Company Constitution Replacement

$447 includes GST

-

Convert the old company to a special-purpose company

Turn your existing company into a Special Purpose Company –

to be the trustee of your Self-Managed Super Fund (with up to 6 members)

Change your existing company to a special-purpose company. Replace your old company’s Memo and Articles of Association or Constitution with a Special Purpose Company Constitution. This is so that your old Company is used solely as the trustee of, up to 6 members, Self-Managed Superannuation Fund.

You are replacing a Company Constitution. This is on our law firm’s website. You get the following for your accountant and your SMSF auditor:

- our law firm letter telling you what to do to convert your old company to a special-purpose company

- minutes for your accountant’s due diligence file

- a Special Purpose Company Constitution for your old company

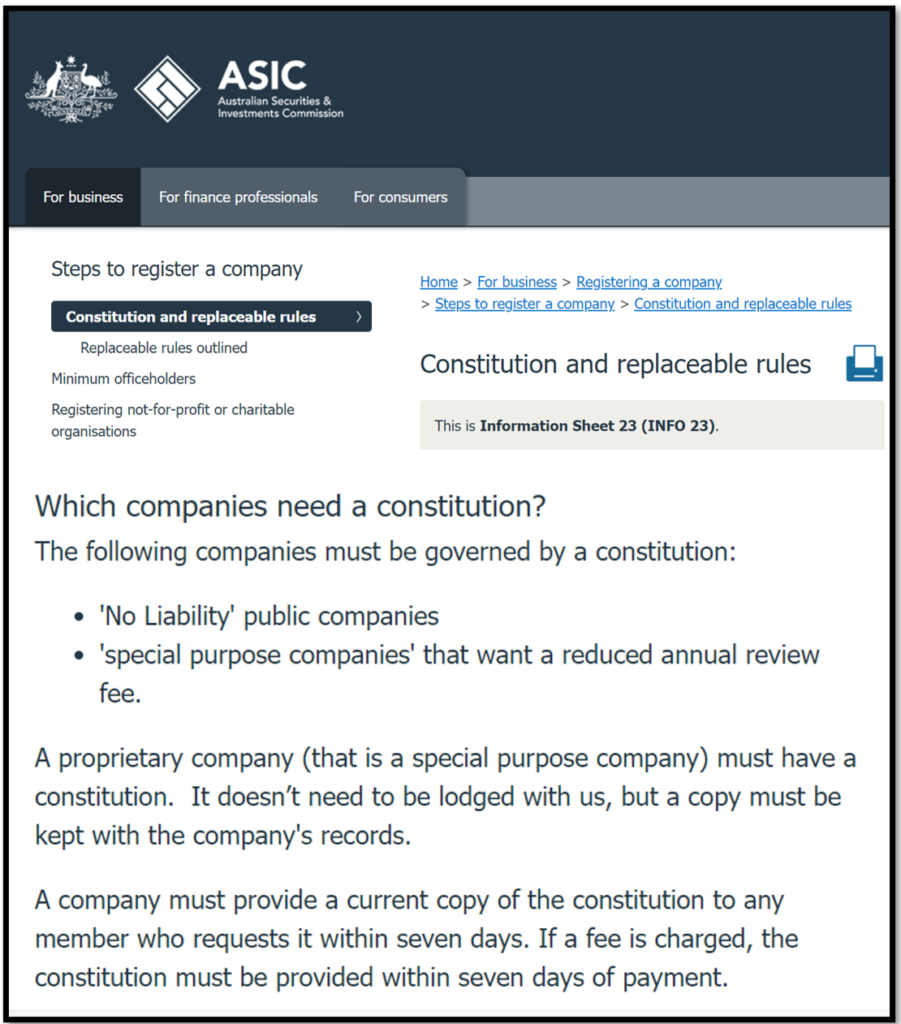

To be a Special Purpose Company you must have a Constitution – Replaceable Rules do not work

An SMSF Special Purpose Company cannot have Replaceable Rules. It must have a Constitution. It is a legal requirement.

Why do I need a Company Constitution for a Special Purpose Company?

It is a legal requirement to have a Constitution for a Special Purpose Company.

ASIC states that company constitutions are mandatory for ‘special purpose companies’. A Special Purpose Company must be governed by a Constitution – not Replaceable Rules.

Why Special Purpose Companies need a Constitution

Special purpose companies are legally required to have a constitution. This rule is set by the Australian Securities and Investments Commission (ASIC) and contrasts with other companies that can use more general rules, known as replaceable rules.

Special purpose companies are designed for a specific task of only doing one job – being a trustee of a Self-Managed Superannuation Fund. This task needs detailed and specific governance rules that the Replaceable Rules cannot cover. This is why a Legal Consolidated constitution is crucial—it tailors the governance to fit the unique needs of each Special Purpose Company.

The Legal Consolidated constitution for your SMSF Corporate Trustee is important because it:

- Ensures Specific Governance: The Legal Consolidated Constitution provides specific rules that help the company operate smoothly and meet its unique goals of running an SMSF.

- Enhances Compliance and Assurance: The Legal Consolidated Constitution helps the company comply with strict regulations and gives the members, confidence in the management and SIS Regulations compliance.

- Guides Corporate Practices: The Legal Consolidated Constitution shapes how the company is managed, helping it meet its changing legal and financial responsibilities effectively.

Having the Legal Consolidated Constitution helps special purpose companies manage their strict SMSF challenges efficiently and transparently, ensuring they meet both their specific roles and general corporate SIS rules responsibilities effectively.

Convert a proprietary limited company into a ‘special purpose company’?

There are three types of Australian companies: Proprietary (Pty Ltd); Limited (Ltd) and No Liability (NL).

Of all the companies in Australia, 99.9% are Pty Ltd.

Yes, you can convert a Pty Ltd into a Special Purpose Company. You are converting your proprietary limited company to a special-purpose company. This is to be the trustee of your Self-Managed Superannuation Fund.

When I convert my company to be an SMSF Trustee who is the best SMSF trustee? Company vs Human?

When I started practising in superannuation law in the 1980s the majority of Self-Managed Superannuation Funds had just dad as the trustee. In those days you only needed one trustee. Now:

- all the members must be trustees; or

- all the members (and only those members) must be directors of the company.

These days most superannuation lawyers, accountants and financial planners recommend a company as the trustee of your SMSF. Reasons include:

1. A company lives forever. This is better succession planning. If a member dies you do not need to transfer land. The land just says in the company name. Instead, you merely update the directors. (While there is generally no transfer/stamp duty or Capital Gains Tax to transfer the property from one human trustee to another it is an added expense.)

2. A ‘deed’ is a formal type of document. Many SMSF Deeds require that a member can only be changed by another deed. Legal Consolidated SMSF Deeds and SMSF Updates do not require a deed to change a member. However, all SMSF Deeds require that a trustee be changed via a Deed of Variation of your SMSF. Conversely, changing a director is straightforward. This is because merely changing a director of the company does not change the Trustee.

3. Where Mum and Dad are the two human trustees there is a problem if one dies. An SMSF cannot have just one human as the trustee. You always need at least two humans (or a corporate trustee). Upon your spouse’s death, you, therefore, need to act quickly to appoint another human as trustee (or replace the human with a company). However, when your spouse dies the last thing you want to worry about is getting your SMSF compliant again. In contrast, a corporate trustee of an SMSF remains compliant with just one director.

4. Ease of SMSF audit. You cannot mix SMSF assets with your assets. When you have a dedicated special purpose company it has no job other than to be your SMSF trustee this is easier to comply with. When Mum and Dad buy an asset for the SMSF they may forget to add ‘as trustee for the SMSF’. You are in breach. In contrast, if you buy an asset in the name of the special purpose company and forget to put ‘atf the SMSF’ it is not such a big issue.

5. Contrary to popular belief, an SMSF can go insolvent. Any structure, even a conservative super fund, may not be able to pay its debts as they fall due. Also, the SMSF can be sued. If you have a corporate trustee you have another layer of asset protection. (A director of a company does not automatically go down with the sinking trustee company.)

6. When an SMSF borrows money the bank requires that both the SMSF and the trustee of the Custodian Trust both have a company as the trustee (different companies, of course).

7. The SMSF ‘Central Management and Control’ rules are easier to comply with if you travel outside of Australia.

8. ATO penalties are less draconian with an SMSF special-purpose company. In contrast, human Trustees are jointly and severally liable.

9. A corporate trustee (SMSF special purpose company) pays lower ASIC fees each year. (Your special purpose company will no longer need an ABN as it does not trade in its own right. Instead, the SMSF has the ABN. Your corporate trustee does not prepare accounts for itself, as it has no assets. Only SMSF accounts are prepared.)

10. Land Tax. The more land in your name the higher the percentage rate of land tax. If you move the land to a fresh company then the rate of land tax may reduce. The percentage rate that you pay may be reduced.

Let ASIC know you have converted to an SMSF Special Purpose Company

Build this Convert a Company Special Purpose Company Kit online. It turns your old company into a Special Purpose company. Your company then pays lower yearly ASIC fees. You must let ASIC know. After you build and sign the documents log in to the ASIC website with your Corporate Key and fill out ASIC Form 484. Our cover letter guides you. Legal Consolidated structures the Constitution and the upgrade so that there are no ASIC fees if you complete Form 484 within 28 days. ASIC does not charge you to lodge the Form 484.

Every SMSF Member signs the Member Minutes

As we have drafted the update, each shareholder signs to give their consent.

All the directors of the SMSF corporate trustee must be members

Before you make the company the trustee of the Self-Managed Superannuation Fund (SMSF):

1. all the directors must be members of the SMSF

(but for a single-member SMSF, the corporate trustee may have a second director who is both:

-

- not a fund member; and

- not an employer of the fund member, unless related to the fund member).

2. all the members of the SMSF must be directors of the company

Example 1: John, Jeff and Mary are the current directors of the company. But Jeff is not a member of the SMSF. Jeff must resign as a director of the company before the company can be the trustee of the SMSF.

Example 2: Paul and Fiona are the only directors of the company. But their daughter Ainsley, together with Paul and Fiona, is a member of the SMSF. Therefore, before the company can be made the trustee of the SMSF, Ainsely is made a director, as well.

Other than the share capital, the old company had a balance sheet of zero before it became an SMSF Special Purpose Company

Your Special Purpose Company has no assets in it. This is other than the share capital for the shares. For example, if it has two shares worth $1.00 each. Then the company balance sheet, if you were to put one together, would state $2.00.

You are welcome to add your logo to our law firm’s documents for free.

Its only job now is to be the trustee of the Self-Managed Superannuation Fund. It can’t do anything else. It can no longer own assets in its own right. This is other than the company’s share capital.

To get to a zero balance sheet so you can turn the company into a Special Purpose Company, make sure:

- the company owes no money

- the company is not owed any money

- no unpaid Present Entitlements

- no Division 7A loans

- no obligations to anyone such as suppliers and family members

- no tax obligations, both state and federal

- done a final tax return and paid all taxes

- your accountant is 100% certain that the ATO is NOT interested in auditing the company at some later date

- owns no assets such as real estate (But of course it still has its share capital.)

- your accountant has prepared or signed off on the balance sheet showing everything as zero, other than the share capital of the company.

In short, the company has no assets, rights or obligations. This is other than its original share capital. This is usually a small nominal amount.

If anything is interesting, strange or exotic in your company’s past you are better off winding up the old company. Just incorporate a brand-new Special Purpose Company.

Even if you think you know the past history of your company, you probably do not. A safe course of action is to wind up the old company. And just incorporate a new company to be the trustee of your Self-Managed Superannuation Fund.

At the very least, talk with your accountant about reusing your old company.

Improvements to an SMSF special purpose company constitution

The SMSF Constitution you are building also updates your company’s internal rules and procedures. It complies with:

- Superannuation laws

- Superannuation Industry (Supervision) Regulations 1994 (Cth)

- Corporations Act

As well as converting your old company to a Special Purpose Company we also make these improvements:

1. Technology in an SMSF Special Purpose Company

Technology has changed how directors can communicate with themselves and their shareholders. When you update your Company to a Special Purpose Company we also update the Constitution. Your Constitution is updated to reflect how changes in technology affect your SMSF corporate trustee’s operations.

Traditionally director decisions are mailed out in physical form to directors. However, email is a faster form of communication that is used by many Self-Managed Superannuation Funds to correspond with directors, shareholders and SMSF members. Your updated constitution takes into consideration how instantaneous communication affects your SMSF members. Further, your constitution outlines how technology is used in meetings.

The ATO often turn a blind eye to these ‘mistakes’. But if you ever fight with the ATO they will not be turning a blind eye to your mistakes..

2. Email voting in an SMSF Constitution update

The SMSF directors and shareholders can cast a vote regarding a meeting. Do it either online or through personalised voting forms. Shareholders do not need to attend the meeting and can appoint a proxy. Your new Special Purpose Company’s Constitution improves meeting efficiency.

3. Each SMSF Member must be a Director

An SMSF can have up to six members. However, each SMSF member must also be a director. Only SMSF can be directors.

For example, Mary and John are the only members of their SMSF. The company that is being converted to a Special Purpose Company currently has their son Michael as the sole director:

-

- Michael must resign as a director; and

- Mary and John must now be appointed the only directors.

You change the directors directly with ASIC. We do not change the directors. You or your accountant do that yourself.

4. Self-Managed Superannuation Funds may have a single member

An SMSF is permitted to have up to 6 members. But it can have less. It can even have a single member. But if you are a single member Self-Managed Super Fund then:

-

- if you do not have a company you have to have a second human trustee (generally who is a family member or a person you have no employment relationship with); or

- more commonly, a corporate trustee. Wonderfully, that corporate trustee only needs one director. That one director is you the SMSF single member. For example, Mavis is the sole member of her SMSF. Then Mavis is the sole director of her SMSF corporate trustee.

5. Who is the shareholder of a Special Purpose Company?

The Superannuation rules are silent on who the shareholder is of your converted Special Purpose Company. Usually, it is all the members of the SMSF. This helps with succession planning.

With the old company having no assets and no tax obligations you, as the shareholders, can generally transfer and allot shares as you see fit. You could issue and allot an equal number of shares to each member. This helps with succession planning.

And each member should also consider signing a Binding Death Benefit Nomination. And if you want your superannuation to remain in the super environment after you die talk to your accountant and financial planner about a Reversionary Pension. There is up to 32% tax on your superannuation going to adult children – put a Superannuation Testamentary Trust in your Will to reduce this non-dependency tax.

Faults in old SMSF Constitutions and Memo & Articles of Association

Australian companies created before 1 July 1998 had a ‘Memo & Articles of Association’. Like old Constitutions, your Memo & Articles of Association still operate but not well. Like old Constitutions, faults with the Memo & Articles of Association include:

1. Mandatory AGM each year

Requiring an Annual General Meeting (AGM). However, the law no longer requires an AGM for Pty Ltd companies. No one has AGMs anymore. But if you do not, under your old rules, then your company is non-compliant. This is for both taxation and SMSF laws. Your new Constitution ensures that you don’t have to have AGMs.

2. Only do as permitted

Stating a ‘list of objects’. This is the purpose of the company. E.g. ‘sell fishing tackle and retail’. This was never a good idea for any company. It is especially not appropriate for a special-purpose company. Your company is acting ‘ultra vires’ if it does not follow the old-fashioned ‘list of objects’. It is acting outside its powers. Again, your company is non-compliant. Legal Consolidated’s Constitution allows you to comply with the SMSF rules – and more.

3. Perform out-of-date and illegal actions

Requiring illegal actions. Instead, update the company constitution to allow these correct powers:

-

- exercise corporate powers

- issue and allot shares

- not avoid liability (a very strange requirement)

- transfer shares

- vote and proxies

- appoint directors and company secretary

- conduct general and director meetings

- sign bank documents, loans and mortgages (however, this may be useful because banks often cannot enforce a loan made by a company that is still working under the old Constitution or M&A)

- allow alternative directors for ‘central management and control’ if the members live outside of Australia for an extended period

4. SMSFs can have up to 6 members

Since 2021 SMSFs can have up to 6 membHowever. However, many old Company Constitutions restrict SMSF to only 4 members.

Build this document to transform your old company into a ‘Special Purpose Company’ so it can operate as the sole trustee of your Self-Managed Superannuation Fund. You pay lower Company annual ASIC fees.

Should I convert to a special purpose company in this financial year in the next?

I cannot answer your question, as I do not know your circumstances. However, the only reason you convert is to pay the lower yearly ASIC annual company fee. So from that perspective, you should convert the old company well before the company’s birthday. Your company’s ‘birthday’ is the date on your Certificate of Incorporation.

ASIC charges the company an annual fee on the company’s birthday. It does not charge at the end of the financial year. This is unless your company’s birthday is 30 June!

A separate question is when should you change the trustee of your SMSF? There is an infinite number of reasons to change an SMSF trustee. For example, a member has terminal cancer and will die shortly. Perhaps there is a land tax issue. Update the Trustee of your SMSF here.

Who pays the annual ASIC fees when the company is a trustee of an SMSF?

Each year ASIC requires that you pay a fee to keep your Australian company registered. This is on the company’s birthday. (This is the day your company was originally registered with ASIC.) ASIC charges a lot of money for the yearly registration. However, when your company is a:

- Special Purpose Company; and

- the company is only being used as trustee of your SMSF

the yearly ASIC fees are substantially reduced. This is the only value in converting your old company into a Special Purpose Company. You save on the ASIC fees. (It is also best practice to only use the company for one purpose. This is the corporate trustee of your SMSF. So why would you not want to get ASIC’s lower fee?)

Your SMSF Fund pays the annual ASIC fees for the Special Purpose Company.

Who owns the shares in the Special Purpose Company?

Neither the ATO nor the SIS Legislation cares who owns the share in your SMSF corporate trustee. As far as the superannuation laws are concerned anyone can own the shares in a special purpose company. The shareholders do not have to be the members or anyone related to the members. This is both before and after the conversion to the special-purpose company.

However, for succession planning the shares should be in the member’s names. Therefore, when you die your estate gets the shares in the special purpose company. If you failed to put in place a binding death benefit nomination then your executors and beneficiaries in your Will are involved in who gets your superannuation.

The special purpose company has no beneficial interest in the super. But ownership of at least some of the shares may help control who gets the super when you die.

There is up to 32% tax on your superannuation when you die. So consider putting a Superannuation Testamentary Trust in your Will. And ensuring that your super goes into your Will. A non-lapsing death benefit nomination is one of the three ways to achieve this.

All super is paid out at your death. This is unless you have a Reversionary Pension.

Any Capital Gains Tax or transfer (stamp) duty if I change the shareholding of a Special Purpose Company?

If your company has a balance sheet of zero then it has no assets. Therefore, you can usually transfer or issue more shares in the company to your heart’s content. This usually has no tax consequences even if your SMSF has millions of dollars in it. And while your company is the legal owner of all that wealth, the SMSF corporate trustee has no beneficial interest in the SMSF assets. Therefore, you can, usually, change the shareholding of a corporate trustee as the members see fit at any time. However, Legal Consolidated is not providing any stamp duty, CGT or tax advice. We do not provide advice on these matters. Speak with your accountant and financial planner.

We help you answer the questions to convert your old company into a Special Purpose Company. But start the free building process first. It answers most questions.

Business Structures for non-SMSF assets

Family trust

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Service trust and Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case

| Upgrade Company Constitution – also allows for single director company | $447 |

| Replace Old Memo and Articles of Association – upgrade from Replaceable Rules | $447 |

| Replace Lost Company Constitution | $447 |

| Convert Old Company Into a Special Purpose Company – to be trustee of SMSF | $447 |

| Replace Replaceable Rules | $447 |