Update SMSF Deed with 1 to 6 members

You are building the Update SMSF Deed. It updates your Self-Managed Superannuation Fund for:

1. Trustees (one company or up to 6 trustees)

2. Members (one to 6)

3. Deed (full replacement)

Legal Consolidated Barristers & Solicitors automatically puts in all Deed updates. These are required for the:

1. new Superannuation legislation; and

2. the budget changes.

Checklist to see if your SMSF Deed is up-to-date

Our Self Managed Super Fund deed update complies with the 19 main changes to SMSF Deeds. This is under the Budget:

- Binding death benefit nominations (BDBNs) given the High Court’s landmark decision in Hill v Zuda [2022] HCA 21

- Contributions given the removal of the ‘Work Test’ for those between 67 and 75 years old from 1 July 2022

- Corporate collective investment vehicles, cryptocurrency, non-fungible tokens and blockchain technology

- Internally ‘rollback’ pensions to accumulation for up to 6 members

- Segregate assets between accumulation and pension phases

- Reject contributions

- Refund contributions;

- Deal with excess transfer balance tax and excess non-concessional contributions

- Allow income streams and Account-Based Pension (grandfathered)

- Specify guardians for incapacity and death

- Identify the Power of Attorney when living overseas for more than 2 years

- Resettle pensions with flexible timing without mingling with an accumulation account

- Allow reversionary beneficiary nominations

- Provide CGT relief

- Deal with segregated and unsegregated assets

- Cease or keep the Transition to Retirement Income Streams

- Calculate member balances, across different funds

- Calculate internal pension rollbacks to accumulation

- Allows for an unlimited number of members (currently the law allows 6 members)

What do I get in the Update SMSF Deed?

Build this Update SMSF Deed. You get:

1. Deed of Variation – updates your SMSF Deed, the Trustees and the Members (up to 6 members)

2. Binding Death Benefit Agreement

3. Minutes for the Trustee to accept the Deed of Variation

4. Product Disclosure Statement – fully updated

5. Letter on our law firm’s letterhead confirming the above. Signed by a partner of the law firm

Other documents you can build on our website:

Only want to update the Trustee?

Want to only update the SMSF Deed (and not change the Trustee or Members)

Only want to update the SMSF Deed to allow for Death Benefit Binding Nominations

Why update the SMSF Deed?

The Superannuation laws have changed. An old SMSF Deed is dangerous. It contains irrelevant clauses. This increases your risk of exercising a power you’re no longer allowed. This results in the loss of tax concessions.

Over the last 4 years, there have been 13 significant changes to superannuation legislation. These include:

* change concessional contribution cap

* Insurance – new satisfying conditions

* pension limits and changed payout rules

* Excess concessional contributions rules

* Investment strategy should now be reviewed annually

* Trustees must report assets at market value using new rules

* remuneration for certain non-trustee duties

* up to 6 members

Trustee vs a Member?

The Trustee looks after the Self-Managed Superannuation Fund. The Member is the lucky person who will, one day, get the assets in the SMSF. The Member gets the assets after retirement.

Usually, the Trustees and Members are the same persons. The law requires that if you are one of the members then you must also be a trustee as well.

E.g. James and Jenny are the Members. They must, by law, also both be the Trustees.

An exception to this rule is if you have a company as your Trustee. This is called a ‘Corporate Trustee’. In that instance, the only Trustee, by law, must be your company. The only directors of the corporate trustee must be the members.

E.g. James and Jenny are the members. They have a company as the trustee. Both James and Jenny must, by law, be the only directors of the company.

An SMSF can have up to 6 members. They must all be trustees as well. However, some States of Australia only allow for 4 trustees of a trust. (And an SMSF is a trust.) So if you have 5 or 6 members you should consider a company as trustee of the SMSF. Most accountants recommend that an SMSF always have a company as a trustee of the SMSF. This is irrespective of how many members are in the SMSF. I think they are correct.

Trustee or Member dead, bankrupt or of unsound mind?

This Deed of Variation updates your Trustees and Members, even if they are dead or otherwise incapacitated.

Does the SMSF Deed update mention AASB15 “Revenue from Contracts with Customers”?

As of 1 July 2021, non-listed companies are no longer allowed to prepare Special Purpose Financial Statements (SPFs). Instead, they prepare arduous General Purpose Financial Statements (GPFS). Small proprietary companies where 5% of their shareholders request GPFS to be prepared are included in the definition of companies that comply with this requirement.

This requirement also applies to SMSF, Trusts and Partnerships, but only where the founding Deed makes mention of AASB15 in its definition of income.

Happily, Legal Consolidated documents do not mention AASB15 in the definition of income.

Further, no Legal Consolidated documents require compliance with the arduous AASB15.

Does the Legal Consolidated SMSF Deed update mention previous deed updates?

Q: Professor Davies, over the years my SMSF Deed has been updated 8 times. I am about to do the SMSF deed’s ninth update. Why do you not mention the 8 updates in your Deed of Variation of an SMSF? Your questions and answers only require me to identify the SMSF Deed that first started the super fund.

A: You are correct. There is no reference to any previous variations. When you build the SMSF Deed update, on our law firm’s website, there are no questions on any updated SMSF deeds. We only identify the original SMSF deed that first established your Self-Managed Super Fund. We intentionally do not refer to any specific deeds of variations.

There is no legal requirement to refer to other updates. It only adds complexity, especially if you lose one of those updates.

How do I know that the SMSF Deed allows for this Deed of Variation?

Q: Do you need to review previous SMSF deeds and any variations? This is to see if the SMSF can be so varied.

A: The SIS legislation controls the Superannuation including SMSF. So most of the rules are in the SIS Legislation, not the SMSF Deed.

Secondly, the SMSF cannot ’embed’ any rules that prohibit the making of amendments or Deed of Variations. This is provided the SMSF updates are done via a ‘deed’. Only law firms can prepare deeds. We are a law firm and all our SMSF variations are done via a deed.

To show the breadth of what you can do to an SMSF without triggering a resettlement you can even replace a lost SMSF deed.

Are tax benefits and old rules protected when I update my SMSF Deed?

Yes. Tax benefits are grandfathered and protected in all our SMSF Deed updates.

Investing in Cryptocurrency using SMSF

Legal Consolidated SMSF deeds, updates and investment strategy are fully compliant with the new Cryptocurrency rules see here.

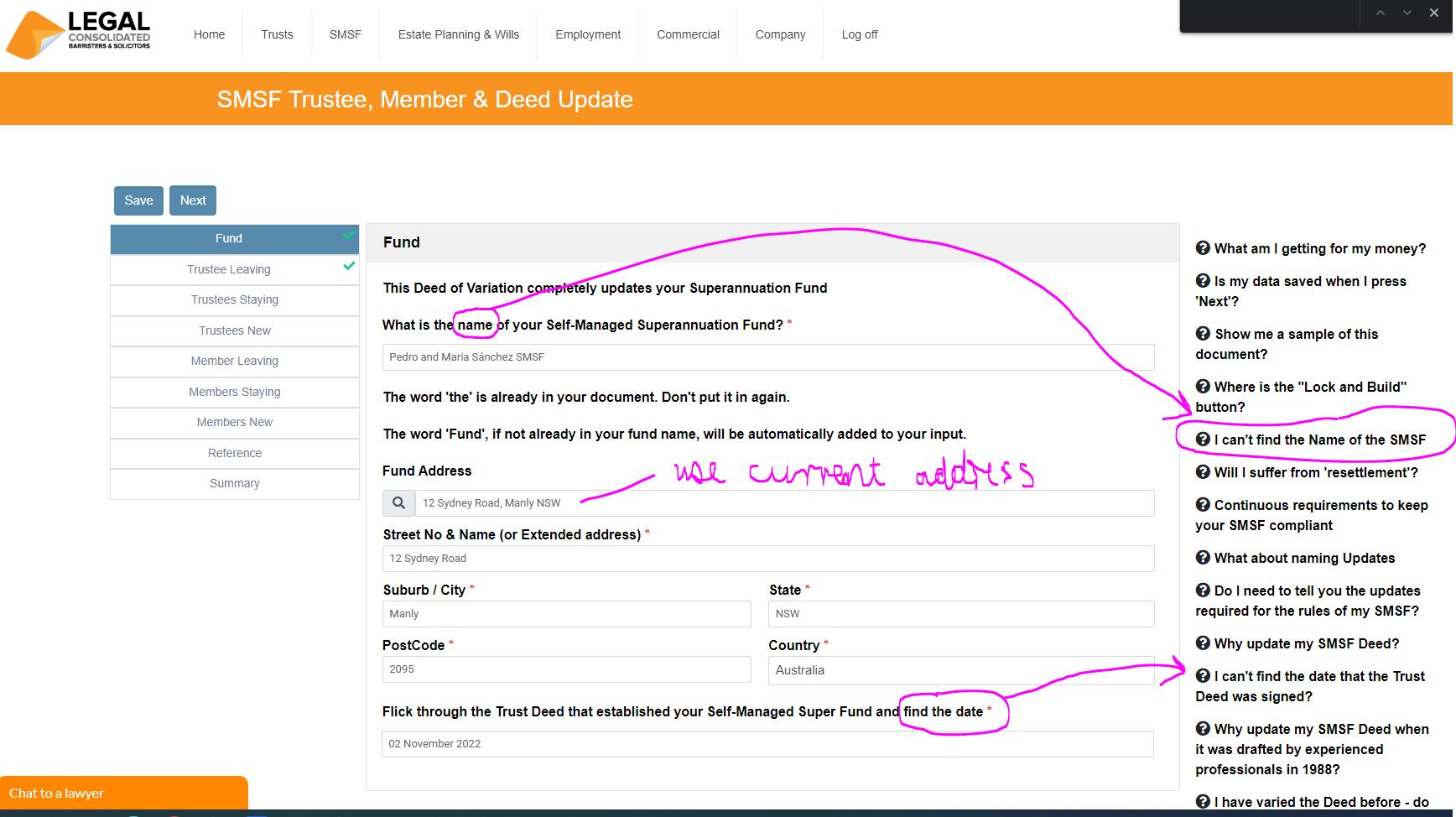

How do I find the ‘name’ of my Self Managed Superannuation Fund? This is to update the SMSF Deed?

As per the screenshot below, read the hints on the right-hand side of the question. The online building process is designed to educate and empower you about your SMSF.

Do I put in the SMSF’s old address or new address? This is when I am updating the SMSF.

See the above screenshot. To the right are many hints. They empower you. They help you take control of your SMSF.

Use the current address of your SMSF. (Do not use the old address in the original SMSF Deed or any of the previous SMSF updates.)

Any stamp duty on Legal Consolidated SMSF Deeds and variations?

Legal Consolidated SMSF Deeds are not dutiable. We draft them so that they do not need to be lodged for stamp duty. However, if the SMSF Deed is in the Northern Territory then you have to lodge the SMSF deed for stamping.

Stamp duty in the Northern Territory for Legal Consolidated SMSF Deeds

A Legal Consolidated SMSF deed that relates to property in the NT (even if signed outside the NT) must be lodged with the:

- NT Territory Revenue Office, GPO Box 1974, Darwin NT 0801

In the NT there is usually a ‘nominal’ fee of $20 (plus $5 for each duplicate deed). This is under section 2 of Schedule 1 and section 9B Stamp Duty Act 1978 (NT)). Upon signing you only have 60 days to complete and lodge the Stamp Duty Lodgement Form. The form is freely available from the NT Department of Treasury and Finance website.

Stamp Duty Requirements for SMSF Deeds in New South Wales

Legal Consolidated SMSF Deeds and our deeds that amend SMSFs are not dutiable for stamp duty in NSW. See 65(10)(a) Duties Act 1997 (NSW). You do not need to lodge our deeds for stamping.

No stamp duty in Victoria for Legal Consolidated SMSF Deeds

No duty assessment is required for Legal Consolidated SMSF deeds that establish or amend the SMSF. See section 39 Duties Act 2000 (Vic). You do not need to lodge our deeds for stamping.

How much stamp duty is payable on a Queensland SMSF Deed and variations?

When you build on Legal Consolidated’s website SMSF Deeds and SMSF Deed Updates there is no stamp duty. And you do not need to lodge such Legal Consolidated deeds for duty. See sections 9 and 10 Duties Act 2001 (QLD). If you are moving cash or stamp dutiable property into or out of the SMSF then you will need to pay stamp duty. But, as to the Legal Consolidated SMSF deeds themselves, they are not dutiable.

The stamping of Western Australian SMSF deeds and variations

No duty assessment is necessary for Legal Consolidated SMSF Deeds and deeds that amend an SMSF deed. See the Duties Act 2008 (WA). You do not need to lodge our deeds for stamping.

Dealing with South Australian stamp duty for SMSF Deeds and variations

The good news here is that Legal Consolidated SMSF Deeds and SMSF Deeds of Variation are not dutiable. They do not need to be lodged. See Schedule 2, Part 2, Item 30 Stamp Duties Act 1923 (SA). However, such deeds need to be lodged if the deed moves assets or changes the interest in the underlying assets in the SMSF. For example, you move the $4m vineyard in the Barossa Valley from Mum’s account in the SMSF to Dad’s account in the SMSF.

Legal Consolidated SMSF deeds and variations are designed to not move or change any rights to the assets in the SMSF.

If your accountant is concerned, then out of an abundance of caution, lodge the Legal Consolidated SMSF Deed or variation at RevenueSA, GPO Box 1353, Adelaide SA 5001 and ask for the deed to be stamped ‘exempt’.

No stamp duty on Legal Consolidated ACT SMSF Deeds

Legal Consolidated SMSF Deeds and deeds of variation are drafted so that they have no stamp duty and are, also, not required to be lodged for stamping. See Duties Amendment Act 2008 (ACT). You do not need to lodge our deeds for stamping.

Tasmanian stamp duty on Legal Consolidated SMSF deeds and variations

Happily, Legal Consolidated drafts its SMSF Deeds and variations so that they neither suffer any stamp duty nor need to be lodged. You do not need to lodge our deeds for stamping.

Starting an Account-Based Pension? Ensure Your SMSF Deed is Ready

As SMSF members approach retirement, talk with your accountant and financial planner about starting an Account-Based Pension. This transition from the accumulation phase to the pension phase allows members to draw a regular income from the capital they have saved. However, a successful transition hinges on a simple but crucial question: is your SMSF’s trust deed up to the task?

An outdated SMSF deed lacks the specific provisions required to start and administer a pension in full compliance with current law, potentially leading to significant administrative and compliance issues.

An SMSF Deed requires an express power to start and operate an Account-Based Pension

A Legal Consolidated SMSF deed provides the Trustee with explicit authority to pay pensions. Our SMSF update specifically empowers the Trustee to pay benefits to a member in the form of an “account-based” pension. Furthermore, it gives the Trustee the clear authority to facilitate the “commencement… of an income stream in the form of an account-based pension”.

SMSF Deeds must align with Australian Superannuation Law for Pensions

Beyond the wording of the deed, the SMSF Deed must align with Australian superannuation legislation. The rules governing what constitutes a compliant Account-Based Pension are detailed in the Superannuation Industry (Supervision) Act 1993 (SISA) and the Superannuation Industry (Supervision) Regulations 1994 (SISR).

Specifically, Regulation 1.06(9A) of the SISR establishes the core standards that a pension must meet. The Legal Consolidated SMSF Update includes:

- minimum annual payment amounts

- rules on commutation, and

- the consequences of the member’s death.

Legal Consolidated SMSF Deeds are designed for ongoing compliance

A robust feature of Legal Consolidated SMSF Deeds is that they are drafted to remain compliant as laws change. The Legal Consolidated deed is designed to be “subservient” to and “augmented by” superannuation legislation. It is structured to incorporate provisions required by the law automatically. This built-in flexibility ensures that the fund’s governing rules remain aligned with legislative requirements, providing lasting peace of mind for trustees.

Can I get legal advice as I update my SMSF Deed?

You are building your SMSF Deed update on an Australian law firm’s website. Telephone us anytime to get legal advice on how to build the SMSF Update.

But start the free building process first. We have been updating SMSFs since 1988. Every time we are asked a unique question, we add another hint. I know you are special and unique. But try building the SMSF Complete Update of the deed first. And then telephone us for further help.

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will