Family Discretionary Trust

$385 includes GST

-

Includes Solicitor's Bank Certificate worth $1,250.

Unique asset protection and income distribution.

What is a Family Trust? A Lawyer’s Guide to Australian Discretionary Trusts

A Family Trust, also known as a Discretionary Trust, is a legal structure created to hold assets for the benefit of a family. It is the single most powerful tool for asset protection in Australia. While often touted for tax benefits, its primary strength is protecting your family’s wealth from lawsuits and bankruptcy. While not as powerful as a Divorce Protection Trust in a Will, a Family Trust also protects from divorce.

Built correctly by a law firm, a Family Trust allows you to control assets without legally owning them, placing them beyond the reach of creditors. This guide explains what a Family Trust is, why asset protection is its greatest advantage, and the tax benefits.

Are Family Trusts only for rich people?

There is a misunderstanding in society that ‘trusts‘ are just for rich people. They are often associated with blue-blood families and powerful moguls. However, trusts are effective for anyone running a business, building wealth, and protecting assets. There are over 800,000 Australian family trusts.

Difference between a Family Trust and a Discretionary Trust

A ‘discretionary trust’ and a ‘family trust’ are the same thing. A family trust has:

“no fixed meaning and is used to describe particular features of certain express trusts”. Commissioner of Stamp Duties (NSW) v Buckle (1998) 192 CLR 226

See the full free sample of the Family Trust deed

As with all Legal Consolidated documents, you can see a full copy and cover letter of the Family Discretionary Trust deed document. Just press the “Sample Document” button above.

To simplify the borrowing process, all Legal Consolidated Family Trust deeds include a Solicitor’s Certificate to provide to your bank.

This is provided on the law firm’s letterhead.

Free Solicitor’s Certificate for your bank worth $1,250

When your Family Trust applies for a loan, banks require a certificate from your solicitor to verify that the trust deed permits borrowing money and providing security.

Getting a solicitor’s certificate is expensive and time-consuming, which is why your Legal Consolidated Family Trust deed includes one for free.

Prepared on our law firm’s letterhead, our Solicitor’s Certificate formally confirms the powers:

-

Borrow Money: “Borrow and raise money from any person, on a full or non-recourse basis, with or without security, mortgage or charge, including via an overdraft.”

-

Grant Security: “Mortgage, lien, pledge, charge, guarantee or otherwise provide the Trust Fund for security for any borrowing, raising, facility, guarantee, indemnity, lease or other contractual obligation…”

-

Give Guarantees: “Provide any guarantee or indemnity for payment of money or for the performance of any person’s contractual obligations.”

-

Open and Use Bank Accounts: “Open and operate bank accounts, to draw, make, accept, endorse, discount, execute, issue or otherwise deal with all forms of negotiable or transferable instruments…”

-

Act with Broad Power: “…[have] all the maximum possible powers of both a natural person and of a Trustee, as though the Trustee was both the legal and beneficial owner of the Trust Fund…”

Benefits of a Family Trust:

1. Family Trust protects assets and saves tax

A trustee holds assets in its name. But it holds the assets for the benefit of someone else. That someone else is called a beneficiary. A Family Trust is a popular vehicle set up by accountants and financial planners. It is great for both wealth creation and asset protection:

1. each year pay trust income to family members on low marginal tax rates

2. protect assets from creditors (asset protection)

3. succession planning – no CGT or stamp duty when you die

4. the trust can loan money to family members to buy investments – delivering tax breaks (or you can lend money to your family trust)

5. invest in insurance bonds to access lower aged care fees

6. hold shares in a company

7. hold units in a unit trust.

Legal Consolidated is a specialist trust law firm. Our Family Trust is cutting edge allowing your accountant and adviser to seek all tax savings.

2. Pay less tax with a Family Trust – hunt down family members with low marginal tax rates

A trust must have a trustee and a beneficiary. If the trustee and beneficiary ever become the same person then the trust finishes. (The third requirement for a trust to exist is that it must have assets or something of value.)

A Family Trust has both a trustee and many beneficiaries. It also has an Appointor. An Appointor is a god. It bosses the trustee around. The Appointor is usually mum and dad and the Trustee is often their company. The Appointor tells the Trustee who gets the trust income each year.

For example:

- Mum earns a lot of money through her work. She pays a high tax rate.

- In contrast, at home Dad earns no income.

- Also, the children at university earn only a little income from part-time jobs.

The Discretionary Trust distributes the trust income to these beneficiaries on low incomes. In this case Dad and the children.

The tax rate is as low as zero. Next year one of the children finishes at university and gets a job. They now pay a high marginal tax rate. Not a problem. The Discretionary Trust does not now distribute to them. Every year you hunt down family members on low marginal tax rates.

Family Trust beneficiaries include mum and dad, their company, adult children, children’s spouses, grandchildren, and their spouses. It includes your parents and distant relatives.

400,000 beneficiaries in an Australian family trust

It comes as a bit of a shock to people, but most Family Trusts have about 400,000 beneficiaries.

-

- It is not just your family and distant family members living all over the world that you do not know and will never meet.

- It is not just all Australian charities, schools, and universities.

Family Trusts have huge, open classes of beneficiaries. Alongside you, co-owning publicly listed shares, are distant relatives you will never meet, charities, and education institutions. A modern Australian Family Trust can have over 400,000 beneficiaries.

But if you own shares in say Rio Tinto, then all the shareholders of Rio Tinto are beneficiaries of your Family Trust. If you could, you would make every person in the world a beneficiary. But the ATO will not allow that. Do not worry. Beneficiaries have few rights. The more beneficiaries the better.

The class of beneficiaries in a Family Trust are often “open”:

Also, there are ‘open classes’ of beneficiaries. For example, when you get married and have children then your spouse and children are automatically added to the class of beneficiaries. Also if you have an ‘interest’ in a company, that company becomes a beneficiary. This is called a ‘bucket company‘.

When I built my Family Trust Deed I was not married. I had no children and I had no company. Later I built a company on the law firm’s website. As soon as I did, the company became a beneficiary of my Family Trust. This is automatic. You do not need to do anything. The class of beneficiaries automatically increases without you doing anything.

Later, I got married and my wife automatically became a beneficiary. We then had a son. And our son automatically becomes a beneficiary of my Family Trust. When my son gets a wife and his children they will automatically become beneficiaries of my family trust.

There is nothing I need to do for these ‘open classes’ of beneficiaries to be increased. There is also nothing I can do to stop these additional people from becoming beneficiaries! But, again, do not worry. These beneficiaries have few rights. The person in power is the Appointor. The Appointor bosses the Trustee. The Appointor tells the Trustee what to do.

3. Family Trusts are less Regulated than Companies

Family trusts compared to companies suffer little government interference. Unlike companies, many of the stringent provisions mandated by the Corporations Act 2001 (Cth) do not apply to family trusts.

Family trusts have less regulation in the disclosure of financial affairs and beneficiaries. Unlike companies, which are required to keep public records of their financial dealings and the identities of those with significant control, family trusts maintain a high level of privacy. The financial affairs of the trust and the identities of persons entitled to receive money from the trust need not be publicly disclosed.

Additionally, while family trusts are required to keep proper accounts and provide information to the tax regulators, there are no audits unless mandated by the trust deed or by certain beneficiaries. This contrasts sharply with companies, which often face mandatory audits, depending on their size and the nature of their business.

Management and winding up of trusts are easier than companies. Winding up a family trust is a straightforward process compared to dissolving a company. Companies adhere to rigorous procedures under the Corporations Act, involving liquidators and formal deregistration processes. Family trusts, on the other hand, are wound up relatively easily without the need for extensive regulatory compliance.

However, while family trusts are less regulated, they are not without their legal obligations. For instance, Section 197 of the Corporations Act makes directors of a trustee corporation liable for debts and other obligations incurred by the trustee. While the trust itself operates under fewer regulations, the individuals or corporate trustee managing the trust face significant legal responsibilities.

Discretionary trusts have capital gains tax advantages over companies. Individual beneficiaries can claim the general discount capital gain (subdivision 115C of the Income Tax Assessment Act 1997 (Cth) (ITAA 1997).

Vest Family Trust – how to wind up old Family Trust

Divorced wife wants her ex-husband removed as a beneficiary

Q: I finally got rid of that blood-sucking leech of a husband. No more (select one):

- toy boys for me; or

- lazy retired husband swanning around at home doing none of the housework

The Family Court property settlement gave me control of our Discretionary Family Trust. (He got my dead father’s property to compensate.) Accordingly, my accountant built the Legal Consolidated Family Trust deed update:

- removing him and making me the only Appointor;

- appointing my two children as the Backup Appointors when I die; and

- getting rid of the old company trustee and putting in a new corporate trustee

I have also updated my 3-Generation Testamentary Trust Will for free. Thank you.

A: Build this document to remove a Beneficiary of your Family Trust.

Beneficiary Rights and Considerations in a Family Trust

What rights does a Beneficiary in a Family Trust have?

Beneficiaries have no right or expectation of any money from the trust. However, a trouble-making beneficiary may ask to see the accounts and records of the trust. The court has the power to grant access, at its discretion. But it rarely does so. See Smorgon v ES Group Operations Pty Ltd & Ors [2021] VSC 608.

Consider Wang v Cai [2021] NSWSC 1162. A beneficiary has concerns as to the maladministration of the trust. The court rejected the request for information about the trust.

Do Beneficiaries in a Family Trust have any rights?

Do Beneficiaries in a Family Trust have any rights?

The rights of a beneficiary are set out in a trust deed. For example, beneficiaries in a Unit Trust (called Unit Holders) and Bare Trusts have control.

However, in a Family Trust, the potential beneficiary has only the right to be considered. This is when the Family Trust is making distributions of income and capital. This is confirmed in Gartside v Inland Revenue Commissioners [1968] AC 553.

In Gartside, the court held that beneficiaries of a family trust:

- so not have a proprietary legal or equitable interest in the trust assets. They are merely members of a class of potential beneficiaries. This is under the trustee’s power of appointment over trust income and capital.

- but do have the right to insist on the proper administration of the trust.

This is confirmed in many cases. Karger v Paul [1984] VR 161 states:

“It is an established general principle that unless trustees choose to give reasons for the exercise of discretion, their exercise of the discretion cannot be examined or reviewed by a court so long as they act in good faith and without an ulterior purpose …” [and that the trustees] “act upon real and genuine consideration”.

However, in 2022 in Owies and Owies and JJE Nominees Pty Ltd [2022] VSCA 142 the Victorian Court of Appeal stated that the trustee must act in good faith, upon real and genuine consideration and in accordance with purposes for which the discretion was exercised for distributions of income and capital.

Does a Beneficiary in a family trust hold an equitable interest in the assets?

A beneficiary does not hold an equitable interest in the trust assets.

But each beneficiary of a discretionary trust has the right to:

- compel the trustee to consider whether or not to make a distribution to him or her

- proper administration of the Trust. (Gartside v Inland Revenue Commissioners [1968] AC 553, 617)

- be considered as a potential recipient of benefits by the trustees

- a right to have their interest protected by a court of equity

To this minor extent, each beneficiary has these limited (useless) rights under the Family Trust.

These minor rights are not to be confused with an equitable interest in the trust property. The beneficiary has no rights to any specific assets in the Family Trust.

Gartside v Inland Revenue Commissioners

In Gartside, it is held that the limited rights of a beneficiary under a discretionary trust are not sufficient to create a taxable “interest” in the property or income of the trust fund. The case is about whether deceased estate duty is payable. This is the death of a beneficiary of a discretionary trust on advances made by the trustees of that trust to other objects of that trust.

It was argued by the cheeky Inland Revenue Commissioner that the duty of the trustees to exercise their discretion gave each object (beneficiary) an “interest” in the trust fund. And that those interests are interests in possession and that the death of one object of the trust (beneficiary) resulted in the cessation of that interest. The Court correctly states:

‘No doubt in a certain sense a beneficiary under a discretionary trust has an ” interest”: the nature of it may, sufficiently for the purpose, be spelled out by saying that he has a right to be considered as a potential recipient of benefit by the trustees and a right to have his interest protected by a court of equity. ….

But that does not mean that he has an interest which is capable of being taxed by reference to its extent in the trust fund’s income: it may be a right, with some degree of concreteness or solidity, one which attracts the protection of a court of equity, yet it may still lack the necessary quality of definable extent which must exist before it can be taxed.’

In the view of the Court, to give any other construction gives rise to a capricious result. Every time an object (beneficiary) of a discretionary trust dies, duty is payable on the whole of the trust estate. This is even if none of those objects (beneficiaries) received anything. On that silly interpretation, the trustees could have chosen to

apply the whole of the income of the trust estate to any one of the objects. Such a ‘monstrous’ (page 605) result

could not have been intended:

‘If giving an extended meaning to a word in an Act, and particularly in a taxing Act, leads to a wholly unreasonable result that is a very strong indication that the word was not intended to have that extended meaning.’ (Gartside at 605)

I could not see an option to add my parents as Beneficiaries. Will the Family Trust allow for distributions to them?

There are about 400,000 beneficiaries in a modern Australian family trust. The ‘classes’ of beneficiaries for Legal Consolidated Family Trusts include ‘parents’, ‘children’, and ‘great, great, and great-grandchildren.

The ‘classes’ are numerous and drafted as wide as possible.

At what point can a new spouse be added as a Beneficiary of a family trust?

You do not ‘add’ a person as a beneficiary. They are automatically added. So when you are in the church and you say “I do” and you sign the marriage certificate, at that very point your spouse is a beneficiary of your Family Trust. It happened automatically, whether you wanted it to happen or not.

By the time you walk out of the church, your new spouse is already a beneficiary of your family trust. This is because the class is open.

Similarly when your child is born, at that very point, your child automatically becomes a beneficiary under your Family Trust.

So just before the end of the financial year, when you do your annual Family Trust distribution you can write in your new spouse and new child and make a distribution to them.

Family Trust elections – the kiss of death

Q: Does a Legal Consolidated Family Trust allow for a ‘family trust election’? The ATO suggests that a family trust election is good.

A: Yes, a Legal Consolidated can have a ‘family trust election’. But a family trust election damages the trust’s discretion. This is because it reduces the class of beneficiaries down from 100,000 to just a handful of your family members. Also, you lose the bucket company. If your Family Trust needs to be destroyed by a family trust election then do not put any more wealth into it. It is dead. Instead, lick your wounds and start a new Family Trust.

As to the disadvantages of an FTE and when you have to make that election speak to your accountant.

Finally, beware of regulators and the government. They are not your friends. Never deal with the ATO directly. Always instruct your accountant to communicate with the ATO.

How does ‘income splitting’ work in a Family Trust?

An Australian discretionary trust minimizes a family’s total tax bill.

The family trust itself doesn’t pay tax. Instead, it distributes the income to beneficiaries: humans and sometimes a company. (‘Bucket’ companies are rarely used because of Division 7A.). These beneficiaries pay tax on the trust distribution (income) at their personal tax rate.

Australians pay tax at marginal rates. The greater your income the higher rate of tax you pay. You distribute income to the lower-income earners. They pay no tax or a lower percentage of tax. Thus, you even out the overall taxable income.

- The high-income individual directs business and investment earnings into the family trust. (These cannot be wage and salary earnings.)

- The trust then has to allocate all that income.

- The family discretionary trust makes payments to beneficiaries on the lowest incomes. Those beneficiaries pay the least tax.

Every year the Appointor directs the Trustee to pay out all the trust income to the beneficiaries. Your choice of beneficiaries can change each financial year. For example, last year you distributed it to your retired parents. This year you distribute to your child who just turned 18 years of age and is not working.

You make multiple uses of the tax-free threshold and lower tax rates enjoyed by family members on low incomes. Family Trust, each year you pick and choose beneficiaries on low tax rates.

Therefore, the effectiveness of a discretionary trust depends on the availability of beneficiaries.

An Australian trust exists under state law. So your trust may be under the laws of a state. E.g. New South Wales, Victoria, Northern Territory or any other state or territory.

This is called the trust’s ‘jurisdiction’. Can you change the ‘jurisdiction’?

An Australian trust exists under state law. So your trust may be under the laws of a state. E.g. New South Wales, Victoria, Northern Territory or any other state or territory.

This is called the trust’s ‘jurisdiction’. Can you change the ‘jurisdiction’?

Changing the jurisdiction of a trust?

This is when you change the jurisdiction from one state to another state. E.g., the trust is currently under Tasmanian law, but you now want it under Queensland law.

Reasons to change the trust’s jurisdiction?

You may wish to change your trust’s jurisdiction because:

- the trust’s assets are mostly in another state

- the trustee or appointor is now living in another state

- you are about to be sued and the trust may get favourable treatment in another Supreme Court

- the other state has tax advantages

- you want to move the trust to South Australia so that it doesn’t stop after 80 or 125 (QLD) years

Why do we nominate a jurisdiction for a trust?

Legal Consolidated forces you to select a state as the jurisdiction when you build the trust deed on our website. This ensures that the governance of the trust relates to the laws of that state.

Each of the states and territories has its own trust legislation. This legislation varies from state to state.

Can the courts give the trust a ‘jurisdiction’?

In administering a trust, a court holds jurisdiction under common law when it exercises authority over the trustees (in personam), as exemplified by the ruling in Chellaram v Chellaram [1985] Ch. 409. However, incorporating a jurisdiction clause into the trust document may alter this standard practice.

Is the ‘jurisdiction’ I select for my trust conclusive?

However, this selection of governing law in your trust deed does not always yield definitive outcomes.

For instance, consider the perplexing scenario of establishing a trust in Victoria while selecting the governing law to be that of South Australia. Australian courts tend to disregard such a choice of law if it seems to have been motivated by ulterior motives, such as evading the application of a law that would otherwise be applicable.

Legal Consolidated has seen from these changes of jurisdictions that they generally ‘trigger’ a ‘resettlement’. This means that all the trust assets are transferred from the ‘old’ trust to the ‘new’ trust. This is the case even though the trust has not changed. You, therefore, pay capital gains tax and stamp duty on the transfer.

Further, if the Australian Taxation Office feels that you just made the change to save tax then it will not give you the tax benefits. This is under Part IVA of the Income Tax Assessment Act 1936.

An Australian trust exists under state law. So your trust may be under the laws of a state. E.g. New South Wales, Victoria, Northern Territory or any other state or territory.

This is called the trust’s ‘jurisdiction’. Can you change the ‘jurisdiction’?

Family Trust – Change Trust Name

Can the courts give the trust a ‘jurisdiction’?

In administering a trust, a court holds jurisdiction under common law when it exercises authority over the trustees (in personam), as exemplified by the ruling in Chellaram v Chellaram [1985] Ch. 409. However, incorporating a jurisdiction clause into the trust document may alter this standard practice.

Is the ‘jurisdiction’ I select for my trust conclusive?

However, this selection of governing law in your trust deed does not always yield definitive outcomes.

For instance, consider the perplexing scenario of establishing a trust in Victoria while selecting the governing law to be that of South Australia. Australian courts tend to disregard such a choice of law if it seems to have been motivated by ulterior motives, such as evading the application of a law that would otherwise be applicable.

Legal Consolidated has seen from these changes of jurisdictions that they generally ‘trigger’ a ‘resettlement’. This means that all the trust assets are transferred from the ‘old’ trust to the ‘new’ trust. This is the case even though the trust has not changed. You, therefore, pay capital gains tax and stamp duty on the transfer.

Further, if the Australian Taxation Office feels that you just made the change to save tax then it will not give you the tax benefits. This is under Part IVA of the Income Tax Assessment Act 1936.

Can the courts give the trust a ‘jurisdiction’?

In administering a trust, a court holds jurisdiction under common law when it exercises authority over the trustees (in personam), as exemplified by the ruling in Chellaram v Chellaram [1985] Ch. 409. However, incorporating a jurisdiction clause into the trust document may alter this standard practice.

Is the ‘jurisdiction’ I select for my trust conclusive?

However, this selection of governing law in your trust deed does not always yield definitive outcomes.

For instance, consider the perplexing scenario of establishing a trust in Victoria while selecting the governing law to be that of South Australia. Australian courts tend to disregard such a choice of law if it seems to have been motivated by ulterior motives, such as evading the application of a law that would otherwise be applicable.

When do we pay tax in a Family Trust?

Q: I want to create a discretionary trust for myself, my fiancé and our future children:

- Do we pay tax when the income is earned in the Family Trust?

- Or do we only pay income tax when we take the income out of the Family Trust?

For example, if I put $1,000,000 into the trust but we only pay ourselves $150K each how does that work?

A: You only pay tax on the income that is earned in the Family Trust. Someone, either a beneficiary or the Family Trust trustee must pay income tax (or capital gains tax) on all income derived by the Family Trust. This is for each financial year. It makes no difference if you:

- fail to distribute the income – in that sad case, the trustee of the Family Trust just pays the tax

- to distribute the income – the lucky beneficiary pays the tax on the income. This is the case, even if the beneficiary never actually sees the money.

Consider these 4 examples:

1. Lend money to a Family Trust

Mum, Dad, or a bank lends $1m to the Family Trust. The loan is interest-free. The Family Trust pays no tax on that $1m. There is no income tax payable on loans. When the loan is paid back the Lender pays no tax on the repayments.

-

- As to your specific example, you put $1m into your Family Trust. Mum and Dad can take back that lent money tax-free. So, yes, you could get the Family Trust to return $150k of the loan principal each year. And, of course, there is no income tax payable by anyone on the repayment of the loan. You use the expression in your question, ‘pay ourselves’. But you are not paying yourselves anything. You are just getting the borrower to return capital from a loan.

- If you are charging interest on the loan. Then the lender (Mud and Dad) pays tax on the interest earned on the money lent. And the Family Trust may get a tax deduction on the interest it pays to the lender. But there is no tax on the principal that is repaid by the borrower to the lender. For example:

- You lend your family trust (or someone else such as a child or your company) $1m at 10% interest payable in one year. One year later the family trust pays you $1.1m. The $1m is tax-free. This is because it is just a return of money lent. But Mum and Dad must declare the $100k in interest as income. This is on their personal income tax returns. The Family Trust (this is the same for any lender, such as a child or your company when you lend them money) may be able to get a tax deduction on the interest they paid on the loan.

2. Gift money to a Family Trust

You gift $250k to the Family Trust. The Family Trust pays no tax on the gift. There is no income tax payable on gifts. (But Centrelink may be interested if you get Centrelink benefits).

3. Earn money in a Family Trust – but not distributed

Your Family Trust earns $350k. But you do not need the money. Therefore, you do not distribute the income to any beneficiary. Do you still pay tax on the $350k? Yes, you pay tax on all income earned by the Family Trust. If you do not distribute that income to a beneficiary, then the Trustee of the Family Trust pays the tax on the income. And this is at the highest marginal tax rate. So your Family Trust is silly if it does not distribute all income to beneficiaries each financial year. This is how to distribute income each financial year.

4. Earn money in a Family Trust – but distributed

My Family Trust earns $18,200. My wife and I are already on the highest marginal tax rate. So we distribute that money to our 18-year-old daughter, who is in high school. Who pays the tax on that income?

-

- The Trustee does not pay tax on this $18,200. This is because you distributed the income to a beneficiary.

- Mum and Dad (who do all the work of earning the money and are the powerhouse behind running the Family Trust) do not pay any tax on this $18,200. This is because the income is distributed to another beneficiary. This is your daughter.

- Your daughter must put this $18,200 on her personal tax return. This is when she completes her yearly tax return. However, your daughter earns no other income that financial year. Under the marginal tax system in Australia, the first $18,200 is tax-free. Your daughter is over 18 years of age. That is the only requirement. The fact that she is not working or is at school is not relevant. The $18,200 is tax-free. Well done. Just make sure you completed the Annual Distribution Minutes correctly.

Children under 18 are not of much use in a Family Trust

Your income from a Family Trust each year is called a ‘distribution’. This is ‘unearned’ income. You can only distribute up to $416 each financial year to a minor. (The tax rate for a minor then climbs to 66%!) This is due to the draconian effect of Division 6AA of the ITAA 1936. However, section 102AG ITAA 1936 gives an exemption to minors (someone under 18 years of age):

- Minors in 3-Generation Testamentary Trust Wills get an adult tax rate threshold – they are treated as though they are adults (but you have to die to get the Will to operate – which is the absolute sacrifice to tax minimisation!)

- Children with disabilities (e.g., those on a disability support pension) also receive an adult tax rate threshold.

There are, however, often other family members aged over 18 who are on low marginal tax rates. These beneficiaries receive trust income. They include adult children who are studying or a spouse with low income.

Also, think of the future. If your child is 12 now, then you have a while to wait. But in the meantime, your spouse might stop working.

3. Reduce land tax with a Family Trust with a Corporate trustee

Own more than one property in the same State? The more property in one person’s name, the higher the marginal land tax rate. Instead, hold each property in a separate Family Trust with a different Trustee. You, therefore, get the tax-free threshold for each property. Secondly, you pay a lower marginal tax rate for each property. Consider having a company or another person as the trustee.

4. Challenges to your Will vs Family Trusts

Only a spouse or de facto can challenge your Family Trust. Children cannot challenge a Family Trust. Family Trusts quarantine assets from challenges to Wills.

A Will (even a 3-Generation Testamentary Trust Will) and anything that forms part of an estate can be contested. But a Divorce Protection Trust in the Will may stop this.

In contrast, a family trust is a separate entity. The assets within the trust are protected from family members and children who could otherwise challenge a Will. However, because of ‘notional’ estates in NSW, it is harder, but not impossible to protect the family trust assets in NSW after the death of the Appointor. In that situation, put a Considered Person Clause in your Will.

5. Superannuation vs Family Trust

Unlike a superannuation fund, holding assets within a trust does not necessarily lock them away for years. If you are young and need flexibility then a family trust is often used to hold assets outside of superannuation. Often your accountant and adviser interchange the family trust and super as part of the overall wealth creation strategy. Depending on your age, they maximise the super contribution levels first and then use surplus funds for the trust. If a client is not maximising super contributions, often they shift assets from the trust into super.

6. Asset Protection – unique protection only provided by Legal Consolidated’s trust deeds

Legal Consolidated Family Trusts have unique proprietary asset protection built into the trust deed.

Family Trusts protect a business owner’s personal assets from their business assets. This is if their business goes down the gurgler. The common strategy is to build a company as a corporate trustee of a family trust. This is how to do it: /company-as-trustee-of-family-trust/

Legal Consolidated’s Discretionary Trust deed deals with Richstar (No 6) (2006) 153 FCR 509 by carefully applying these cases:

- Tibben & Tibben [2013] FamCAFC 145 – The only “entitlement” of the beneficiaries under the Deed of Settlement is a right to consideration and due administration of the trust: Gartside v Inland Revenue Commissioners [1968] AC 553.

- DCT v Ekelmans [2013] VSC 346 – The applicant relied on the decision in Richstar to contend that the cumulative effect of the role and entitlement of Leopold Ekelmans under the trust instruments amounted to a contingent interest in all of the assets of the trust, making those assets amenable to a freezing order as if the assets of Leopold Ekelmans. The Court found that the applicant could not in this matter rely on Richstar.

- Hja Holdings Pty Ltd and Ors & ACT Revenue Office (Administrative Review) [2011] ACAT 91 – Notwithstanding those beneficiaries under a discretionary trust have some rights, such as the right to have the trust duly and properly administered, generally, a beneficiary of a discretionary trust, who is at arm’s length from the trustee, only has an expectancy or a mere possibility of distribution. This is not an equitable interest that constitutes “property” as defined.

- Donovan v Sheahan as Trustee of the Bankrupt Estate of Donovan [2013] FCA 437 – A beneficiary of a non-exhaustive discretionary trust has no assignable right to demand payment of the trust fund to them (and nor have all of the beneficiaries acting collectively) and that the essential right of the individual beneficiary of a non-exhaustive discretionary trust is to compel the due administration of the trust.

- Simmons and Anor & Simmons [2008] FamCA 1088 – The court and parties referred to Richstar on several occasions and confirmed that a beneficiary has nothing more than an expectancy.

- Public Trustee v Smith [2008] NSWSC 397 – Richstar did not establish that because a beneficiary of a discretionary trust controls the appointment or removal of the trustee, or controls the exercise of the trustee’s power and can appoint trust property to themself, the holder of such a power is the beneficial owner of the trust property irrespective of the terms of the trust deed.

- Swishette Pty Ltd v Australian Competition and Consumer Commission [2017] FCAFC 45 (“Swishette“) – As an object of a discretionary trust, a beneficiary has no legal or beneficial interest but only the right to due consideration and due administration of the trust. The fact that someone may control a trust both as appointor and as director of the trustee company does not give them an interest in the trust property amounting to ownership (see DKLR Holding Co (No 2) Pty Ltd v Commissioner of Stamp Duties [1980] 1 NSWLR 510).

- Please, in the matter of Equititrust Limited (In Liquidation) (Receivers and Managers Appointed) (No 3) [2017] FCA 1074 – The reasoning in decisions such as the case of Swishette (mentioned immediately above) reject the arguments put forward in Richstar and should be followed as the correct approach, in preference to the reasoning in Richstar.

- Colefax v National Australia Bank [2018] QCA 244 – The interests of an object under a discretionary trust do not vest in a trustee in bankruptcy (see Dwyer v Ross (1992) 34 FCR 463 and Fordyce v Ryan [2017] 2 Qd R 240 and confirmed in Edwards v Crawford [2020] TASSC 20).

In a safe house family trust, who should be the trustee and appointor?

Q: I am an employed engineer. I am only an employee. I am not a partner in the business. And I am not a contractor. However, I have investment properties directly under my name only. My wife is a medical doctor with no significant assets under her name.

As you can see, we follow the tried and tested Legal Consolidated ‘man of straw and woman of substance‘ asset protection strategy.

Who should be the Trustee? Who should be the Appointor?

Does my Settlor and Family Trust Trustee need to sign together?

A Legal Consolidated Family Trust deed and Family Trust updates are drafted so that the Settlor and Trustee can sign the Family Trust deed on different days. And they can have different witnesses.

For example:

Robert is the accountant. He is the Settlor of his client’s family trust. (Which is common.) Robert builds the Legal Consolidated Family Trust deed on the law firm’s website. He prints it off. Robert immediately signs the Family Trust deed as a settlor. This is in North Sydney. This is in front of one of his secretaries. Robert dates the family trust on the day he signed as a settlor. The process, from beginning to end, took approximately 20 minutes.

The family trust has two human trustees. One of the trustees is currently skiing in Mount Beauty in Victoria. Robert couriered the family trust deed to Mount Beauty. It arrives a few days later. The first trustee signs the Family Trust deed. A stranger witnesses his signature.

The second trustee lives in Brisbane. But it is currently on holiday on the Greek island of Milos. The first trustee couriered the Family Trustee deed to Milos. The second trustee signs the Family Trust deed. His signature is witnessed by another stranger.

The second trustee scans and emails the now fully signed Family Trust deed to his accountant, Robert, and the first trustee. He then keeps the Family Trust deed in his luggage and drops it off to Robert when he is back home in Sydney. This is in a few weeks.

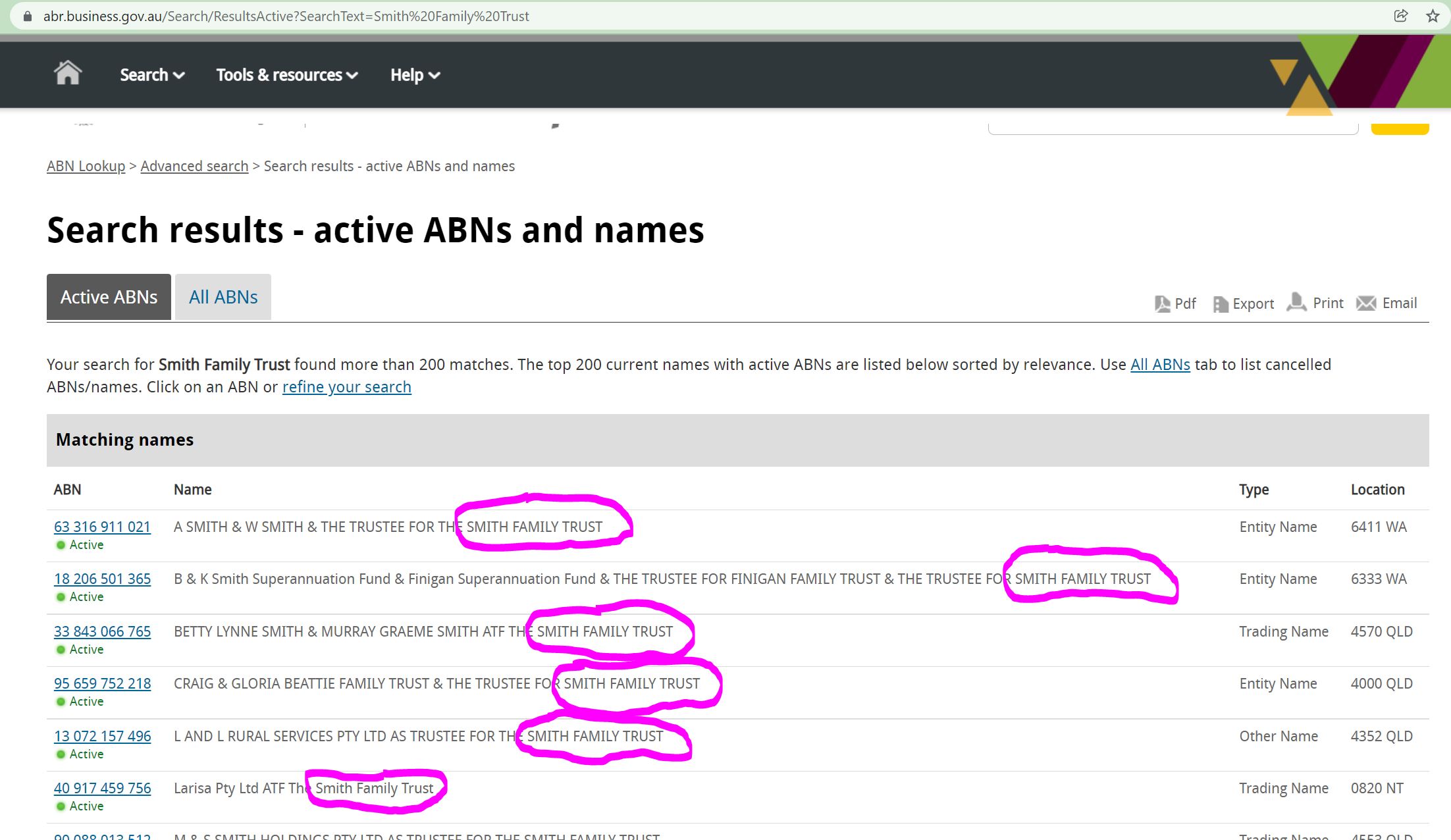

Where is the name check for a Family Trust? Is there a register of Family Trust names?

Q: I built a corporate trustee company. And now I am building the Family Trust. I did a company name search on your website. Where is the Family Trust name search? I want to see if

someone is using the same Family Trust name.

A: There is no register of Family Trust names. Your Family Trust’s name can be identical to someone else. It is only the ABN that is different. For example, search ABN Lookup for “Smith Family Trust”. There are a lot. All have the same Family Trust name. (Also many Family Trusts do not need an ABN. And therefore do not appear in these government records.)

Family Trust vs other types of trusts

a. Company vs Family Trust – CGT concessions trapped in a company

Discretionary Trusts often hold appreciating assets such as shares or land. CGT relief flows through to the beneficiary. Capital gains are taxed at concessional rates. In contrast, when you dispose of an asset out of your company, the CGT concessions are lost. You can’t get them out of a company.

Also, when a trust makes a capital gain, 50% of the amount is tax-free. This is provided that the asset is held in the trust for over 12 months.

b. Last Will & Testament vs Discretionary Trust – you can’t challenge a Discretionary Trust

Your children’s divorce, spendthrift children, and conniving children-in-law can’t touch the assets in your Family Trust. The only person who can attack your Family Trust is your spouse. In contrast, many people, including parents, children, and grandchildren, can challenge your Will. Except for NSW, the Discretionary Trust quarantines assets from your Will.

A Will and your estate are contestable – but see a Divorce Protection Trust in your Will. However, a Family Trust is a separate entity to you. Trust assets are harder to attack.

c. Superannuation vs Discretionary Trust – super traps your money

Superannuation is a wonderful tax haven. The tax rate, going in, is usually only 15%. But the money is locked away until you retire. Unlike a superannuation fund, your assets in a Family Discretionary Trust are not locked away. Also, potentially, you can get the tax rate down below 15%, even to zero. This is if you have beneficiaries on low incomes.

Often your accountant and financial planner maximise your super contribution levels first. They then put surplus funds into the Family Trust.

Company or a Human? Which one is best as the trustee of my Family Trust?

Your family trust must have a trustee. The trustee is a human or a company. Which one is best?

This question is about asset protection. If the Family Trust goes insolvent, then the trustee of the Family Trust goes down with the Family Trust.

But if your Family Trust:

- only holds passive safe assets (like shares) then there is not much value in having a company as the trustee of your Family Trust.

- is going to operate a business then build a company and make it the trustee of your family trust. This is called a ‘Corporate Trustee‘. It is worth the extra cost. Research the issue here.

‘Discretionary’ trust vs ‘Family’ trust

A discretionary trust is often called a Family Trust or Family Discretionary Trust. It means the same thing. It gives the Trustee (acting under the Appointor) huge discretion on who gets the trust income each year.

Each financial year, the Appointor tells the Trustee which beneficiaries are to get that trust income.

Until the Trustee exercises its discretion, the beneficiaries have no interest in the trust property. This means that your children have little power to try to get money out of the trust.

Every year, the Trustee decides who gets the trust income. The Trustee hunts down beneficiaries on low tax rates and uses those low tax rates to pay less tax. The beneficiaries rarely see any money out of the trust. Each year, they merely forgive the debt by signing a Debt Forgiveness Agreement.

What is a Settlor in a Family Trust?

The settlor provides the initial settled sum. This is usually a nominal sum of $10. This is by way of a gift. This is just to ‘prime’ the trust.

The settlor must have no future dealings with the trustee in its capacity as trustee of the trust. Adverse income tax consequences arise if the settlor is the parent of a beneficiary under 18 years of age or if the settlor has power to revoke or alter the trust so as to acquire a beneficial interest in income or property of the trust: section 102 ITAA 1936.

Does Legal Consolidated provide a Settlor service?

Legal Consolidated does not act as a Settlor. Any individual can serve as a Settlor as long as they are not related to you.

Should your chosen Settlor become unavailable, contact us. We will provide a voucher to change the Settlor in your Family Trust.

Trustee vs Appointor – which is god?

There is only one power in a Family Discretionary Trust. That person is the Appointor.

- The Appointor hires and fires the Trustee.

- The Appointor does not ‘own’ the Family Trust assets.

- But the Appointor ‘controls’ the Family Trust assets. And that is good for both tax and asset protection.

- The Trustee is merely the Appointor’s puppet. The Appointor can replace the Trustee.

- The beneficiaries receive nothing from the trust. This is unless the Appointor tells the Trustee something different.

- The Default Beneficiaries also get nothing out of the trust. They only get something if the Appointor forgets to tell the Trustee to distribute income and capital. (This rarely happens.)

- The Settlor primes the trust with a few dollars:

- The amount is usually $10. This is to establish trust.

- The Settlor is heard of no more. The Settlor can never be a beneficiary. So make sure the Settlor is a stranger and not related to you.

- The Backup Appointors only get the job of being the Appointors after the current Appointors all die:

- For example, Mum and Dad are the Appointors. The Backup Appointors are the children.

- Dad was killed in a car accident. Mum is now the sole Appointor.

- Mum has now died. The Backup Appointors (the children) automatically become the Appointors.

- The Appointor can update and change the Backup Appointor.

Trustee vs Appointor – who holds the power in a Family Trust

Who is in charge? Is it the Trustee that ‘owns’ the assets? No, the Appointor is god. The Appointor bosses the Trustee. The Trustee appears to be in control, as it holds the assets in its name. However, the Trustee takes marching orders from the Appointor. The Appointor can sack the Trustee on a whim, for no reason at all.

Can the Family Trust Appointor be BOTH mum and dad?

Yes, commonly Mum and Dad are each an Appointor together. You can have as many Appointors as you wish.

You can also have as many Backup Appointors as you wish. The Backup Appointors are generally your children: ‘the union of Dad’s Full Name and Mum’s Full Name’.

Can the Family Trust appointor be a company?

It is becoming more common to set up a company as a dedicated Appointor of a family trust. For example, Mum and Dad are Appointors in the first instance. The company is the Backup Appointor. You and your spouse own the shares in the company. (Obviously, the shareholders have ultimate control of the company, not the directors.) When you and your spouse die (i.e. once the Appointors die), your children inherit the shares in the Appointor company. Your children receive everything equally in your Will and therefore control the family trust through their control of the shares in the Appointor company. (This is an exemption to the rule that a Will should not control the family trust.) Typically, you would also have a Shareholders Agreement to establish and enforce the rules. If the beneficiaries getting the shares are minors, then the executors in Mum and Dad’s Wills control the shares (and therefore the assets in the Family Trust). They can only act in the best interests of the minor children. (Whether you have a 3-Generation Trust Will, the position is the same.)

Succession Planning in a Family Trust for a Blended Family

Q: We are a stepfamily. We have one “ours” child (Ralf), and one “hers” child (Mary) from a previous de facto relationship. We are pregnant with a second “ours” baby. We have also taken on the responsibility of my dead brother-in-law’s 12-year-old son (Colin). We treat Colin as our child.

I (Peter) and my current wife (Eva) are going to be the joint Appointors.

How do we answer the “Default Beneficiary” and “Backup Appointor” questions for a blended family?

A: The “Default Beneficiary” is not that important.

But the “Backup Appointor” is vital. You and your current wife are the current Appointors. The Backup Appointors get control of the Family Trust after both of you die.

If you want all of those family members to get control of the Family Trust assets after you both die then name them all. And if the ‘classes’ are open – such as future children then name the class ‘…. and the children of the union of Peter Bernard Smith and Eva Ruby Smith’. For example in a Default Beneficiary and Backup Appointors:

Ralf Full Name, Mary Full Name, Colin Full Name, and the children of the union of Peter Smith and Eva Smith

Does my Family Trust finish after 80 or 125 years?

Since 1988, we have been predicting that all trusts, not just SMSFs, will one day live forever.

Some Australian states do not like trusts that last forever. Some restrict the life of a trust to 80 years or, for QLD, 125 years. Thankfully, South Australia saw the light and never introduced the rule against perpetuities. Therefore, South Australian trusts go forever. Strangely, some Family Trusts that you can build on websites (that pretend to be a law firm) have an even shorter perpetuity period.

However:

- Legal Consolidated Family Trust Deeds do not have a vesting date for South Australia. Legal Consolidated South Australian Family Trusts can go on forever.

- Also, if the 80-year or 125-year limitation period is ever rescinded in a particular State, then the Legal Consolidated Family Trust vesting periods are extended to the longest time period allowed. This is automatic.