Loans to children

Parents making loans to children

1. Sad parents – no Parent to Child Loan Agreement

Mum and dad give their daughter, Joanne $800k to buy a house. She then marries the good-looking Ken. Ten years later Joanne and Ken divorce. The house is still worth $800k. It is the only asset of the marriage.

Sadly, the Family Court gives Ken $400k. The Family Court is not interested that the money is a gift from Joanne’s mum and dad. Instead, lend the child the money. Do not make gifts to children. (Even if you die many years after their divorce your daughter still loses some of your money.)

2. Smart parents – legally prepared Parent to Child Loan

Mum and dad lend $800k to their daughter, Joanne. Joanne signed a legally prepared Loan Agreement built on Legal Consolidated’s website. Joanne purchases a house with the money. She marries the handsome Ken. Ten years later they divorced. The house is still worth $800k. It is the only asset of the marriage.

The Family Court is shown the Loan Agreement. The Family Court gives Ken nothing. This is because the assets of the marriage are nil. ($800k – $800k = nil.)

To protect your loan build a legally prepared Loan Agreement – on a law firm’s website. Homemade loan agreements may not work. They carry less weight with the Family Court and Bankruptcy Court. Why take the risk?

But I love my child – a Loan to my child seems harsh

There is nothing wrong with helping our children financially. It could be for their first car, grandchildren’s school fees, a holiday, medical expenses, non-concessional superannuation contribution or a property.

It is becoming more popular to help our children with a home deposit. But simply giving away the money has risks. It is important to protect the money in case your child:

1. divorces

2. go bankrupt

3. suffer from drugs

4. vulnerable or suffer a mental condition

5. stop loving you – ‘King Lear’ gives his daughters his Kingdom for their love, but they abandon him

6. you run out of money yourself, in your old age

Documenting loans to children

Never ‘give’ your children money. Always ‘lend’ them money ‘payable on demand’. Get it back if something goes wrong. Treat yourself like you are a bank, and your children are taking out a loan.

Creating a loan agreement for your children:

- not only protects your interests; but

- protects the child – you can, in the future, forgive the loan while you are alive or in your Will.

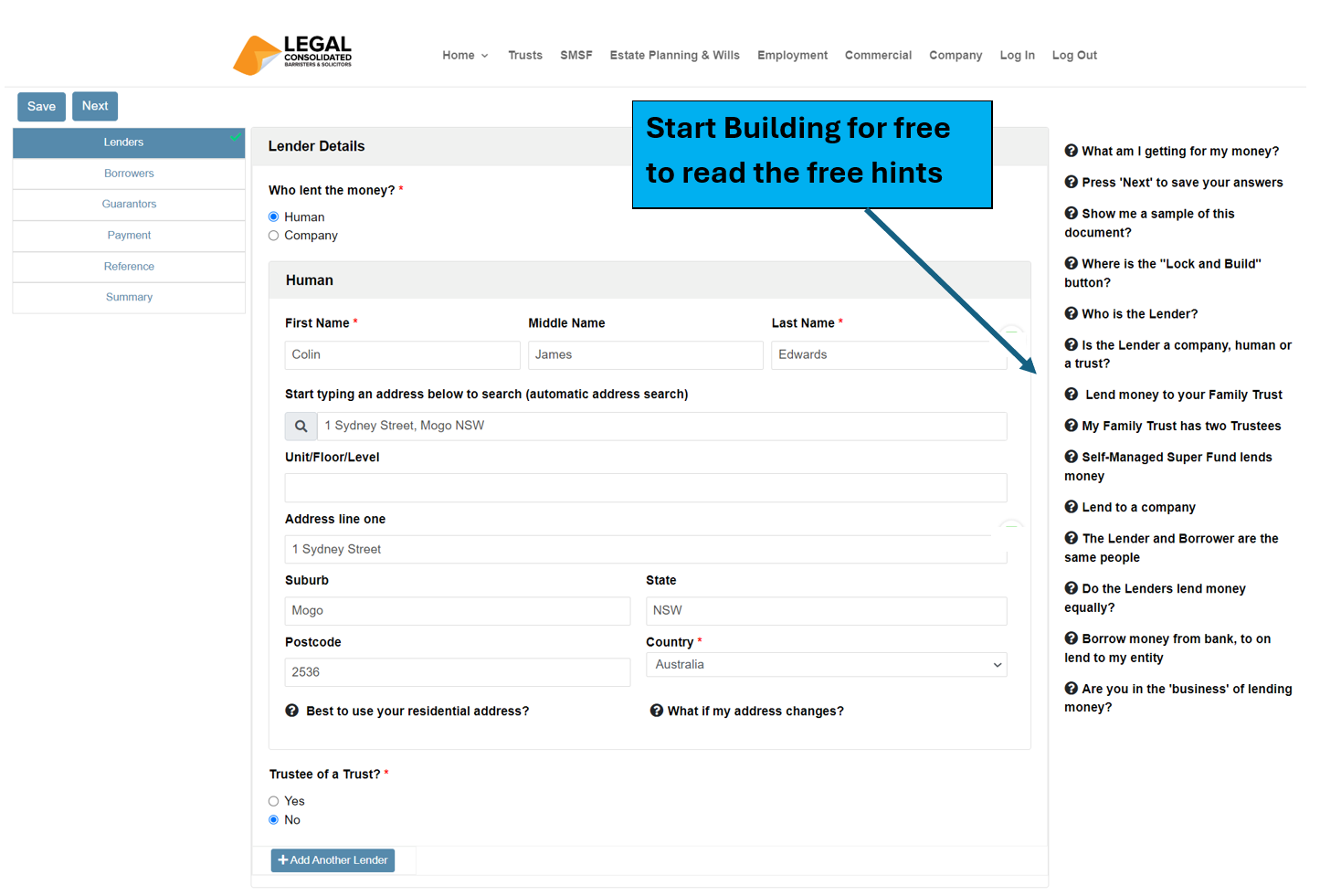

With loans to children, never rely on a verbal agreement. Press the above Start for free button and build a Parent lends Money to a Child Loan Deed.

We are Australia’s only law firm website, directly, providing legal documents online.

Divorce Protection Trust in Wills – stop children-in-laws taking your money

“Payable on Demand” seems a bit harsh for my loan to my son

Q: Under “Payment Date” I currently have your default words “Payable on demand as demanded by the Lender“. It does sound a little threatening. My situation is that I do not wish the loan to be repaid. But rather my son’s entitlement under my Will is reduced by the debt amount when that time comes. My son is a beneficiary in my Will, alongside with our two other children – equally shared.

A: You are at war, Neville Chamberlain. Your son is only one of the enemies:

- The Loan Agreement is contested in the family court by your son’s first wife, second wife, current mistress and his gay partner – all at the same time.

- The trustee-in-bankruptcy tries to attack the Loan Agreement.

War is ugly. Toughen up to Winston Churchill level. Do not be weak:

- The Loan contract is the first and only line of defence

You give everything away, upfront. This is the money. But Borrowers are yet to perform their side of the bargain. This is to pay the money back. So the Lender is at a disadvantage. Yes, the Loan Agreement is biased. But this is to protect the Lender. The Loan Agreement is all that the Lender has.

- Does your son (and his wife) feel that the Loan Agreement is disrespectful and Draconian?

Does your son refuse to sign it? Your son wants to get out a blue pen and draw a line through some of the ‘offensive’ wording?

Dad, let me be clear. Your son either signs it, as it is drafted. This is by your lawyers, Legal Consolidated. Or you do not lend him the money.

Your son and his wife are free to go off to their bank, instead. At the bank, the young man will be taught manners.

- When the Family Court and Bankruptcy Court review the Loan Agreement it needs to be couched in the terms of a legally prepared and binding Loan Agreement

A wishy-washy ‘friendly’ Loan Agreement is more likely to be ignored by, not only your son but by everyone else.

- Clearing the debt at your death

As you correctly point out, your son’s entitlement is automatically reduced at your death. This is because you made the Loan Agreement ‘payable on demand’. And the executor merely demands the repayment – or rather a reduction of what the boy is going to get under your Will.

This saves having to make a new Will every time you lend a child some money. Or, every time they pay some of the loan off.

Keep these Child Loan Contracts and other Loan Agreements with your Will.

- Finally, you may want the money back if you run out of money

I am not sure if you are worth a billion dollars. But I have acted for billionaires who have run out of money. (Or rather, they get down to their last $100m.)

Other clients pay over $1m a year to have:- A rotation of 6 nurses so that one is always, on duty, at their home or wherever they are. This is 24 hours a day.

- And a GP on retainer ready to drop everything and attend at their home in Brisbane, or fly to their estate in Byron Bay.

Protecting Vulnerable and young children tool kit

Free resources to help protect young and vulnerable children:

- Vulnerable children in Wills – free training course

- Divorce Protection Trusts in Wills – when a beneficiary, child or grandchild divorces

- Making Wills for minors

- Special Disability Trusts – for severely disabled children

- Only young and disabled children can benefit from your SMSF Reversionary Pension

- Elder Abuse – protecting the children as well

- Life Estates do NOT protect children and they are NOT tax-friendly

- Child renounces a gift or Family Trust distribution to keep Centrelink & stop Trustee-in-Bankruptcy

- Children pay 32% on your super when you die

- Parent dies child pays 66% tax

- Dad’s Will: child vs charity

- Son loses the farm to his two sisters in the Family Trust

- Disabled dad has $9m, two children and no Will

- Court rewrites disabled Dad’s Will to protect children

Help son and his girlfriend buy a home –

The parent Lends Money to a Child Loan Agreement

Q: The bank is lending money for my son and his girlfriend to buy a home. I am also loaning $283,000 to them. We are going to do the same for our daughter when she gets older. How does the Loaning Money to a Child Agreement incorporate these expectations?

A: It does not. You are not writing a Charles Dickens novel here. You are merely lending $283,000 to your son. The Loan Agreement does not record what he does with the money. He may give the money to his Church. That is his call.

Consider the future loan to your daughter. You may die tomorrow. In this case, the loan to the daughter never happens. That is fine. Your son still owes you (or rather, your deceased estate) the money. So you are all square between your two children. Well done.

This stops you from having to redo your Will every time you lend money to a child.

Son buying a property 99% in his name. And 1% in his wife’s name. Who is the Borrower?

Q: I am lending money to my son to buy a property with his wife. Ownership will be 99% in my son’s name and 1% in my daughter-in-law’s name. There are no other debts. And the property will not have any mortgages. Should the Loan Agreement reflect this, or is it not relevant? Who is the Borrower?

A: I need to make four points.

- You are not lending the money for any particular purpose. Your son may drink and gamble away the money. Or he may burn the money. Or he may use the money to travel. A Loan Contract does not set out the purpose of the loan. You are just lending money. What the Borrower does with the money is up to them. It is none of your business. If you are unhappy with that, do not lend them the money.

- Both your son and his wife are the Borrowers. They owe the money 100% each. It is a ‘joint and several’ liability. This is under the Legal Consolidated Loan Agreement. If the son goes bankrupt, the daughter-in-law normally remains responsible for owing you 100% of the money.

- The rule of thumb for a Loan Agreement is to lock in as many Borrowers as you can. The more people who agree to repay the debt, the stronger your chance of getting your money back.

So, consider making both the son and his wife the Borrowers.

If you can make his wife’s mum a guarantor, that would be nice. And, if the wife has an Uncle Harry, then make Uncle Harry a guarantor as well. The more people owing the money or guaranteeing the debt, generally, the better your chances of getting your money back. - We are not giving stamp duty or tax advice. You need to speak to your accountant on such matters. And, it is none of the law firm’s business, and it is not relevant to the Loan Agreement, but I am guessing that the 99% and 1% structuring is because of one of these reasons:

- My son has wealth. His pretty dizzy wife has nothing. Therefore, I as the controlling father, want my son to own most of the property.

Fair enough. However, be aware that after about 8 – 12 years the Family Court may order half or even all of the equity (if any) in the property to go to his ‘dizzy’ wife. We are not family lawyers. Speak to a family lawyer if you want more advice on this. (Legal Consolidated does not practice in family law. And we do not give advice on such matters.) - There is a land tax benefit in having 99/1%.

I do not believe that is correct. I do not believe that this old strategy works in any Australian state or territory. (However, we are not giving any advice on tax matters. This is a general comment only.) Speak with your accountant on such matters. - My son is a stay-at-home father. His wife is a business person and, like all business owners, is at a higher risk of bankruptcy. So the 99/1% is for asset protection.

We do not know your individual circumstances, but this is generally a good asset protection strategy. (I assume the 1% is in case your son ‘secretly’ sells the property under his wife and leaves the country. As she will have ownership (albeit only 1%), she must agree to the sale.) Again, we are not giving advice on asset protection.

- My son has wealth. His pretty dizzy wife has nothing. Therefore, I as the controlling father, want my son to own most of the property.

Does the Child Loan Agreement conflict with the bank lending money?

Q; I am lending money to my daughter and her partner. A bank is also providing them with a loan. The bank is lodging a mortgage over the property (Property). The Bank will not want our parental Loan Agreement repayable “on-demand”, such that we may get paid before the Bank does.

Does the Legal Consolidated Loan Agreement permit me to amend the Loan Agreement, to the satisfaction of the Bank?

A: We do not advise in this area. To fully understand the rights between other Lenders and you, speak with a securities or conveyancing lawyer.

Does the bank (with a mortgage over the home) need to know about this Loan Agreement?

Q: Our son and his wife of five years are renting a property. They are currently looking to purchase their own home.

I am loaning them $250,000 as a big deposit. Both our son and his wife are the Borrowers. So they will both owe me the money.

They will borrow a further $350,000 from a bank. The bank will put the first mortgage on the title.

Our son is a builder and like all business owners is at risk of going bankrupt. (We loved your asset protection strategies.) Good asset protection suggests the home be put only in our son’s wife’s name only.

- Does any first mortgage lender need to be consulted to see if they would allow our second mortgage?

- What happens if my son divorces and the home is solely in his wife’s name?

A: The Loan Agreement is a private family matter.

We do not provide advice in this area. You need to speak with a securities or conveyancing law firm. The information below is only general in nature:

- You have a fundamental misunderstanding of how property settlements between a couple operate. The family court has little interest as to who legally owns the ‘matrimonial’ assets. The home could be in your son’s name, his wife’s name or a Family Trust. It makes little difference. The family court often puts all the assets in a bucket. It stirs the pot. It then pours out the assets as the family court sees fit. However, we are not family lawyers. You need to speak with a family lawyer.

- The situation is different for assets your child gets through your Will. This is if you have put a Divorce Protection Trust in your 3-Generation Testamentary Trust Will.

How to lodge a caveat or mortgage using the Loan Agreement

- Build and sign your Loan to Children Agreement.

- It contains the right to lodge securities, such as caveats and mortgages over the Borrower’s assets.

- But speak with your accountant and securities lawyer about lodging such securities.

- Your accountant, commercial lawyer or conveyancer can print out the Caveat or Mortgage form (free download from the titles office):

- New South Wales: Land Registry Services

- Victorian: Land Registry Services

- Queensland: Department of Resources

- Western Australia: Landgate

- South Australia: Land Services

- Tasmania: Land Titles Office (all States use to use this name originally. Tas is the least arrogant titles office in Australia)

- Northern Territory: Land Titles Office

- Australian Capital City (ACT): Land Titles Office

- They can lodge the Caveat or Mortgage with the title office.

- Other than South Australia, which is difficult to deal with, the relevant title office helps you. Your conveyancer, settlement agent or property lawyer should be able to lodge the caveat or mortgage for you.

The evil Presumption of Advancement – unfair to dads!

The Australian “Presumption of Advancement” is that where a husband:

- transfers property to his wife or his children;

- then, in the absence of other evidence, the Court presumes that the transfer is a gift – not a loan.

In contrast, if the mum or child transfers money or assets to the dad then there is an assumption that this is a ‘loan’ – not a ‘gift’.

A transfer from a father or a husband is presumed to be a gift, but not a transfer from a wife or a mother – this is presumed to be a loan to the father. A parent Loan Agreement to a child overrides this rebuttable presumption.

This is the case even if the couple is only engaged: Wirth v Wirth (1956) 98 CLR 228.

At Legal Consolidated, we take the view that this would also apply to de facto and same-sex couples under the authority of the Hong Kong case of Cheung v Worldcup Investments Inc [2008] HKCFA 78.

This has always been the law in Australia. We follow the English case: Grey v Grey (1677) 2 Swans 594; 36 ER 742.

This is messy. So it is best to either:

- build this Loan from Parent to a Child

- build a loan agreement from spouse to the spouse

- expressly forgive the debt by building a Deed of Debt Forgiveness

- expressly make a gift with a Deed of Gift

Presumption of advancement when dad buys a home for the wife and child?

The Presumption of Advancement applies when a husband either:

- provides the purchase price; or

- makes contributions

to the purchase price of a property.

This is where the wife or child is given ‘legal interest’ in the property. In other words, the property is put solely in the name of the wife or the child.

The “presumption” is developed from a belief that:

- dads are more likely to ‘gift’ money

- in contrast, the mum and the children are more likely to ‘lend’ someone money, including the dad.

Free Asset Protection Kit for clients of lawyers, financial planners and accountants

Clients often start their asset protection journey by speaking with their accountant, financial planner or lawyer. Legal Consolidated has put this kit together to help these professionals on what needs to be done. Enjoy the free resources:- Asset Protection Strategies – a complete list and how to use them.

- Family Trusts – how to set up a safe house vehicle (free training video).

- Loans to children – in case the child divorces or goes bankrupt.

- Loans to parents – a rich child lends money to parents to get into a retirement home.

- Spouse Loan agreement – ‘safe house spouse’ lends to high-risk spouse (man of straw strategy)

- Forgiving a Debt – for ‘love and affection’.

- Deed of Gift:

- to a Family Trust – to prove the money you put into your Family Trust was a gift (not a loan)

- to a child – forgive the money your child owes you

- to a person overseas – forgive what the person owes you

- Stop mistresses and disgruntled children challenging your Will.

- Stop people stealing money from your disabled and vulnerable children when you die (free training video).

- How to set up a Bankruptcy Trust in your Will.

- The value of a Divorce Protection Trust in your Will.

(Yes, I know that presumption of advancement is sexual discrimination. Please complain to your Member of Parliament.

What if the parents and the child together put money into the purchase of the property? But the property is only in the child’s name?

Related to the above ‘presumption’ is where the:

- purchase money is provided by two people; but

- property is put into only one of their names

The law presumes a ‘resulting trust’. This is in favour of the other party. E.g. Mum and the child put money into a property. But the property is only in the child’s name.

There is a presumption that Mum is the ‘equitable’ owner equal to her contribution. This can be rebutted. It is a mess of confusion, especially if you add bankruptcy, divorce and taxation matters into the mix.

Obviously, to avoid confusion and ambiguity:

- build a Loan Agreement; or

- if you want the gift to be a gift, rather than a loan, then build a Deed of Gift; or,

- if it is too late for that, consider building a Deed of Debt Forgiveness.

When making loans to children:

1. talk with all your children together about the loans

2. never gift children money – only loan them money (this protects both you and them)

3. do not rely on homemade loans, IOUs, minutes or journal entries. Instead, build a Legal Consolidated Loan Agreement

Child Loan Agreement on the back of an envelope?

In the movies, IOUs are often handwritten on a piece of paper. Sometimes, instead of a Loan Agreement, someone does a ‘minute’. Both approaches fail. In Rowntree v FCT [2018] FCA 182 shows the additional care required to document even simple related-party transactions, such as loans. In this case, the taxpayer, a practising NSW lawyer, claimed he borrowed over $4m from his group of private companies. The Court said:

‘Mr Rowntree has not deliberately chosen to ignore the law. His evidence presented to the Tribunal suggests that he genuinely believed that there were arguments to support his view that a loan was in existence.’

He failed. Only a legally prepared Loan Agreement satisfies the ATO, Bankruptcy Courts and Family Court.

Do IOUs and undocumented loans work?

In Russell and Dunphy v Dunphy [2023] NSWSC 282, the Court found that it was not enough to show that the money was advanced by the dead person and received by his son. The plaintiffs had to prove offer and acceptance in the formation of the alleged loan contract, as well as some outward behaviour that, viewed objectively, would establish a contract, let alone a loan.

You need a legally prepared Loan Agreement – which is a contract – to have the highest chance of it being upheld in court.

Cheeky son refuses to pay dad back – Berghan v Berghan

In Berghan v Berghan [2017] QCA 236, the son borrows money from his Queensland-aged father. The son refuses to pay it back.

In the first court case, the son successfully argued that the money was given to him as a gift. However, the Court of Appeal held that the amounts are loans.

Portrait of an ungrateful child.The facts of Berghan v Berghan

The son’s company suffers financial stress. The son receives $98,000 from his Dad. The boy continues to borrow more money from Dad.

Later, the son borrows his father’s credit card. The boy racks up another $13,000 of debt.

First court case – child wins – no child loan agreement

His Honour said that Dad failed to prove a legally binding agreement. There was no paperwork. There was no written loan agreement. It was a gift.

The Judge said:

- The son promised to look after his Dad in old age. But that was just a moral obligation.

- Dad making the payments to the son, for the benefit of the company, is simply discharging his parental obligations. This is because his daughter is an employee at his son’s company. The money is therefore of a charitable nature. Dad is protecting the son’s company, so his daughter keeps her job.

- Dad allowed the boy to use the credit card when the boy was injured and impecunious. These circumstances are charitable.

Good sense prevails in the Appeal – child loan agreement inferred

The Court of Appeal had a better sense:

- The lengthy period it took Dad to make a demand for the money does not count against his assertion that a breach of contract existed. The Court held that post-contractual conduct is not taken into account when interpreting the terms of a loan contract.

- The motive Dad had in transferring his son the money, be it “charitable” or otherwise, is not relevant.

The Court set aside the decision of the District Court. The Court said that the monies were paid with the understanding that they would be repaid. This is an “inescapable conclusion”. The transactions are a contract of loan. The Court gave judgment in favour of Dad of $286k including interest.

This is another example of elder abuse. The decision shows the perils of not signing a loan agreement. Going to Court – twice in this instance – is expensive and exhausting for the aging father.

Child buying home in partner’s name?

What happens if the property is purchased in both your child’s and their partner’s names? Or, just in the name of the in-law for asset protection?

Then both your child and their partner should be parties to the Loan Agreement. They are both debtors.

You are lending money to an asset jointly owned. It is only fair—and legally necessary—that both owners are liable for the debt. If one refuses to sign, do not lend. Let them go to a bank.

Never lend money for a home purchase unless the people on the property title are the same people signing the Loan Agreement.

Should My Child’s Partner Also Be a Debtor on the Family Loan Agreement?

Most lawyers at Legal Consolidated believe it is best to have both your child and their partner named co-debtors on the Loan Agreement. This increases the chance that both are responsible for repaying the loan.

But not all our lawyers agree. There are arguments for and against adding your child’s spouse or partner to the loan as a principal debtor.

Reasons to Include your Child’s Partner as a Co-Debtor

-

-

Evidence that the loan was completed some time ago: If the relationship breaks down, your child’s ex might claim the loan was only documented after the separation. Having both parties sign the agreement helps prove the partner knew about the loan.

-

Asset protection concerns: Families often use the “man of straw and woman of substance” strategy. One partner (e.g. your son) may be a business owner or professional, so the other, your daughter-in-law, holds the family’s assets. If they separate, you may be left trying to recover funds from someone without money. Naming both as debtors reduces this risk.

-

Reasons Not to Include the Partner as a Co-Debtor

-

-

The Loan Agreement is harsh: Our Loan Agreement is deliberately strict. It mirrors the kind of documentation used by banks. It has to — it must stand up in court. Your child might sign without hesitation. The partner might not. If they do not want to sign, they are welcome to borrow from a bank instead.

-

Relationship strain: Some in-laws do not appreciate being asked to sign something that looks like it came from a bank or a lawyer. That is fine. They do not have to accept your money. They can go to the bank themselves!

-

What If the Couple Separates Later? Many family loans are set up as revolving lines of credit. But if your child separates from their partner, you should not lend further money under the same Loan Agreement. You have received notice that the relationship has ended. It would be potentially unenforceable to keep using the original Loan Agreement for ‘new’ money you lend. If you want to lend more, build a new Loan Agreement, an added expense, where your child is the sole Debtor.

-

Should I Add My Child’s Partner as a Guarantor Instead?

Guarantors are delicate creatures. While a guarantor can be hard to enforce, a co-debtor is equally liable and, therefore, usually easier to enforce.

The child loan expires – if a few dollars are not paid within 6 years

Q: I read your comments that loans expire every 6 years (e.g. the ACT). One way to ensure that it continues is for the borrower to make a $1 payment before the end of the 6 years.

A: Yes. Alternatively, get the Borrower to sign a Deed of Acknowledgement of Debt. That freshens up the 6-year limitation rule. (Three years in the Northern Territory.)

Buy a home just in the child’s name?

Q: My daughter is married. I am going to lend her money to buy a home. Should she purchase the house only in her name? How does this benefit my daughter or me?

A: Your question does not relate to building a Loan Agreement. We do not give advice on this area of law. Below are some general comments only:

- Your daughter could borrow the money and give it to her church. Or burn the money out of spite. She uses the money for her business. The Loan Agreement does not require that she purchase a home.

- Secondly, the Family Court cares little about whether your daughter or her partner is the legal owner of the property. Speak to a Family lawyer.

- But there is nothing wrong with lending the money to just your daughter. The Family and Bankruptcy Courts generally acknowledge that you are owed the money. But get the Loan Agreement signed before you lend any money.

Daughter and husband separate – is the loan taken into account?

Q: What if my daughter and her husband separate? The $1m home goes into the matrimonial asset pot. But does the Family Court take into account the debt? This is the Legal Consolidated Loan agreement ($200k) and the Bank mortgage (500k). Therefore, is only the net figure of $300k available to the Family Court to share? ($1m – $700 = $300k equity)

A: We do not give advice on this area of law. You need to speak with a family lawyer.

Below is general advice only:

- You are building the Loan Agreement with the expectation that the Family Court will reduce the ‘matrimonial assets’ by the debt owed to you.

- Alternatively, if you had no Loan Agreement then there is ambiguity. Was it a gift? Was it a loan? By getting your daughter (and her husband, if you can) to sign the Legal Consolidated Loan Agreement at least a day before you hand over the money you protect both your daughter and yourself.

- Best to add both your daughter and son-in-law as the Debtors. This is as you build the Legal Consolidated Loan Agreement. So both are responsible for the debt. The more people responsible for a debt the higher the chance you may get your loan repaid. It also stops the son-in-law from arguing that he knew nothing of the Loan Agreement.

- What if the son-in-law (or daughter, for that matter) does not want to sign the Legal Consolidated Loan Agreement? That is fine. Keep the money. And go on a holiday!

Should the home just be in the daughter’s name?

Q: How then is it more advantageous if the house and the loan agreement are in the name of my daughter only? How is keeping the partner out of it a benefit?

A: Again, we are not family lawyers. The family court puts everything in the pot. So, it may make little difference. But, as to the Loan Agreement, it is better to have as many people as possible be responsible for the debt.

Also, consider asset protection issues in having the home solely in the name of the ‘person of substance’. And not in the name of the high-risk of bankruptcy husband.

However, we do not provide advice on these areas of law. The above is general advice only.

Why is a caveat weaker than a mortgage?

We do not advise on securities. We are only providing you with a Loan Agreement. The Loan Agreement authorises you to lodge and register securities.

A mortgage is similar to a caveat. But a Mortgage is more secure and enforceable. A caveat is indeed weaker than a mortgage. However, for advice speak to your conveyancer or securities law firm.

Do I need three loan agreements if I am lending to my three children?

Yes. If you are making loans to children, even at the same time and for the same amount, you need separate Loan Agreements. Remember this document needs to stand up against the Family Courts, Bankruptcy Courts and other courts and tribunals. You contaminate the Loan by getting ‘other people’ co-owing the money with one of your children.

In the Legal Consolidated Loan Agreement, each person borrowing the money is required to pay it back. So if you were to do only one Loan Agreement then each child is guaranteed payment by the other children! Children do not want to be responsible for the debts of their siblings.

If you are lending to your child and their spouse, that is fine. They both are forced to pay back the loan. So if your child cannot pay, their spouse must then pay the loan.

Do I need to update my Will after I do the Loan Agreement?

You need to review your Will every few years. This is to make sure it still reflects your wishes.

However, you probably do not need to update your Will now that you have the Loan Agreement in place. In fact, an advantage of a Legal Consolidated Loan Agreement is that you do not need to keep updating your Will.

Let me explain, with this example:

Loving Dad is going to gift $300k to each of his three children. This is when they each buy their first home. Child one buys a home. And then child two buys a home. But before child three buys a home, Dad dies. The third child misses out on getting the $300k.

Instead, the loving dad lends the $300k as each child buys a home. So now child one and child two must pay back the $300k at dad’s death. So, child 3 does not miss out. The Loan Agreements correct the Will continuously. They make the Will fair. This is without the need to keep updating your Will all the time. (You get free Will and POA updates for the rest of your life. But you need to remember to update your Will.)

If all three children get the $300k then that is fine. The children are getting everything in Dad’s Will equally, anyway.

Also, if the child:

-

- Gets divorced or bankrupt the Loan Agreement is beneficial.

- Pays back the loan (uncommon, but it does happen!) then the Will automatically self-corrects. The children are always treated fairly and equally with the Legal Consolidated Loan Agreements in place.

Gift or lend to my favourite child?

Q: My client, in my accounting practice, is aged 69. He has two adult children. His older son, troubled by addiction, causes distress. I am considering building a Deed of Gift to gift the $130,000 to his daughter for her loyalty. His Will divides his estate equally (50:50), but he fears the druggy son might view the $130,000 as an early inheritance and challenge the Will.

A: Do not make gifts to children, even ones you love more. Lend the $130,000 (rather than gifting). A gift risks loss if the daughter goes bankrupt or suffers a divorce (Liakos v Zervos [2011] FamCA 547) or may trigger Will disputes (Russell and Dunphy v Dunphy [2023] NSWSC 282). Instead:

-

Build the Loan Agreement to protect the daughter from creditors and divorce.

-

Build and sign a Deed of Gift, but leave it undated to be stored with your Will. This document instructs your executor to forgive the $130,000 loan upon your death, effectively converting it to a gift without altering the Will’s equal distribution (Wirth v Wirth (1956) 98 CLR 228). The undated nature ensures flexibility, allowing you to retain control throughout your lifetime.

-

Stop the Will being challenged with a Considered Person Clause in your Will for both children.

- Increase the Age of Majority for the drug-affected son.

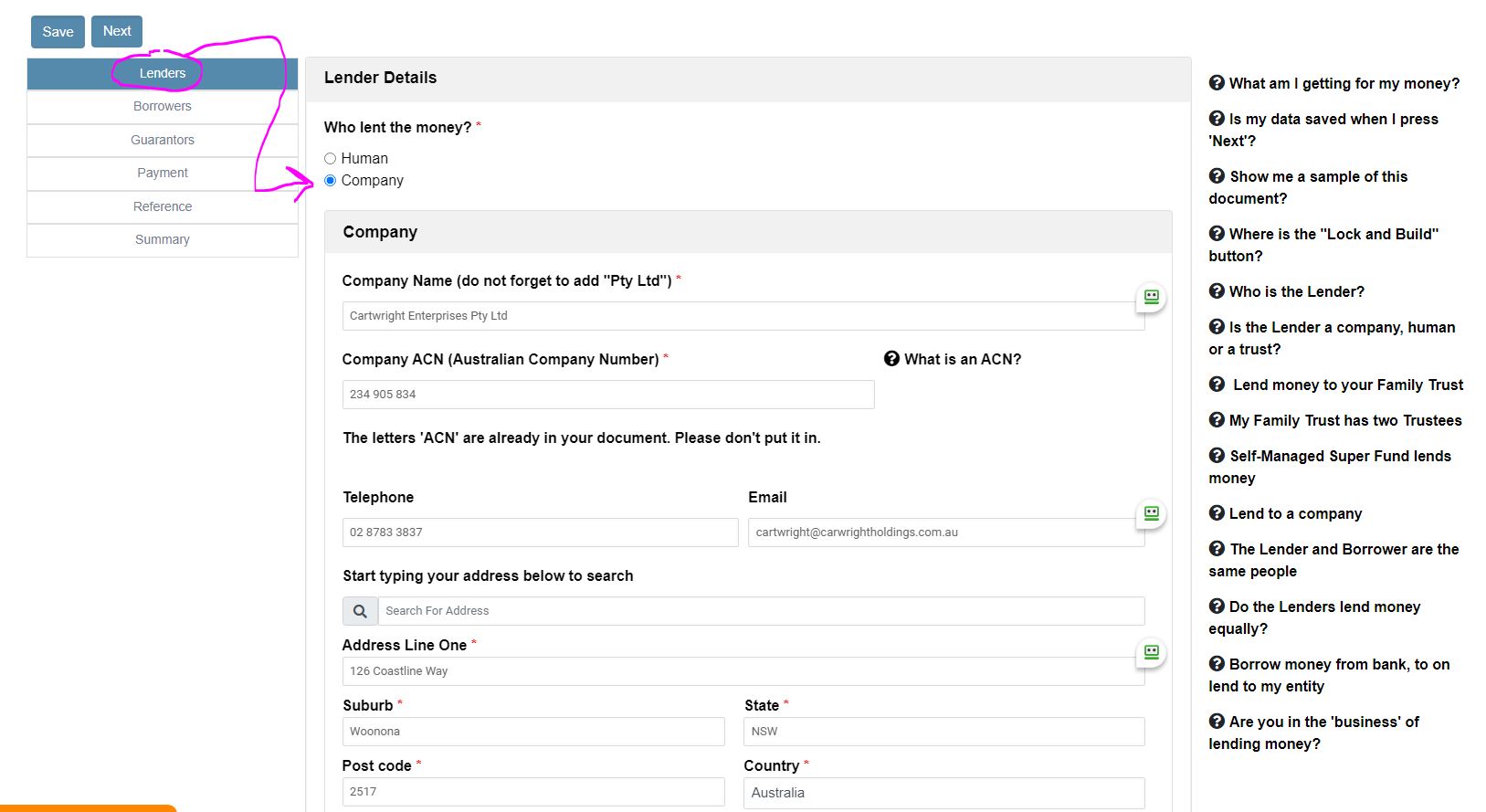

When the Lender is a Company

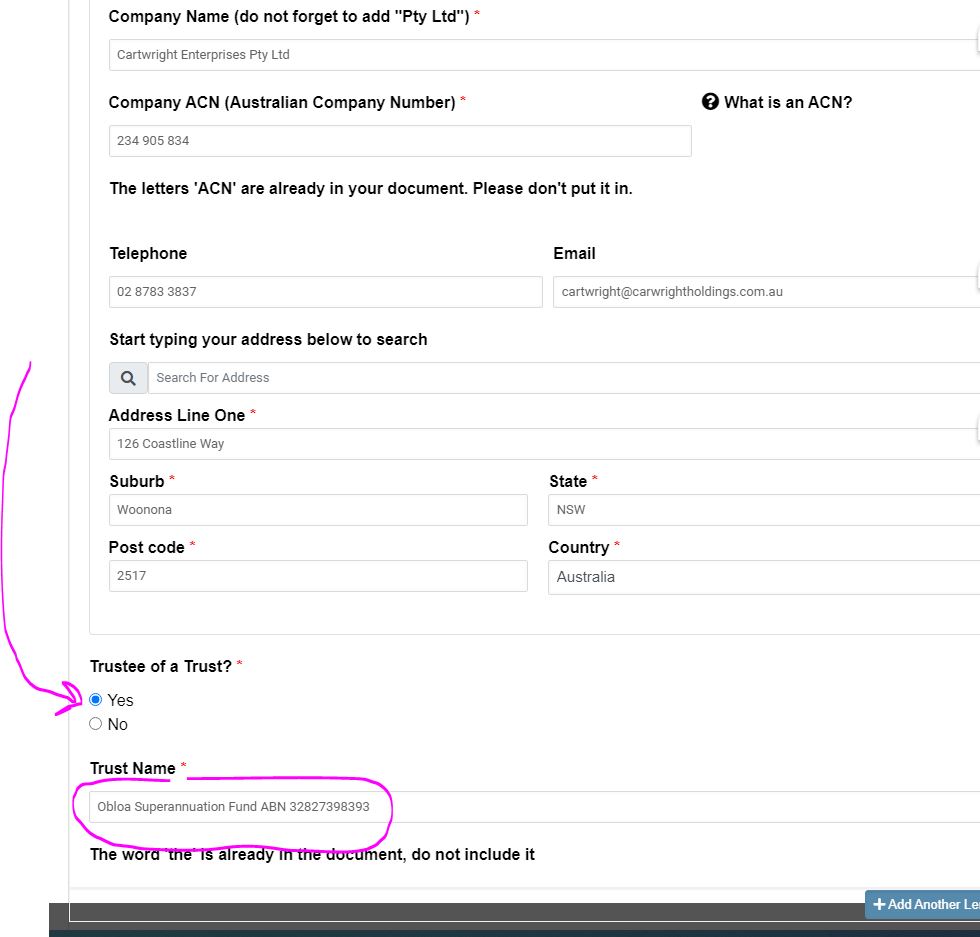

When the Lender is a company as trustee of a Trust (e.g. Family Trust or Unit Trust)

In this example, the Self-Managed Superannuation Fund has a company as its trustee. You tick ‘yes‘ to the “Trustee of a Trust“. And put in the full name of the trust. Put in the Australian Business Number (ABN) as well.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will