Wind up Family Trust – how to get rid of a Discretionary Trust

Vest Family Trust for Centrelink? Wind up and get rid of a Discretionary Trust

You have finally retired and applied to Centrelink for a pension. Unfortunately, Centrelink takes issue with the fact that you have an old discretionary trust created 30 years ago. It has not been used for years. There is no money left in it. The trust has a nil value. It has no assets and no debts.

Centrelink does not understand and is frightened of Family Trusts whether they have assets or not.

How to prove to Centrelink that the Family Trust no longer exists

You must formally wind up (vest) the trust. This is to close down this unused structure. Build this Vesting a Discretionary Trust deed on our law firm’s website. (Centrelink and the ATO have the same requirement for getting rid of old Unit Trusts.)

Vest and wind up a Family Trust to reduce yearly costs

Every year, you pay to prepare Trust tax returns for trusts that are no longer in use. Perhaps your Trust was set up for a specific purpose. But that time has passed.

Is the Trust no longer required? Vesting your trust and closing it saves you money. Perhaps an opportunity may arise in the future for your old trust. Rarely is reusing a trust worthwhile. A Discretionary Trust Deed is like a car; it requires regular updates. These are called Deeds of Variation. Setting up a new trust is usually less expensive than updating an old Discretionary Trust deed. And a new trust has no baggage or festering problems.

I cannot find my original Family Trust deed – I only have a copy

You started your Family Trust many years ago. It has been updated a number of times. But you cannot find the original Trust Deed or one of the original Deeds of Variation. Sure, you have copies. But the banks and others demand to see the ORIGINALS. With only copies, the bank is refusing to open a new bank account. You are frantic. Your accountant is worried.

Since the Family Trust has no assets, the accountant recommends closing it immediately. ‘It is a dangerous creature’, the accountant declares.

Getting rid of a Family Trust for the Family Court, Bankruptcy Court, Centrelink and the ATO

This Deed of Vesting closes the Family Trust and eliminates the nightmare. It dissolves and closes your family trust to comply with the Family Court, Bankruptcy Court, Centrelink and the Australian Taxation Office.

Re-use my old Family Trust Deed?

The rule of thumb is to get rid of old Family Trust deeds, companies and Unit Trust deeds. This is as often and as quickly as possible. If any of those vehicles get down to a zero balance sheet, take advantage of getting rid of them.

You may think you know what your own trusts have been up to over the years. But that is often not the case. Also, laws and tax rules change.

Also, trust deeds go out of date. On average, in Australia, every 6 – 7 years, your trust deed needs to be updated. You can update Family Trust Deeds here. But it is generally more expensive. A new trust deed is less expensive.

Wind up Discretionary Trust you do not want? Get rid of a Trust.

You have an old Family Discretionary Trust. Your accountant or financial planner suggests that it is more trouble than it is worth. The Vest Family Trust Deed is simple and straightforward. Just build this Terminate a Discretionary Trust deed.

Why dissolve a Discretionary Trust?

• The Trust has achieved its original purpose

• It has no assets (if it has debts, do a Debt Forgiveness Deed first)

• The controllers of the trust don’t want to continue

• The trust has reached its vesting date

How to terminate a Family Trust?

1. Distribute any capital that is left

2. Build a Debt Forgiveness Deed to forgive loans and Unpaid Present Entitlements owed to beneficiaries

3. Prepare any outstanding tax returns

4. Build and sign the Windup Family Trust Deed and the minutes

Get rid of my Family Trust via a ‘minute’?

A ‘minute’ is a record of something you have done. It is just recording an event. In contrast, a Deed of Variation to vest your Trust is the actual document that vests and winds up your Trust.

The Discretionary Trust Deed started the trust. The way to terminate the Trust is to do another Deed. A minute is not good enough. It is not best practice, and your accountant would not be prepared to take the risk of just using a ‘minute’. A ‘minute’ does not satisfy the ATO or other government departments. See Taxation Ruling TR 2018/6.

Any CGT or stamp duty issues to dissolve a family trust?

Provided you follow the procedures set out in our cover letter (which comes with the Deed of Variation), there are generally no Capital Gains Tax issues and no ad valorem stamp (transfer) duty in any Australian State or Territory.

This is because your Balance Sheet has nothing on it. You need to get your Balance Sheet to almost zero before you can wind up and get rid of your old Family Trust.

However, Legal Consolidated is not giving advice on any of these matters. You need to talk with your accountant, who knows your individual circumstances.

Stamp duty and CGT when you close the family trust

Your documents to get rid of a family trust are drafted so that there are generally:

- no stamp duty

- no transfer duty

- no Capital Gains Tax

- no family law issues

- no bankruptcy clawback

Stamp Duty and Transfer Duty are State-based taxes. However, in all Australian States and Territories, they do not generally apply to closing a family trust prepared by Legal Consolidated Barristers & Solicitors.

Capital Gains Tax is a tax levied by the Federal Government. Again, there is generally no CGT payable on these vesting documents.

However, we confirm that you have not instructed us to provide you with any taxation, family law or insolvency/asset protection advice.

Forgive UPEs before you vest the Family Trust

The Family Trust may owe people and beneficiaries money. These obligations are often called ‘loans’ or ‘unpaid present entitlements’ (UPEs). To get rid of Family Trust UPEs and loans, build and sign a Deed of Debt Forgiveness.

However, check with your accountant before you do that, especially if the loans are to a Company. Division 7A may apply.

Get rid of Unpaid Present Entitlements before you terminate the Family Trust

The balance sheet must show zero before you wind up your Family Trust. No assets and no liabilities of the family trust you are about to get rid of.

However, often, there are Unpaid Present Entitlements (UPEs) on the Family Trust balance sheet. A UPE is created when your Family Trust distributes income to a beneficiary. The beneficiary rarely sees the money. Instead, the beneficiary merely ‘lends’ the money back to the Family Trust.

As the years go by, the UPE builds up. It is not uncommon to have UPEs where the Family Trust owes millions of dollars to beneficiaries.

A UPE is a liability on the Family Trust balance sheet. To get rid of the UPE, the beneficiary forgives the ‘loan’. The beneficiary signs a Deed of Debt Forgiveness. Build that document here.

Get rid of beneficiary loan accounts before you terminate the Family Trust

Question: Our Trust has a $60K capital loss. This is the balance of the beneficiary loan accounts. Is this the debt to be forgiven?

Answer: Your accountant may include debt forgiveness in the capital account along with non-financial and non-produced asset transactions. We, however, are not accountants. You need to talk with your accountant.

Question: So, if my husband and I are forgiving the debt, would we each be able to claim the capital loss on our own personal tax returns for the amount forgiven?

Answer: You need to speak with your accountant. Read the letter of advice that comes with the Deed of Debt Forgiveness. And speak to your accountant.

Question: Do we purchase two debt forgiveness agreements? And then this Family Trust Deed of vesting?

Answer: Yes. You need to build those three documents.

What is the difference between a UPE and a Loan?

- Unpaid Present Entitlements: A UPE is when a family trust makes you ‘presently entitled’ to a Family Trust distribution. But then does not pay the money. It is an ‘unpaid’ ‘present entitlement’. The beneficiary just waits around. This is until the beneficiary gets his money.

- Loan: A Loan is when a person lends you some money. For example, you may want to buy a necklace for your wife. You pay for that necklace from the family trust’s bank account. You are borrowing the money from the family trust. You are the borrower. Your family trust is the lender.

However, do not get too caught up in the delicate distinction between a UPE and a Loan.

Either way, you must get rid of them. This is to get your family trust balance sheet to zero. The Legal Consolidated Debt Forgiveness Agreement is designed to get rid of both the UPE and the Loan Agreement between the family trust and one person.

ATO’s view of closing a family trust – Taxation Ruling TR 2018/6

ATO Taxation Ruling TR 2018/6 sets out the views on the income tax consequences of a trust vesting. Our vesting deed complies with the ruling.

A trust’s ‘vesting” or ‘termination’ date is when the beneficiaries’ interests in the trust’s property become ‘vested in interest and possession’.

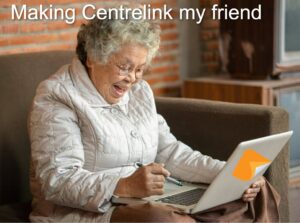

Centrelink vs a closed Family Trust

To get Centrelink, you move your assets into your Family Trust. In 2002, the laws changed, and Centrelink and the ATO started data-matching. I remember it well. I was sitting on the Tax Institutes’ Education Committee and organised a paper to be delivered. Try as I might, I could not find a taxation lawyer to present the paper. So, I had to write and deliver the paper myself.

Centrelink deems you to own 100% of the Family Trust assets

Family trusts are flexible. There are over 400,000 beneficiaries in an Australian trust. But you generally only distribute to your immediate family. Centrelink’s specific assessment rules do not cope with this. They are far too broad-reaching. Centrelink has an unrefined and unfair catch-all set of attribution rules. If you had any involvement with a family trust as an appointor, trustee or one of the 400,000 beneficiaries, you:

- are assessed as owning all the family trust assets, and

- you are deemed to have earned the corresponding income.

This is under Centrelink’s attribution rules.

Sadly, little old grandmas, who are destined to receive none of the assets from their children’s and grandchildren’s family trusts, are caught up in this. Centrelink is harsh and unsympathetic.

We had one disabled nephew client (who did not even know he was a potential beneficiary) attacked by the shameful and heavy-handed Centrelink.

Sadly, even family trusts with no assets attract the enmity of Centrelink. Wind up the Family Trust and escape the Centrelink attacks.

If your family trust still has assets and you want to keep them going, then talk with your accountant about changing the trustee and the appointment.

The Family Trust has no assets. Should I get rid of it?

Q: My family trust is empty. Should I keep it going in case it is needed in the future?

Keeping an empty family trust is a mistake. Bizarrely, these “empty” trusts get more ATO audit scrutiny. For financial planners, it’s a major headache as Centrelink sees the client is an appointor (even of an empty trust) and stops the Age Pension application. The only way to stop this lingering liability is to formally wind up the trust with a Family Trust Vesting Deed.

Family Trust deeds also need regular updates. This is expensive.

A: This is a mistake. Keeping an empty family trust is like keeping an empty fridge plugged in — it uses power, attracts pests, needs to be regularly serviced and has no purpose.

Here are the five traps of keeping a dormant Family Trust.

1. Empty trusts are more likely to get onto the ATO’s radar

The ATO still demands ‘nil’ returns for these empty trusts. Bizarrely, these zero-balance funds are often flagged as a ‘novelty’ and attract more audit scrutiny, not less. Accountants complain that their clients are still paying annual ASIC review fees for corporate trustees and professional fees to manage the empty family trust. While some clients try to preserve carry-forward losses, advisers report this is usually a poor cost-benefit given the annual costs and audit risk.

2. Bizarrely empty family trusts stop you from getting the pension

Financial planners report this is the biggest headache. A client applies for the Age Pension. Centrelink sees that they are an appointor or trustee (even of an empty trust) and stops the application. It becomes a ‘please explain’ that indefinitely delays the pension. It is a powerful reminder of why clients build 3-Generation Testamentary Trust Wills—to escape this asset-test scrutiny.

3. Banks and AUSTRAC freeze assets of an empty family trust, which seems strange as the trust has no assets!

Banks and AUSTRAC increasingly view empty trusts as a liability. Banks may freeze the trust’s accounts due to inactivity, while AUSTRAC can flag the empty trust as a high-risk structure resembling a shell company, triggering anti-money-laundering (AML) reporting requirements.

4. Old, empty trusts can be picked over for old mistakes

Lawyers in our network warn that trustees remain personally liable for the trust’s past actions. An ’empty’ trust is not a ‘dead’ trust—it is a zombie that can still bite. We also see clients facing surprise stamp duty reviews related to historical trustee changes. The only way to end this lingering liability is to formally “kill off” the empty Family Trust by terminating it with a vesting deed.

5. Family Trusts need to be updated

Family Trusts are like your car. The Family Trust deed needs updating every 5 – 7 years. This is more expensive than getting a new Family Trust when you need one.

Stopping the Ongoing Liability

Winding up the trust properly saves your client from ATO scrutiny, ASIC penalties, and Centrelink frustration.

The correct formal process is to ‘vest’ the trust. This legally ends the entity and provides the final document for all government departments.

Build the Family Trust Vesting Deed by pressing the Start for Free button at the top of this page. It includes our law firm’s cover letter, Deed of Vesting and the required minutes.

Does my Family Trust finish after 80 years, 120 years or never?

A Family Trust deed must specify a date on which it terminates, known as the “vesting date.” This is the date that the Family Trust must end. This maximum period is typically 80 years, although it is 125 years in some states, such as Queensland. In South Australia, trusts can continue indefinitely. Unfortunately, some deeds may be drafted with a shorter, more restrictive period. (Legal Consolidated Family Trust deeds are unique in that they are drafted to extend if the laws change to allow the Family Trust to continue longer.)

The Family Trust deed often calls this the ‘vesting date’ or ‘termination date’.

On vesting, the beneficial interests in the trust’s property become fixed. This is to avoid breaching the ‘rule against perpetuities’. If your Family Trust has reached its vesting date, build this Vesting Deed kit.

Legal Consolidated Family Trust Deeds do not have a vesting date for South Australia. Legal Consolidated South Australian Family Trusts can go on forever.

Also, if the 80-year or 120-year limitation period is ever rescinded in a particular State, then the Legal Consolidated Family Trust vesting periods are extended to infinity. This is automatic.

Family Trust Vesting Date linked to His Majesty King George VI – still wind up the Family Trust?

“Royal lives clause”

Royal lives clause

Q: Dear Dr Davies, our law firm is instructed to close an old discretionary family trust he set up in 1976. The husband and his wife are the Primary Beneficiaries. The wife is dead.

The family trust deed has never been varied or updated. So, it is hopelessly out of date. And we want to get rid of it as soon as possible.

- The trustee is a company.

- For asset protection, his dead wife is the Appointor/Guardian. This is during her lifetime.

- The husband is and remains the “Supervisor”. (Dr Davies, this is an expression I have never seen in a Family Trust before.)

Normally, the Vesting Day is 80 years minus one day. For this Family Trust Deed, the Vesting Date is:

“Vesting Day is the 21st anniversary of the death of the last survivor of the issue of the now living of his Late Majesty King George VI or such earlier day as the Trustee may in their absolute discretion at any time during the lifetime of the Guardian with the consent of the Guardian OR if the Vesting Day is later than the day of the death of the last surviving Guardian then after such last-mentioned date without any consent appoints PROVIDED ALWAYS that notwithstanding anything herein contained all powers and dispositions made by or pursuant to or contained in this Deed which but for this provision would or might vest take effect or be exercisable after the expiration of the perpetuity period shall vest and take effect and be exercisable only until the last day of the perpetuity period.”

I am writing this definition in full as it is written in the most archaic language. It is not what you find in a Legal Consolidated discretionary trust!

As you recommend in your Family Trust Vesting kit, the accountant prepares the balance sheet showing nil assets. I confirm:

- The assets are transferred out of the Family Trust.

- Net assets are distributed to the beneficiaries.

- The Loan Accounts are forgiven.

- The final ATO tax return is about to be lodged.

Five questions regarding the Family Trust Vesting Deed:

- Does this Vesting Day definition pose problems using the Legal Consolidated Vesting Deed to close the Family Trust?

- What do we do about the dead Guardian?

- What do we do with the ‘Supervisor’?

- As a lawyer, I would like to play around with the wording of the finished Family Trust Deed Update. But I understand I cannot and should not change anything.

- Can I contact Legal Consolidated for help both before and after we build the Family Trust Vesting Kit?

Answers to vesting a Family Trust

1. Does this Vesting Day definition pose problems using the Legal Consolidated Vesting Deed to close the Family Trust?

A: The Vesting Day wording is common for Family Trusts of this vintage. That wording is fine. I note the vesting day definition also states ‘or such earlier day’. But this lifeline is not required.

2. What do we do about the dead Guardian?

A: The full answer is contained elsewhere on this page. And it is repeated in our cover letter that comes with the Vesting Kit.

The short answer is that whoever is the Backup Appointor signs as the Appointor/Guardian. This is the person mentioned in the Family Trust deed. It is often expressly stated to be Dad or the children. While it is not good practice, the Backup Appointors may be Mum’s ‘legal personal representative’. These are the executors of Mum’s Will.

3. How do we deal with the Supervisor?

A: The full answer is contained elsewhere on this page. And it is repeated in our cover letter that comes with the Vesting Kit.

The short answer is to treat the “Supervisor” as one of the controllers of the Family Trust. Have them sign, in effect, as one of the Appointors. It is a conservative and cautious position to take. The more people that ‘seem’ to be in control of the Family Trust that sign the Vesting Deed, the better.

I know that Dad is not dead. But if Dad was dead, then his next of kin or executors normally sign where Dad would normally sign the Vesting Deed.

4. As a lawyer, I would like to play around with the wording after I build the document. But I understand I cannot and should not change anything.

A: We have provided Deeds of Vesting of a Family Trust since 1988. The kit you are building is based on hundreds of ATO desktop audits that we have attended, or accountants have relayed to us.

As with all Legal Consolidated documents you build on our website, they cannot and should not be altered.

A Family Trust with no assets is no longer a trust. So, from a trust law position, the Family Trust ended when you got to that empty balance sheet from your client’s accountant. This vesting deed is to formally close the family trust to the satisfaction of the following:

-

-

-

-

-

-

- Australian Taxation Office

- the state (stamp) duty office

- bankruptcy court

- family court

-

-

-

-

-

5. Can I contact Legal Consolidated for help both before and after we build the Vesting Kit?

A: Yes. However, start the free building process first. It answers most questions.

Start building the Family Trust Vesting Kit:

-

-

-

-

-

-

- The building process is highly educational, informative and fun.

- Well, it is not much fun!

- But it does guide you into questions you should be asking.

- Each question has informative hints.

- And telephone me or the law firm if you need more help answering the questions.

-

-

-

-

-

6. What about the Primary Beneficiaries being dead?

A: Often, the Primary (Default) Beneficiaries are long dead by the time the Family Trust is to be ended. In that capacity, the Primary Beneficiaries do not need to consent to the vesting.

My old Family Trust deed already allows the winding up of the Family Trust

While many trust deeds, such as those for Family Trusts, Self-Managed Super Funds, and Unit Trusts, already include provisions allowing for the termination of the trust, a Family Trust Vesting Deed pack provides several additional benefits.

Firstly, while the old Family Trust Deed may already confer broad powers on the trustee, including the amendment of trust provisions and the vesting date, it may not always allow for ‘earlier’ vesting or may require a vesting process that triggers stamp duty and Capital Gains Tax. The Family Trust Vesting Deed pack allows for these adjustments and aligns with the ATO’s latest rulings to ensure compliance.

Furthermore, entities and trusts created by a deed must be ended by a deed rather than just minutes. To the author’s knowledge, we have never known a lawyer or accountant to recommend minutes. A Deed reduces future legal risks involving entities such as the Family Court, Bankruptcy Court, Centrelink, or the ATO. Using the detailed documentation provided in the Family Trust Vesting Deed pack, which includes a Family Trust Winding Up deed, ensures that all procedures follow best practices and are legally robust. This offers peace of mind and security, protecting trustees from future disputes or challenges to the termination process.

Overall, the Family Trust Vesting Deed pack makes provisions for standard termination and enhances the process, ensuring it is up-to-date with current legal standards and practices, providing comprehensive protection and assurance to clients.

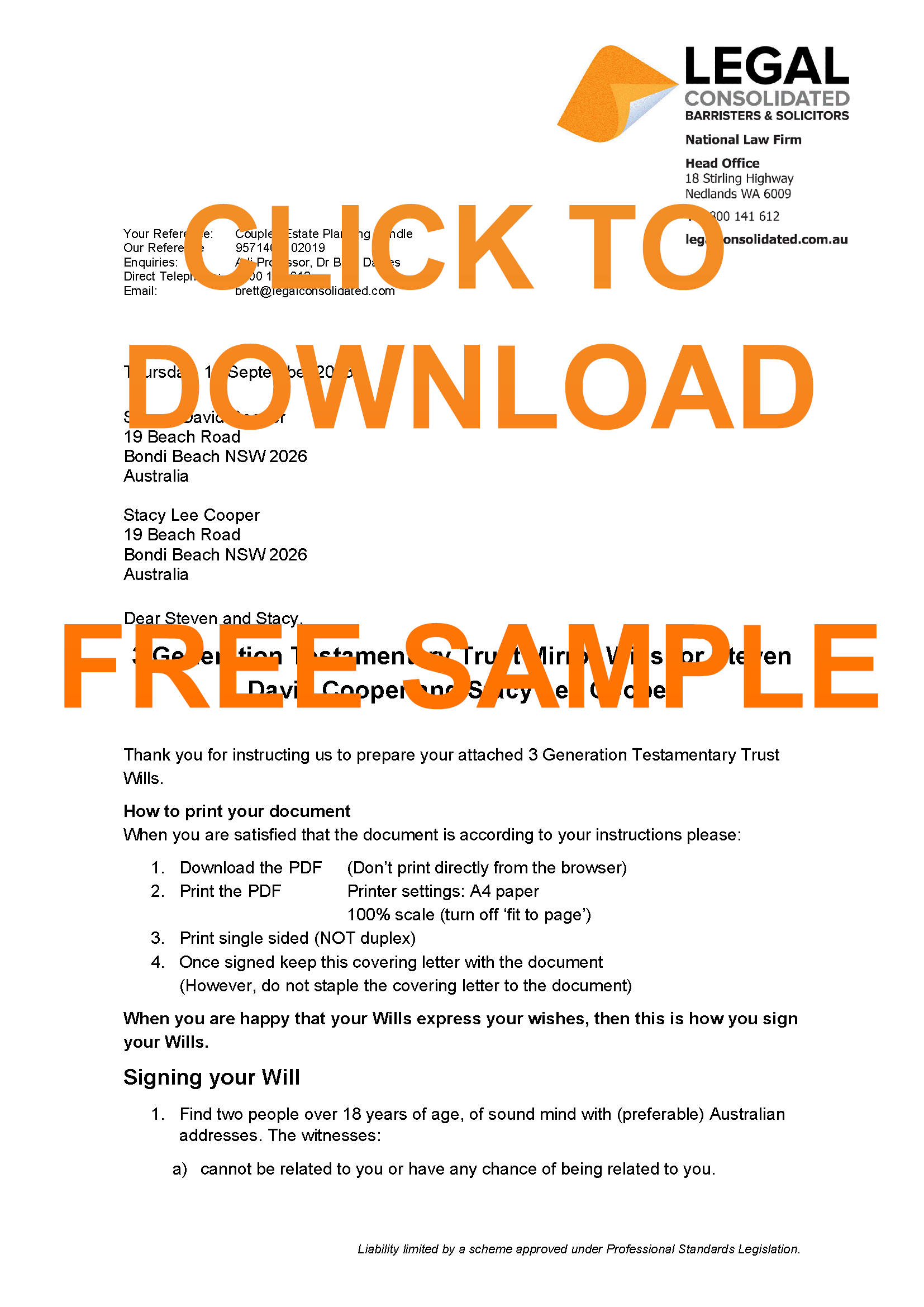

Further, the power to end the trust in the old trust deed is only part of the process. The Family Trust Vesting Pack contains five documents:

-

Law firm letter of Advice on ending the Family Trust:

- signed by a partner of our law firm on our law firm letterhead

- confirmation that the Family Trust is authorised to be ended in this manner set out in the Family Trust Winding Up kit

- Capital Gains tax issues are addressed

- what to do with the capital and assets in the Family Trust in compliance with the ATO

- when a Family Trust final tax return is required and the wording the ATO requires

-

Family Trust Vesting Minutes:

- containing the required resolutions to end the Family Trust

- required by your accountant’s due diligence file

-

Vesting of a Family Trust Deed:

- updating the Appointor and Trustee, in consequence of an audit by the ATO

- allowing earlier winding up of the Family Trust

- augmenting the Family Trust’s Trustees’ powers to allow all things necessary to vest and terminate the Family Trust

- no ‘partnership’ relationships to reduce the threat of Trustee, Appointor and Default Beneficiaries being joint and severally liable for the winding up

-

Checklist to end a Family Trust:

- Step-by-step guide

-

Family Trust Certificate of Vesting

Does the government give me the rules to wind up a family trust?

Q: There are Federal statutory schemes to liquate and de-register companies. There are also rules for each state to dissolve and wind up a partnership. Surely, there are statutory rules to get rid of old Family Trusts?

A: Thankfully, trusts are not a creature of government. Apart from SMSFs, Family Trusts and Unit Trusts are under the user’s control. That is why using a specialist trust law firm, like Legal Consolidated, is important to build your trust deeds and updates.

Neither the Federal government nor state governments have rules for bringing a Family Trust or Unit Trust to an end. The ATO has some tax requirements. But they do not tell us how to get there – but the Legal Consolidated Family Trust Vesting kit does.

Appointor is dead. There is no Backup Appointor. Who signs the Family Trust Vesting Deed?

Q: The Family Trust Deed has an Appointor. But she, the wife, is dead. To repeat the same thing three times (sorry, but I want to make the facts clear):

- there is no Backup Appointor

- the wife (Appointor) never appointed another person

- the wife never consented for her husband (or anyone else for that matter) to be the Backup Appointor

Who signs for the dead Appointor? Can her husband sign? Can we get the Trustee of the Family Trust to appoint the husband as the Appointor?

Secondly, the husband is named as a separate type of person called a Supervisor. He is alive. Therefore, two people need to sign as ‘controllers’ of the Family Trust? These are:

- the dead wife (as Appointor), and

- husband (as Supervisor)?

A: I would not get too delicate here. It may have been a breach of:

- trust law

- the Family Trust deed, and

- the ATO

that the Trustee has been merrily distributing income and capital out of the Family Trust without the Appointor’s approval. This is for all these years since your wife died.

We are not instructed in the above. And you will need to get your own legal and accounting advice on the above matter. Rather, Legal Consolidated only accepts instructions to prepare a Family Trust Vesting Kit. And this is because the Family Trust has no assets in it. So, in trust law, the Family Trust has already ceased to exist.

Now, having said that, let us answer your two questions:

- Appointor is dead. Best practice is to have a Backup Appointor named in the Family Trust deed or the Deed of Family Trust Appointor Update. If this has not been done, then the Family Trust deed may have the replacement Appointor as the dead Appointor’s ‘Legal Personal Representative’. In which case, get the Executor in the dead Appointor’s Will to sign. This is on behalf of the dead Appointor.

- Additional people appear to also be controlling the Family Trust. If other persons may appear to also be controlling the Family Trust, then it does no harm for them to be included as one of the Appointors. The ‘Supervisor’ should be treated as a ‘controller’ of the Family Trust. And accordingly, I added as the second Appointor when building the Family Trust Winding-up kit.

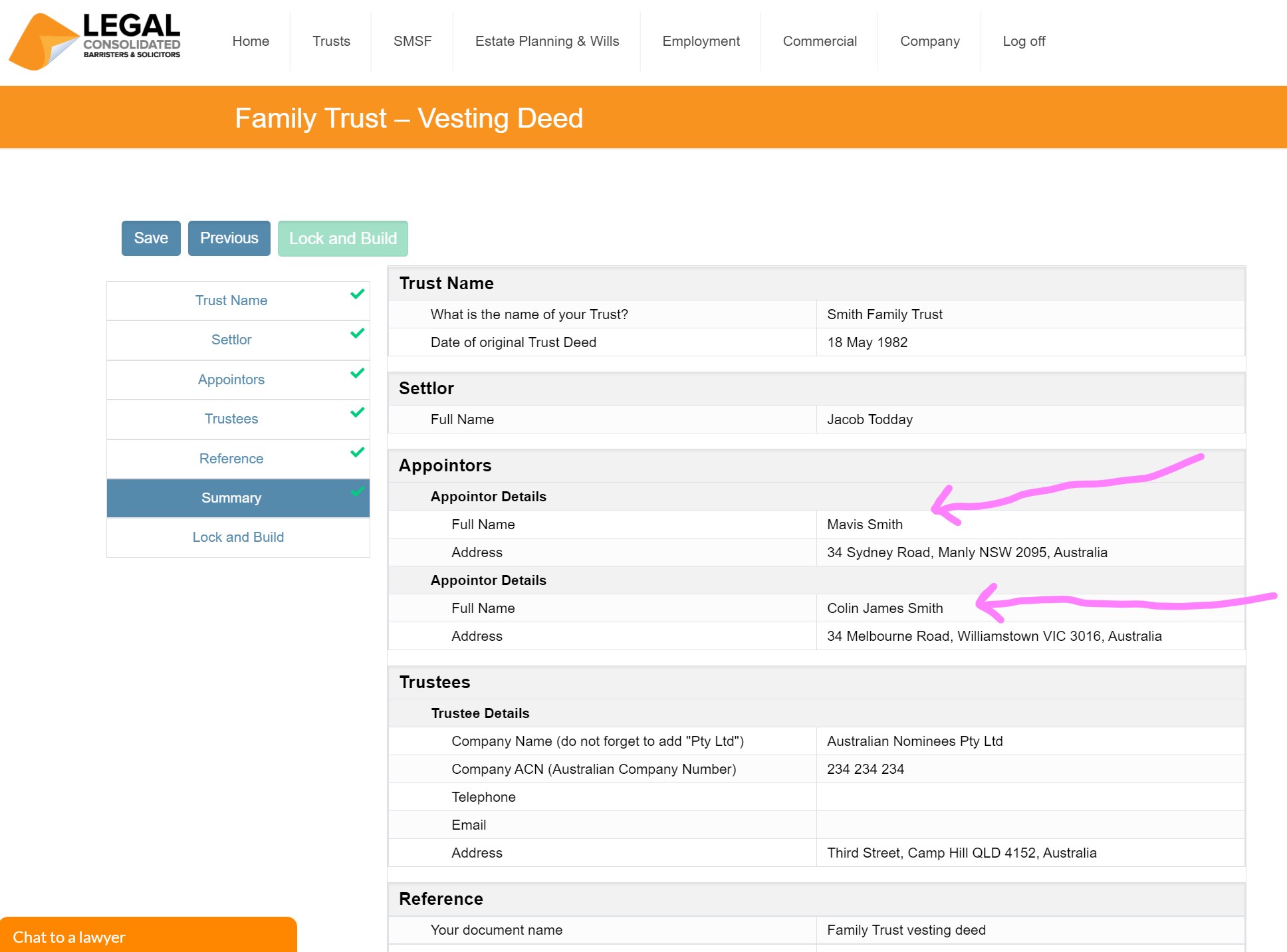

So let us say:

- your dead wife’s name (Appointor) is Mavis Smith (use your wife’s last address while she was alive)

- your name, as the husband (Supervisor), is Colin James Smith

Then this is how you answer the Appointor question for the Family Trust Vesting Deed:

You ask if there is any value in the Trustee of the Family Trust now appointing you, as the husband, as the Appointor.

Trustees normally do not have that power. You could, however, include the Trustee as a third Appointor. In this case, in the above example, the Trustee wears two hats—one as the trustee. And the second is as the third Appointor. It is probably not needed but does no harm.

Lodge the final Family Trust tax return after the Family Trust Vesting pack is signed

Q: Our accountant prepared the tax return for the Family Trust for the financial year that just ended. He intends to notify ATO that the Family Trust will not be lodging tax returns in the future. We now need to build the Family Trust Vesting pack. Is it necessary to prepare a return for the period for the following financial year? Or can we simply rely on the tax return for last year’s financial year?

A: The best practice is to sign all the documents relating to the Family Trust Vesting Deed and then lodge the final Family Trust tax return. But if the final Family Trust tax return has already been correctly lodged, you do not need to do another one. But you do need to let the ATO know that the Family Trust is finished. Our letter of advice sets out how the accountant does this.

To end a Family Trust, get a balance sheet showing ‘nil’

Q: Our accountant has financial statements for the Family Trust for the last financial year. If we wish to build your Family Trust Vesting Deed pack, is it necessary to prepare financial statements for the following financial year? Or can we simply rely on the financial statements for the last financial year?

A: A balance sheet (statement of financial position) provides a snapshot of your assets and liabilities. It shows the Family Trust’s net worth. This is at a single point in time. (This is unlike other financial statements. Such as profit and loss reports. These only give information about your Family Trust over a period of time.)

From a CGT point of view, the ATO is not very interested in financial statements. Rather, it wants to see a Family Trust balance sheet showing zero. Before you wind up your Family Trust, you need to have your accountant prepare a Balance Sheet showing that the Family Trust has (or will have) no assets.

Who signs the Family Trust winding up minutes?

Q: In your section for the Family Trust Vesting Deed, you state as to the Minutes: “Pass a resolution stating the that the trust is vested (terminated)”. Two questions:

- Who needs to pass this resolution? The Trustee, Appointor or Default Beneficiaries?

- Are these Minutes included as part of your Family Trust vesting package?

A: The minutes are in the Sample. Have a look at the Sample to see the answer to that question. And, of course, that Minute is in the Family Trust winding-up pack. Have a look at the sample to see what you get.

How do I get free legal advice when building the Family Trust vesting deed?

Start building the Family Trust Vesting Deed. Read the many hints for each question—answer as many questions as you can. And then telephone the law firm for a good chat. The building process is highly educational and answers most questions.

We have been winding up Family Trusts deeds since 1988. Your ‘unique’ questions about your individual circumstances regarding the winding up of your Family Trust may already be addressed in the many hints you can read during the building process.

Q: My Family Trust is undated. Can I still build a Family Trust Vesting deed?

A: Press “Start Building for Free” and read the free hints on this question.

Q: I have lost my Family Trust Deed. Can I still build a Legal Consolidated Vesting Deed?

It is rather careless of you to lose your Family Trust Deed. It suggests you are an unorganised person. If you cannot look after things that you own, such as trust deeds, how reliable are you? The ATO, Bankruptcy Court and Family Court will now punish you.

It is now doubly important that you end this Family Trust to hide your shame.

The important thing is that your accountant has given you a balance sheet showing that the Family Trust has no assets. If you have that balance sheet showing the trust has no assets, then read on. (If you cannot get a balance sheet that states zero assets, then stop building this document. You will, instead, need to write a very big cheque to a litigation law firm for a Supreme Court order that the Family Trust no longer exists.)

Q: Lost Trust Deed: How does a Balance Sheet showing that the Family Trust has no assets help me?

To be a trust under Australian law for a trust to exist, you need three things:

- Trustee

- Beneficiary (object of the trust)

- Assets in the trust

Since your Family Trust has no assets, it is already NOT in existence in many respects. The Deed of Vesting and the kit you are building merely acknowledge that the trust is no longer in existence. The Vesting Kit provides evidence that the Family Trust no longer exists.

Q: Since I do not have a Family Trust Deed, how do I answer the questions about building the Legal Consolidated Vesting Kit?

But you still need to build the Vesting Kit. So, talk with your accountant, financial planner and lawyer about the best information that you can put into building the Vesting Deed.

Legal Consolidated does not give advice on this, but this may help you:

- Is there a copy of the Family Trust deed?

- Was the Family Trust Deed ever amended?

- Are there any records of tax returns?

- When did the Family Trust apply for a TFN, GST, ABN, etc…?

Build this Closing Family Trust deed on our website

Your Family Trust vesting kit includes:

1. Letter of advice – signed by a partner of Legal Consolidated Barristers & Solicitors

2. Minutes – for your Accountant’s due diligence file

3. Termination of Family Trust Deed – just print and sign; it amends your Family Trust deed to allow it to be vested and wound up

4. Certificate of Vesting

Have a look at the Vest Family Trust sample document. Plus, there are many training videos and hints as you build the Family Trust vesting kit.

What does Centrelink want to see when you wind up a Family Trust?

When you vest (wind up) an old Family Trust to satisfy Centrelink and the Age Pension, Centrelink requires clear evidence that the Family Trust:

- has been terminated;

- no longer holds assets

- does not influence your financial position

- can no longer be influenced by you

Start building the ‘Vest a Family Trust Deed’ on our website. The free building process is educational. It outlines the process of closing a discretionary trust, especially as Centrelink scrutinises old, unused trusts as part of its attribution rules.

Centrelink’s primary concern is ensuring that the trust is genuinely dissolved and that you are not retaining control or benefits. A dormant family trust and a nil balance are not enough.

Centrelink does not publish a checklist specifically for trust terminations. However, we have been terminating trusts for Centrelink purposes since 1988. We find that its approach to means testing is under the Social Security Act 1991 (Cth). Centrelink needs to cite documents proving the trust’s end. Sections 1207V and 1208E of the Social Security Act 1991 (Cth) address the treatment of trusts for income and asset assessments, requiring formal evidence of termination. The Vesting kit that you build on our website is designed for this purpose.

Key Documents for Centrelink

When Centrelink requests proof that your Family Trust no longer exists, the following documents from the Vesting Kit help:

- Fully Signed Deed of Vesting: This legal document formally terminates the trust, amending the original trust deed to wind it up. It is the core evidence of the trust’s dissolution, signed by the trustee and appointor (or their representatives if deceased, as outlined in the document’s question-and-answer sections).

- Certificate of Vesting: This certificate, included in the kit, confirms that the vesting process is complete and provides a concise summary of the termination for third parties like Centrelink.

Additional Documents Centrelink Might Request when you end your Family Trust

Centrelink is free to ask for whatever it deems necessary—its discretion is broad under its information-gathering powers. Section 192 of the Social Security (Administration) Act 1999 (Cth) allows Centrelink to request further information as needed. From our experience, we have found that they often request:

- Balance Sheet Showing Nil Assets: A statement from your accountant confirming the trust’s balance sheet is zero (as emphasised in the document: ‘To end a Family Trust, get a balance sheet showing “nil”’). This proves that no assets remain attributable to you.

- Final Tax Return: Evidence of the trust’s final lodgment with the Australian Taxation Office, as noted in ‘Lodge the final Family Trust tax return after the Family Trust Vesting pack is signed’, ensures that no ongoing tax obligations linger.

- Bank Statements: If the trust had a bank account, statements showing it is closed or zeroed out could be requested to verify that there are no hidden funds.

- Birth Certificates or Identification: If Centrelink questions the identity of trustees, appointors, or beneficiaries involved in the vesting (for example, a deceased appointor’s executor), they ask for identification or birth or death certificates to confirm relationships.

How to vest and end other trusts

Free Centrelink tool kit

These free resources help you, your lawyer, accountant and financial planner deal with Centrelink:

- Centrelink attacking innocent grandparents – what we do for our children

- Family Trusts:

- Replacing the Appointor in a Family Trust – succession planning for a person wanting Centrelink

- Company to replace pensioner as trustee of a Family Trust

- Can grandma disclaim a trust distribution?

- What to do before the end of year financial year – to appease Centrelink

- Wind-up Unit Trusts

- Can I abandon a gift in a Will to keep the pension?

- Centrelink compliant Power of Attorney – keeps your family in control, not Centrelink

- 3-Generation Testamentary Trust Wills – beneficiaries retain Centrelink benefits in your Will

- Special Disability Trust – to avoid Centrelink deprivation rules

You have finally retired and applied to Centrelink for your Age Pension.

Unfortunately, Centrelink takes issue with the fact that you have an old trust that was created 30 years ago. It hasn’t been used for years. There is no money left in it. The trust has a nil value. It has no assets and no debts. What can you do? You need to formally wind up (vest) the trust to close down this unused structure; you can do so with this Vesting Deed

Why should I get rid of the trust?

– The Trust has achieved its original purpose

– It has no assets

– The trust has reached its vesting date

– Centrelink, the ATO, a liquidator, or the family court are causing problems even though there are no assets in the Family Trust

What do I need to do to get rid of the trust?

1. Distribute the trust capital to beneficiaries.

2. Payout all trust liabilities. Or get them to forgive all debt with a Deed of Debt Forgiveness. This includes any existing or future

tax liabilities arising from the termination of the trust.

3. The Trustee must pass a resolution determining that the trust is to be vested (terminated).

4. The final accounts of the trust, including a final tax return, must be prepared.

Once this is done, you can build our Deed of Vesting of a Trust and a set of documents allowing you to vest and close the family trust.

After building this document on our website, you are emailed:

1. Family Trust – Deed of Variation of Vesting

2. Minutes

3. law firm Letter of advice

What do I need to do to terminate the trust? Get rid of a trust.

1. The capital of the trust is distributed out of the trust.

2. The Trustee must satisfy any existing liabilities of the trust. This includes any existing or future

tax liabilities that arise from ending the trust.

3. The Trustee must pass a resolution determining that the trust is to be vested (terminated).

4. The final accounts of the trust, including a final tax return, must be prepared.

5. Build this document

To update your Trust, we need to first identify it. We do this by referring to:

1. The Trust name (e.g. Jones Family Trust)

2. Date the Trust Deed that established the Trust was signed

3. The Settlor’s name and address, as it appears in the Family Trust Deed

Every trust has a name. Sadly, they are generally quite boring. For example, the Smith Family Trust is named after Mr. Smith.

The trust name is a ‘nickname’. It is not registered anywhere. It just helps you and your accountant identify your Trust.

Take out your Deed of Trust that first started your Trust. Have a look at the front cover. It often has the name of your Trust. It repeats in the body of the Deed as well. Check any subsequent Deeds of Variation to make sure that your Trust didn’t change its name.

Be careful not to confuse the Family Trust name with your Trustee. Your Trustee (e.g. XYZ Pty Ltd) is not your trust name.

There is generally no difference between a:

– Family Discretionary Trust

– Family Trust

– Discretionary Trust

We, tax lawyers, tend to call them ‘Discretionary Trusts’. This is because we like the fact that every year, the Trustee has the discretion to distribute income to different beneficiaries.

Meanwhile, our friends, the accountants, usually call them ‘Family Trusts’. This is because only mum and dad and the immediate family operate a family business or hold assets in a ‘Family Trust’. If people out of the immediate family are involved in the business, then a ‘Family Trust’ is inappropriate.

Resettlement of a Family Trust

‘Resettlement’ happens when you alter the Trust to such a level that it becomes a new trust. You would then suffer Capital Gains Tax, Stamp Duty and other issues. Resettlements are bad.

As a taxation law firm, we ensure that you do not suffer a ‘resettlement’.

Your Discretionary Trust vesting kit complies with:

1. Commissioner of Taxation v Clark and the subsequent

release of Taxation Determination TD 2012/21.

2. High Court decision in FC of T v Commercial Nominees [2001] HCA 33.

3. ATO’s (now withdrawn, but still loved by many at the ATO) Statement of Principles on the Creation of a New Trust. Plus the related ATO’s Decision Impact Statement.

Can I download the soft copy of the vesting deed and email it to my client for signing? She is currently overseas

Yes. All our documents come in soft copy. This is a locked PDF. A copy is emailed to you within a few seconds of you paying for the Family Trust Vesting Deed with your credit card. You can also log in anytime to “Your Documents” and download the document again.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack the mental capacity to sign my Will?

- sign my Will in a hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will