2017/13. This is under Division 7A – PS LA 2010/4 sub-trust arrangements maturing in or after the 2016-17 income year. This is the fifth update to PCG 2017/13!

Am I allowed to update – or build another – Division 7A Loan?

Q: My clients had a non-law firm website prepare a Division 7A Loan Agreement. For the reasons you state in your article, it is wrong. I telephoned the website, and they said they were not lawyers. But were reselling a law firm’s template. She agreed with the Legal Consolidated article, and she apologised.

She said that she used a commercial lawyer’s old template and that the commercial lawyer did not practice in tax. This begs the question of why the lawyer ventured outside their area of expertise. To add insult to injury, the lawyer had retired!

The faulty Div 7A Loan Agreement started on 30 June last year. If the loan agreement started on 30 June last year, and I built a correct Div 7A Loan Deed on your website a year later, how does the ATO view this?

A: You can do as many Division 7A Loans as you wish. Sadly, the correctly prepared Div 7A Loan only operates ongoing. You are stuck with the previous year’s badly drafted Div 7A loan agreement. But the new one you are building on our law firm website overrides the old one and applies for new loans.

Does a new Div7A Loan Deed fix old mistakes?

Q: Does building a compliant Division 7A Loan Deed correct a faulty Div7A loan from a previous year?

A: Division 7A Loan agreements can not work retrospectively.

Does the ATO permit retrospective adjustments to faulty Div 7A agreements?

A new Div7A Loan Deed is not retrospective. The Australian Taxation Office (ATO) does not permit a new agreement to fix past non-compliance.

When does a new Div7A agreement start?

Your new, correctly drafted Div7A Loan Deed operates from the day you sign it. It applies only to new loans and advances made in that time period and, of course, future loans by the company.

Am I stuck with a faulty Div7A loan?

You remain bound by the terms and non-compliance of your old, faulty agreement for all past financial years.

Many Div7A “templates” from non-law firm websites contain errors. These include referencing withdrawn ATO rulings (like TD 2018/14) or failing to be a proper “deed”. These errors expose you to a deemed dividend under Division 7A of the Income Tax Assessment Act 1936 (Cth).

Building a new Div 7A Loan Deed does not rectify those past breaches.

How do I correct a faulty Div7A loan going forward?

Your best strategy is to contain the problem. Build a new, compliant Div7A Loan Deed on our law firm’s website immediately. This new deed overrides the old, faulty agreement for all future transactions. It ensures all new loans comply with the law.

But I made an honest Division 7A mistake

Law Administration Practice Statement PS LA 2011/29 allows the ATO to exercise discretion on Div 7A deeming matters. The statement provides relief for taxpayers who trigger a deemed dividend due to an honest mistake or inadvertent omission. In section 109RB, the Commissioner can either disregard a deemed dividend or allow it to be franked.

ATO’s honest mistake discretion under PS LA 2011/29

The ATO Commissioner’s power is not random. Law Administration Practice Statement PS LA 2011/29 outlines the process. Your accountant must make a formal submission to the ATO. They must prove the breach was an “honest mistake” or “inadvertent omission”. Do not try to make this application yourself. Allow your accountant to deal with the regulator.

Example of an honest Div7A mistake: The late minimum repayment

We see clients make honest mistakes. A common one is the minimum yearly repayment. You pay the full amount, but it is one day late. You pay on 1 July, not 30 June. A deemed dividend is automatically triggered.

Your accountant must now beg the ATO for discretion under section 109RB. They argue it was an inadvertent error. You immediately paid the amount. If your compliance history is good, you may be forgiven.

Example of an honest mistake under Div7A: The $100 calculation error

Another common error is miscalculation. You calculate the minimum interest and principal repayment. The calculation is wrong by $100. The ATO discovers this error on an audit.

This is a clear breach. A deemed dividend applies to the entire loan, not just the $100. Your only hope is a plea for discretion. You must prove the calculation was an honest error and immediately pay the $100 shortfall.

Relying on an honest Div7A mistake under section 109RB is risky

Relying on section 109RB is a terrible last-ditch strategy.

- It is not guaranteed. The ATO’s indulgence is not a right. If your compliance history is poor, the ATO often refuses.

- It is expensive. Your accountant charges thousands of dollars to prepare a detailed PS LA 2011/29 submission.

- It is stressful. You wait for months, not knowing if the ATO accepts your plea or hits you with tax penalties.

The cost of this submission is significantly higher than that of a compliant legal document.

Div7A compliance is cheaper than forgiveness

Avoid the cost, stress, and uncertainty. The best strategy is always compliance. Build a correct, ATO-compliant Division 7A Loan Deed on our law firm’s website from the start. This removes the risk. It prevents the need to beg the ATO for forgiveness.

History of Division 7A

Division 7A of the Income Tax Assessment Act 1936 was introduced on December 4, 1997, to prevent private companies from making tax-free distributions of profits to shareholders (e.g. Mum, Dad) or their associates (e.g. children and Family Trust) in the form of payments, loans, or forgiven debts.

On 12 December 2002, Division 7A was expanded to include transactions between trusts and companies where the company becomes ‘presently entitled’ to trust income that is not paid, and the cash is distributed to shareholders or associates.

On 1 July 2009, the Division 7A rules were further extended to arrangements involving interposed entities between trusts and shareholders or associates.

In October 2018, the Treasury released a consultation paper proposing changes to improve the integrity and operation of Division 7A. These proposed amendments included:

- Simplified Division 7A loan rules to make compliance easier.

- A self-correction mechanism to assist taxpayers in promptly rectifying breaches of Division 7A.

- Safe harbour rules for the use of assets to provide certainty and simplify compliance.

- Technical amendments to improve the integrity and operation of Division 7A while providing increased certainty for taxpayers.

- Clarification that unpaid present entitlements (UPEs) come within the scope of Division 7A.

These changes were initially intended to take effect from 1 July 2019 but have yet to be enacted. Division 7A continues to operate under the existing provisions.

What is the purpose of Division 7A ITAA 1936?

Division 7A is a provision in the Australian income tax law (Income Tax Assessment Act 1936).

Div 7A applies to private companies (e.g. Pty Ltd). But only if:

- the company has unpaid present entitlements (UPEs) from a Family Trust distribution or

- ‘loans’ outstanding to their shareholders or their shareholders’ ‘associates’.

Division 7A forces these UPEs and loans:

- be treated as ‘dividends’ from the company and

- included in the shareholder’s assessable income.

Div 7A’s purpose is to prevent private companies from avoiding tax by making tax-free distributions to their shareholders, which are in the form of UPEs or loans rather than dividends.

Under Division 7A, a private company must either:

- repay a UPE or loan to a shareholder or their associate within seven years. This can only be done if you have a Div 7A Loan Deed, or

- the UPE or loan is treated as a dividend and included in the shareholder’s assessable income.

Exceptions to Division 7A

Certain exceptions to Division 7A apply. These include cases where the UPE or loan is ‘genuine and commercial’—that is, it is not a means of avoiding tax.

Division 7A has significant adverse tax consequences for private companies and their shareholders. This is potentially almost a 100% tax penalty.

Do Div 7A Loan agreements expire after 6 years?

Q: Professor Davies, you claim that all Div 7A loan deeds expire after 6 years. Now, I accept that:

- there is legislation in each Australian state where ‘at call loans’ cease to work after 6 years – under the Statute of Limitation;

- loans under division 7A are ‘at call loans’; and

- if the Div7A is so ‘expired’, it is unrecoverable – and automatically forgiven, in the eyes of the ATO – disaster!

However, these six years start from the date the ‘claim is made’, which is when the cause of action arises. This could be in 50 years. So, in other words, the company just needs to send an email to the shareholder or related party ‘demanding’ payment, and the six years start again.

A: Your argument is not without merit. It is often argued that the start date for the limitation period is when a demand is made to repay the debt. So, the argument goes that the company sends an email to the shareholder or their related party. This is to demand payment. And the argument goes that the 6-year period starts again. Your approach does not work under VL Finance Pty Ltd v Legudi.

Meet the ATO’s friend, VL Finance Pty Ltd v Legudi

Our friends at the ATO dispute your approach. It cites the Victorian case of VL Finance Pty Ltd v Legudi [2003] VSC 57. The ATO believes that the limitation period for Division 7A starts on the date it is signed, not from the time the ‘first call for repayment’ is made.

Legal Consolidated is happy to bring court proceedings against the ATO to test what the ATO states is correct. Many years ago, I did a Tax Institute talk with an ATO Second Commissioner. In the heat of the debate, I reminded him that Legal Consolidated wins 50% of all our court actions against the ATO. And that the ATO should not carelessly state a position to the detriment of the taxpayers of Australia – especially when it does so by press release. He, of course, shot back with, ‘Yes, Professor Davies, but we win against you the other 50% of the time!’. Which I thought was a clever comeback.

However, rather than spend a lot of money fighting the ATO, it is best to keep your head down, act demure and be polite to regulators.

How to stop a Division 7A from being statute-barred after 6 years

To stop Div 7A from going ‘stale’, there are three ways to protect the longevity of a Legal Consolidated Division 7A Deed:

- After 5 years (do not wait until 6 years have passed), log back into Legal Consolidated’s website. Go to “Your Documents” and, for free, print out the same Division 7A Loan Deed again. Sign and print it on that day’s date. A unique advantage of a Legal Consolidated Div 7A Loan Deed is that it ‘dovetails’ with older Legal Consolidated Div 7A loan deeds. You could, for example, print (for free) the same Deed and sign it every year. (That would be overkill.)

- If you do not have a Legal Consolidated Div 7A Loan, then build one now. Sign it today. And print it out every 5 years. As per the above.

- And also build a Deed of Recognition.

However, if six years have passed,, it is too late. If the loan has ‘expired,’, nothing can revive it. Contrary to what some of my lawyers may think, we are not gods.

Q: Can my client buy a Legal Consolidated Div7A and use it for all members of his family?

No. They cannot do so.

For example, if you have a mother, father, and three children, you need to build and pay for five Div7A Deeds.

However, you can, for free, print out the five Deeds each year. For example, once you build the Div7A for Mary, each year, you just log back into our website. Go to “Your Documents” and reprint Mary’s Div7A Deed. This is free. You have already paid for Mary’s Div7A Loan.

If Mary has a new baby brother, you need to build a sixth Div7A Loan Deed. This is for the new child.

What do I get when I build the Div7A loan on your website?

We email you within 60 seconds of you building the Division 7A agreement:

- Our law firm’s letter of advice on our law firm’s letterhead

- Minutes

- ATO-compliant Division 7A Loan Deed

How to sign a Division 7A Loan Agreement as a deed

1. ‘Signing’ as a Deed

To be valid, a deed must be signed by the parties making the deed. This signature is typically required to be made in front of a witness who also signs the deed.

2. ‘Sealing’ a Div 7A Loan Agreement

Historically, deeds are distinguished from other legal documents by the presence of a seal. While the use of seals has largely become symbolic, some jurisdictions, including Australia, still recognise the concept of sealing. In practice, a seal may be ‘affixed’ to the deed. This is often alongside or near the signature. However, in many jurisdictions, including Australia, the requirement for a seal has been relaxed, and a deed can be valid without one.

3. ‘Delivery’ of a Deed for a Division 7A Loan Deed

Delivery refers to the intention of the party signing the deed to be bound by its terms. In Australia, ‘physical’ delivery is typically inferred from:

- the act of signing or sealing the deed;

- coupled to be legally bound by its contents.

Physical transfer of the document is not necessary for delivery to occur; rather, the intention to be bound matters.

4. Witnessing of a Deed for a Division 7A Loan

Deeds must be witnessed to be valid. However, the specific witnessing requirements may vary depending on the jurisdiction within Australia. Generally, a witness must be present when the deed is signed and must also sign it to confirm that they witnessed the signing. The witness does this by writing their name and signing and dating the document below or next to your signature.

We experienced a worldwide pandemic that began in late 2019 (sadly, it was not acknowledged by the Australian government until well into 2020), and ill-conceived rules were introduced to allow electronic witnessing. To make it worse, every state came up with its own conflicting regulations that did not work when you take the deed across state borders. Legal Consolidated is considered a conservative law firm; we have never been involved in these shenanigans. Get a blue pen and the witness into the room at the same time. This is how to witness a Will in isolation.

See also for Family Trusts and Unpaid Present Entitlements:

ATO says ‘loans’ from a company were not loans

Business Structures for Personal Services Income, tax and asset protection

Family Trust v Division 7A Loan Deed

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- Is the company a Trustee of a Family Trust, only for asset protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Division 7A Loan Deed

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate Structures and Division 7A Loan Deed

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Service trust and Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the back end of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly, engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case