Protecting Vulnerable Children in Wills Training Course

FREE

-

The Training Course covers how to protect vulnerable children in Wills.

Legal Consolidated’s Protecting vulnerable beneficiaries in Wills training course.

Capital Protected Trusts

I am an adjunct Professor, holding seven university degrees, including a doctorate in Estate & Succession Planning. Since 1988, I have specialised as a lawyer in Estate Planning, Superannuation and taxation.

The Vulnerable Children in Wills Training Course shows how to build a Will that protects beneficiaries. This is not just your children or spouse. It is for any beneficiary in your Will who suffers from these situations:

- spendthrift

- cannot handle money

- gives money away to ‘friends’

- too immature to handle money if you and your spouse were to die in the next few years

- mentally challenged

- suffers from a mental illness

- alcoholic

- drug affected

- young second spouse

- Willmaker is a control freak and wants to rule from the grave

The training course empowers you to build Wills on our law firm’s website.

Protecting a vulnerable child in your Will by creating a Capital Protected Trust

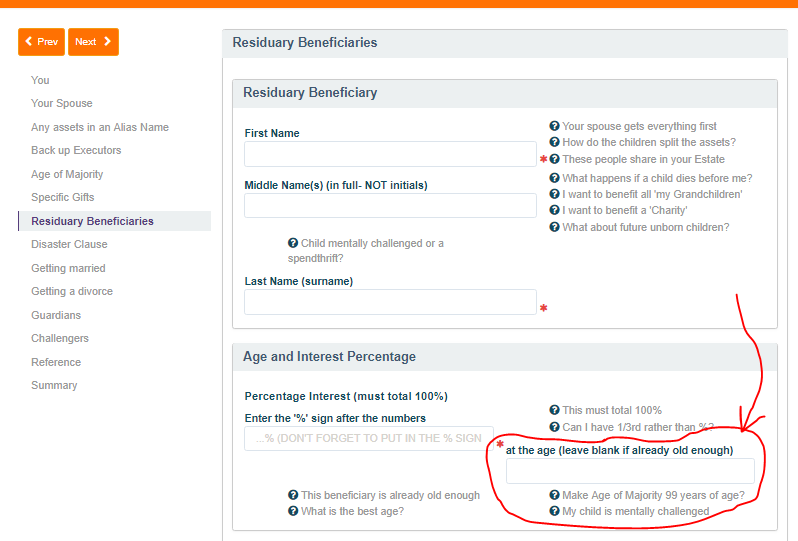

When you build your Wills on our website, you are asked for the general Age of Majority. Usually, you select an age of 18, 21, 25, or some other age.

But you may wish to set a higher Age of Majority for the vulnerable beneficiary.

As you build the Wills on our law firm’s website the Age of Majority question allows you to select a higher Age of Majority. This is just for this one vulnerable Residuary Beneficiary.

Age of Majority

Consider increasing the Age of Majority for a Residuary Beneficiary in any of these situations:

1. Set a higher Age of Majority

If the Residuary Beneficiaries’ challenges are permanent or life-long then consider increasing the Age of Majority to 99 years of age.

Alternatively, if the child’s challenges may be temporary then consider increasing the Age of Majority for this person by a few extra years.

As you see fit, you can increase the Age of Majority for that particular child to a higher age.

Example: you may wish to increase the Age of Majority, just for one particular child to, say, 35 years of age. That means that the Backup Executors (which may include the child, as well) drip feed that child, or their carer or institution, the money the child needs. However, once that child reaches 35 years of age then that child takes the money and does with it as that child wishes.

Is the money protected for that particular child while it is in trust?

The inheritance for that child is protected in a Maintenance Trust. (This is just one of the many trusts that are in your Wills.) The inheritance for the child can only be used for that child. So while the child can’t get their hands on all the money (well, not until 35 years age) the money can only be used for that child’s benefit.

The Backup Executors must act in the child’s best interest at all times. This is an obligation under trust law. It is strictly enforced by the Australian Courts.

Young and vulnerable beneficiaries tool kit

Free resources to help protect young and vulnerable children:

- Loans to children – protects them if they divorce or go bankrupt

- Divorce Protection Trusts in Wills – in case a beneficiary, child or grandchild separates

- Making Wills for your children

- Special Disability Trusts – for disabled children

- Elder Abuse – protecting the children as well

- Life Estates are a waste of time and do NOT protect children

- Child renounces a gift or Family Trust distribution for Centrelink and stops Trustee-in-Bankruptcy

- Children paying 32% on your super when you die

- Only disabled children can take your SMSF Reversionary Pension

- Parent dies baby pays 66% tax

- Dad’s Will: child vs charity

- Son loses the farm to his two sisters

- Disabled dad has $9m, two young children and no Will

- Court rewrites disabled Dad’s Will to protect children

2. Or, the child is never allowed to control the inheritance – bloodline trust

The Residuary Beneficiary may be mentally disabled or an alcoholic so you may wish to increase the Age of Majority to 99 years of age. In that instance, type in ’99’.

The Backup Executors drip feed this Residuary Beneficiary (or their carers) money that they need throughout their life. The challenged child may also be one of the Backup Executors – they all have to act together.

What if there is a medical cure or the Residuary Beneficiary recovers? Then the Backup Executors, when acting unanimously, may wish to get some or all of the capital to the Residuary Beneficiary at that time.

Otherwise, for the child’s life, the money is looked after for them by the Backup Executors.

The Backup Executors must always act in the Beneficiary’s best interest. The Courts strictly enforce that requirement.

Alcoholic child recovers

The child had been an alcoholic for most of his life – even before he had turned 18 years of age. His parents decided to increase the Age of Majority for the alcoholic child to 99 years of age.

His parents died.

His brother and sister, as the Backup Executors, looked after the money for the alcoholic child. Our law firm had put in a Maintenance Trust in the Will. We put a Maintenance Trust in all our Wills, in case they are ever needed.

Over the years, a miracle occurred. The child stopped drinking, got married, and had children. He completed his engineering course at the University. Eventually, his brother and sister released his inheritance to him.

I continue to act for the family. Twelve years have passed, and I am happy to report he has grown to be a well-respected member of the community. His parents would have been proud.

How do Maintenance Trusts work?

A Maintenance Trust is just a tool to hold and use the inheritance. This is for the benefit of the particular Backup Beneficiary. The Beneficiary does not own the assets directly. The Maintenance Trust allows your Backup Executors (as trustees) to look after the Maintenance Trust. The Backup Executors must always act in the best interest of the Beneficiary through the use of inheritance.

The Maintenance Trust offers an alternative to leaving property outright to your child with special needs. This is because they may have little capacity to manage and protect their inheritance themselves.

In all our Wills, we include maintenance trusts – just in case they are ever needed. Like many of the trusts we put in your Will, the Maintenance Trust is dormant until needed.

The Maintenance Trust under your Will allows the assets to be used for the benefit of the challenged person. The challenged child won’t have to administer their own affairs or have an unknown third party do so. It reduces the risk of them being left isolated, with nothing.

Without a Discretionary Maintenance Trust in place, the challenged child may end up with an inheritance they don’t understand. In any event, in Australia, the law prohibits the direct transfer of property where there is no capacity to manage it. In these circumstances, the challenged person has a government official appointed under the Guardianship Act. This is costly and difficult. It allows the government to take control of your child and their inheritance. Instead, the Maintenance Trust puts that power back to your Backup Executors. The Backup Executors are usually your other children and family members.

The Backup Executors, under the power of the Maintenance Trust, can put some of the inheritance into a Special Disability Trust, after you die.

Special Disability Trust v Discretionary Maintenance Trust

v Capital Protected Trust

Q: Our son has severe Autism. He is 9 years old.

We are concerned about his future. What happens financially and supportively when we are gone? It literally haunts me! It is such a heartbreaking thought that I’m sad to say I’ve tried to block it from my thoughts. Hoping it goes away. Obviously, that’s not going to happen! I have heard that setting up finances for a child with a disability is very different. Do you have any advice on this?

A: One of the most emotional meetings I have ever had as a lawyer practising in this area of law since 1988 is an 80-year-old father worried about who will change the nappy of his 62-year-old son. This is after the father dies.

He cried. I cried.

Even with money and government support, our vulnerable children are just that, vulnerable.

There are two types of trusts in your Will to protect vulnerable beneficiaries:

- Vulnerable Children Testamentary Trust

- Special Disability Trust

Your Legal Consolidated 3-Generation Testamentary Trust Wills contain both.

Vulnerable Children Testamentary Trusts: Vulnerable Children Testamentary Trusts, are potentially not means-tested for Centrelink. This is because they are discretionary in nature. They can have unlimited wealth in them.

Special Disability Trust: Another type of trust we also put in your Will is a “Special Disability Trust’. We are not an advocate of these. Sure, Centrelink means testing is guaranteed. But, the amount is limited. And what the money can be spent on is restricted to mostly care and accommodation. And these may be exactly what the government is already providing.

Further, for Special Disability Trusts the child must have a ‘severe’ disability. What you may understand as a ‘severe’ disability may not come within the definition. And this is a big risk given that you will not find that out until after you are dead.

While we put in your Will both the Vulnerable Children Testamentary Trusts and Special Disability Trusts another challenge is who is the trustee of these trusts? You need people you can trust after you are dead.

Discretionary Maintenance Trusts in Wills: purposes of spending

Each individual circumstance varies depending on the level of disability and the child’s particular needs and capacities. Your child needs to be properly cared for. You need to ensure their general health and well-being. Without a crystal ball, this is impossible. Therefore, the Maintenance Trust that we put in your 3-Generaiton Testamentary Trust has flexibility. The Backup Executors have the power to protect the challenged child for:

- Physical needs

- Accommodation

- Support mechanisms

- Social support and interaction

- Hobbies and interest support

- Health considerations

No capital to beneficiaries and definitely no money for step-children

Q: My client has 3 children. One of his children (his son) has children of his own AND step-children.

His estate is held in trust (99-year Age of Majority) for his son and then at his death, the money is available to his children. He does not want the money to be available to his son’s stepchildren.

My client desires that the step-children don’t get the money. They can return to their “other family” for financial support.

A: Firstly, all clients do not want in-laws and stepchildren to get any of their money. And Legal Consolidated Wills are automatically drafted that way.

You set up a ‘capital protected’ trust for your client’s children. This is simple to do in a Legal Consolidated Will. You just increase, for everyone, or just a specific beneficiary the Age of Majority from the usual 18 or 21 to 99 years of age. That gives you the ‘capital protected trust’. It is automatically also a ‘bloodline trust’ as it goes to the child’s own children at death.

So the person never gets access to the capital. It is protected. They only get the income and perhaps a bit of the capital. This is at the discretion of the dead person’s friends and relatives – these are the Executors/Trustees named in the Legal Consolidated Will.

However, if the beneficiaries are ‘normal’ (not vulnerable) and the dead person’s estate is worth under $5m then the Will maker is being churlish. Just give them the money. Stop controlling from the grave. It is expensive and time-consuming to have these family members and friends look after money for someone else.

Now, it may be worth the expense where the estate is huge. And it is worth the effort if the beneficiary is vulnerable. But otherwise, the Will maker is being a control freak for no reason.

And in any event, there are other forms of protection for children. For example, the Legal Consolidated 3-Generation Testamentary Trust Will contains a:

- Divorce Protection Trust. So none of the money is lost to the son’s current wife, next wife, same-sex partner or mistress.

- Bankruptcy Trust so that if the boy goes bankrupt none of his father’s money is lost.

- Life Estate.

So a Capital Protected Trust, which is a very blunt and old fashion weapon for these facts, is rarely needed.

Use a Capital Protected Trust on a hot second spouse?

Q: I am old and rich. That affords me benefits. One benefit is to have a hot second spouse. Which I enjoy. I have watched your course on vulnerable beneficiaries in Wills. My young spouse is not vulnerable – far from it actually! But can I also dial up their Age of Majority to 99 years of age in my Will? Do these Capital Protected Trusts and Bloodline Trusts in Legal Consolidated Wills also work for a second spouse?

A: Yes, you can. But for what purpose? Cannot you just give them some money in your Will without these strings attached? You need to put in place some additional executors to ‘look after’ the money. The young second spouse can also be one of those executors.

But:

- your young spouse may challenge the Will, in which case answer yes, as you build the Will, this is for the Considered Person Clause question. This is to stop the second spouse from challenging the Will.

- think about putting in the Will a Life estate or its weaker alternative Right to reside

- build and get your second spouse to sign a Contractual Will Agreement so they cannot change their Will after you die

Who should be executors when you have vulnerable children in your Will?

You should add a fair number of executors. Your parents, brothers, sisters, accountants and financial planners will all be dead by the time you and your wife die. So think about adding your other children, nephews and nieces.

For example, you have two children. One can not look after money. The second child that can look after money is 6 months old. So add that baby to the group of executors. On average that ‘baby’ will be in their 60s when you and your wife eventually die.

If the child is not interested in looking after the money and trusts then they can outsource the job to professionals at that time. Legal Consolidated Wills allow for this.

Can we appoint our 4 parents now and then our ‘normal’ child after he is grown up?

Do not do that. You may ‘forget’ to update your Wills. Or, you may suffer a mental condition yourself and be unable to ever update your Will again. You may get dementia or suffer a car accident.

Just appoint the child and his 4 grandparents in the Mirror 3-Generaiton Testamentary Trust Wills you are currently building.

Free Legal advice building Wills on our website for vulnerable beneficiaries and Capital Protected Trusts

As a father who has lost a child, I know that this is a very emotional and difficult discussion for you. I have been practising as a lawyer in tax and Estate Planning since the 1980s. I or the law are very willing to speak with you on this. So please do not hesitate to telephone to talk about what is the best decision for your vulnerable child. We can help you answer the online questions.

However, start building the 3-Generation Testamentary Trust Wills first. As the question and answers contain many hints. They may answer many of your current questions. And they may open up new questions.

Once you have answered as many questions as you can call the law firm. We will have a good chat. And discuss your answers. Please do not call the law firm until you have watched the training video and answered as many questions as you can.

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case

Free Asset Protection Kit for clients of lawyers, financial planners and accountants

Clients often start their asset protection journey by speaking with their accountant, financial planner or lawyer. Legal Consolidated has put this kit together to help these professionals on what needs to be done. Enjoy the free resources:- Asset Protection Strategies – a complete list and how to use them.

- Family Trusts – how to set up a safe house vehicle (free training video).

- Loans to children – in case the child divorces or goes bankrupt.

- Loans to parents – a rich child lends money to parents to get into a retirement home.

- Spouse Loan agreement – ‘safe house spouse’ lends to high-risk spouse (man of straw strategy)

- Forgiving a Debt – for ‘love and affection’.

- Deed of Gift:

- to a Family Trust – to prove the money you put into your Family Trust was a gift (not a loan)

- to a child – forgive the money your child owes you

- to a person overseas – forgive what the person owes you

- Stop mistresses and disgruntled children challenging your Will.

- Stop people stealing money from your disabled and vulnerable children when you die (free training video).

- How to set up a Bankruptcy Trust in your Will.

- The value of a Divorce Protection Trust in your Will.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will